Technical Report 44

Clayton Puckett, Jay M. Lillywhite, Ereney Hadjigeorgalis, and David Delannoy

Agricultural Experiment Station, Cooperative Extension Service, College of Agriculture and Home Economics

Authors: Graduate assistant, assistant professor, assistant professor, summer intern. Department of Agricultural Economics and Agricultural Business, New Mexico State University, Las Cruces. (Print Friendly PDF)

Introduction

According to the 2002 Census of Agriculture, more than 116,000 farms participated in direct sales to individuals for human consumption, with sales value exceeding $812 million (USDA/NASS 2002). Nearly 50 percent of this revenue ($382 million) was earned by farms whose total direct sales were less than $50,000. An important component of direct sales are sales made through farmers’ markets. In 2004 there were approximately 3,706 active farmers’ markets1 operating in the U.S. (USDA- AMS, 2005).

The increasing popularity of farmers’ markets as a direct marketing tool is also observed in New Mexico. From 1971 to 2003, farmers’ markets increased from three to 38 (New Mexico Farmers’ Market Association (NMFA), 2002). Total farmers’ market sales in New Mexico more than doubled between 1998 and 2001 and exceeded $3 million annually in 2002 (NMFA, 2002). The growth of farmers’ markets in the state can be associated with the large proportion of small farm operations. Approximately 43 percent of New Mexican farms had fewer than 50 acres in 2002 and 54 percent reported sales under $2,500 in 2002 (USDA-NASS, 2002). Total direct sales to individuals for human consumption in New Mexico reached $6,582,000 in 2002 (USDA-NASS, 2002).

Since 1994, the USDA has issued a biannual national survey of farmers’ markets (Payne, 2002)2. This research complements the work conducted by the USDA by providing specific information about New Mexico farmers’ markets from a manager’s perspective. It summarizes the findings of a 2003 New Mexico survey of farmers’ market managers and compares them to data obtained from the USDA publication “U.S. Farmers’ Markets-2000 A Study of Emerging Trends.”

New Mexico’s Farmers’ Markets

With a ratio of nearly 20 farmers’ markets per million people in the population, relative to its population, New Mexico ranks 11th in the U.S. (NMFMA 2002; U.S. Census 2004). The state ranks 34th in terms of its agricultural workforce,3 as there is less than one farmers’ market per 1,000 people working in agriculture-related industries (NMFMA 2002; U.S. Census 2004). According to the 2002 Census of Agriculture, 1,071 New Mexico farms generated over $6.5 million in direct sales. Based on sales estimates from the New Mexico Farmers’ Marketing Association, we can conclude that the majority of these direct sales were generated through farmers’ markets.4

Methodology

Preliminary data regarding issues facing New Mexico farmers’ markets were obtained from the New Mexico Farmers’ Marketing Association (NMFMA). Researchers at the Department of Agricultural Economics and Agricultural Business at New Mexico State University, together with administrators at NMFMA, developed a survey instrument to assess the current state of New Mexico’s farmers’ markets from the perspective of the market manager. Survey design and content were influenced by a number of factors, which included previous national research conducted by USDA and suggestions and comments made by NMFMA and by market managers during instrument pre-testing.

Data were collected through phone interviews and mail surveys. Managers were first contacted by mail to inform them of the researchers’ intent, followed by phone calls to schedule a convenient time in which the manager could be interviewed. Managers were asked to rate a series of characteristics of their market on a scale of one to 10, where one indicated minimal importance and 10 indicated high importance. Information from the survey presented in this report is categorized into five areas:

- Customers and Competition

- Vendors

- Market

- Problems and Issues

- Manager Characteristics

Results

Out of the 38 markets located across the state at the time of the survey, 30 responses were obtained (25 phone interviews and 5 written responses), representing an overall response rate of 79 percent. Where possible, comparisons are made to results obtained by the USDA in its nation-wide survey. Information from New Mexico is compared to national data from the USDA survey in the areas of self-sustainability, WIC5 participation, market governance and retail sales.

Customers & Competition

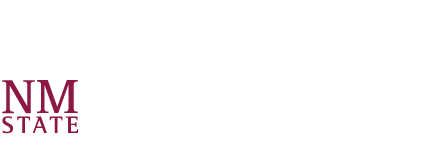

Customers. Managers identified county residents as the most important customer population base6 (fig. 1). Nearly two-thirds of respondents considered their county to be the most important source of customers. The least important population base was “outside of the county,” although four managers indicated that tourists were an important component of their customer base, with an average importance value of 7.5. This indicates that farmers’ markets are largely a local phenomenon in New Mexico and that distance to market may be an important determinant of customer participation. Market managers were asked to describe a “typical” customer at their market. The question proved to be difficult given the diversity of customers who frequent the markets and the wide variety of answers received. Customer descriptions included: (a) older, retired individuals; (b) young families; and (c) individuals participating in the WIC program.

Figure 1. Importance Rating of Customer Population Base

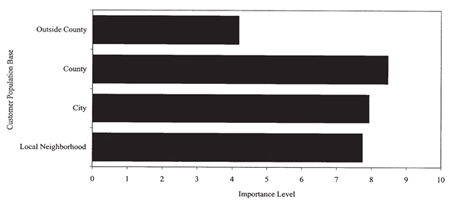

Competition. In general, grocery stores were found to provide the greatest competition for farmers’ markets (fig. 2). Traditional grocery stores as compared to other competition sources showed a higher or equal rank in 57 percent of responses. However, several managers believed that traditional grocery stores provided minimal competition as a result of either geographic location (isolation from major competition) or because their markets provided a social experience not available in traditional grocery stores.

Figure 2. Ranking of Sources of Competition

During phone interviews, several managers expressed concerns that other direct marketing activities, primarily roadside vendors from outside the community, contributed to disruptions in their market’s operation. Some managers also indicated that direct home sales were a growing source of competition for their market. Not only do these sales impact the market by drawing away customers, they also draw away vendors. A majority of managers cited declining numbers of vendors and consumers as a major concern for the market (see Problems/Issues Segment). In general, farmers’ market managers did not view other farmers’ markets as an important source of competition. This illustrates the segmentation of farmers markets across the state.

Vendors

Managers were asked to report their weekly gross sales volume for three product categories: (a) fresh produce; (b) processed agricultural products; (c) other products (e.g. crafts). Ninety-two percent of markets indicated that fresh produce provided the largest revenue with average estimated weekly revenue of $2,497 per market. Processed agricultural products and other products (e.g., crafts) combined accounted for an average weekly revenue of $412 per market.7 According to the USDA, farmers’ market retail sales in 2000 averaged $312,000 in sales per market per year (USDA-AMS, 2002). Average sales for data collected in New Mexico for all goods sold at farmers’ markets were $157,207 (NMFMA, 2002).

The number of vendors per farmers’ market in New Mexico ranged from 140 to two with a state average of 37 vendors per market. Urban markets tend to have more vendors than rural markets.8 Markets operating in or near urban areas had an average of approximately 53 vendors participating in the market, while markets operating in more rural parts of the state had an average of 30 vendors per market. Urban markets also tend to have higher total sales of fresh produce. Weekly average fresh produce sales in urban markets were $3,280, while rural weekly sales averaged $2,280 per market, not adjusted for the number of vendors.

Production methods for fresh produce are increasingly scrutinized by the public. Managers rated the importance of organic products in their market as 5.7 on average and the importance of processed foods as 4.7, on a scale of 1 to 10. In addition, approximately two-thirds of managers indicated that they expected their markets to become more diversified as the importance of organic and processed foods continue to grow.9

Generally, managers responded that their relationships with vendors were positive, with typical responses describing the relationships as friendly, cooperative and supportive. Several managers indicated some problems pertaining to vendor relations. These problems seemed to center on concerns over vendor reselling or competition between vendors.

Market

Self-Sustaining. Forty percent of market managers indicated that their market was self-sustaining,10 whereas only 18 percent of markets nationwide classified themselves as self-sustaining in the USDA’s 2000 survey. This difference may be related to the New Mexico’s managers’ perception of the question. For example, 58 percent of managers who indicated self-sufficiency also indicated that their market received funding from outside sources such as state and local governments, grants and administrative assistance.

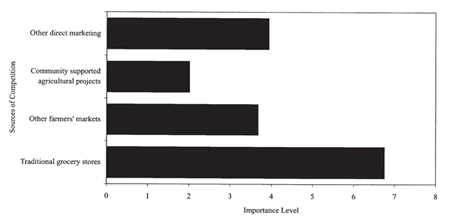

Advertising. Ninety percent of market managers indicated that word-of-mouth advertising was the most important source of advertising used by their market. Word-of-mouth advertising ranked an average value of 9.4. Newspaper advertising, other signage (signs and billboards), and radio advertising were also rated as important by the managers (fig. 3).

Figure 3. Success of Advertising Effects

Market Employees. Almost half of the New Mexico farmers’ market managers who participated in this study were volunteers. Twenty-seven percent are employed by the market, with the remaining 26 percent employed by other entities (e.g., city government). Of the managers who indicated they were employed by the market, eight reported salaries less than $1,000 per month and four reported monthly salaries between $1,000 and $2,000.

Farmers’ Markets and the WIC Program. The Farmers’ Market Nutrition Program (FMNP), an extension of the Women, Infants and Children program (WIC), was established by Congress in 1992. The program was initiated to “provide fresh, unprepared, locally grown fruits and vegetables to WIC recipients, and to expand the awareness, use of and sales at farmers’ markets” (USDA, 2004). In July 2000, the USDA report of farmers’ markets showed that 58 percent of farmers’ markets nationwide participated in the FMNP-WIC program.

Sixty-six percent of the market managers polled in this study said they participate in the WIC program, while 10 percent indicated that while their market did not currently participate, they were investigating the possibility and feasibility of doing so. Only 17 percent of managers indicated that their markets had chosen not to participate in the program because their particular market’s success did not depend on participation or because the benefits of the program did not exceed the costs associated with its establishment and administration.

Market Governance. Forty-six percent of markets participating in this study were governed by a board of directors or committee. Thirty-three percent of markets were governed by the market manager. The remaining markets were either self-governed or managed by a president and vice president. In the USDA national study, the majority of markets were governed by a board of directors or committee (63 percent) (USDA-AMS 2002).

Problems/Issues

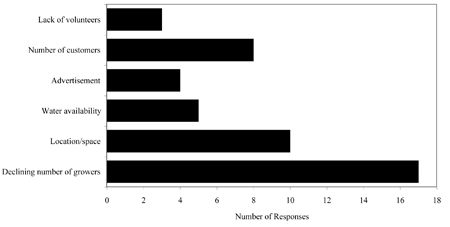

Managers were asked to identify the three most important issues facing their market (fig. 4). Forty-two percent of market managers identified recruiting and retaining vendors as their primary problem. Other concerns, in order of importance, were lack of adequate infrastructure (size, location of a permanent facility, availability of restrooms, and safety concerns with current facilities), identifying new customers, and encouraging customer attendance at the markets. Other less-noted concerns included vendor production issues (primarily lack of water due to drought conditions in the state) and an inadequate number of volunteers and market staff to run the market effectively.

Figure 4. Market Issues

Manager Characteristics

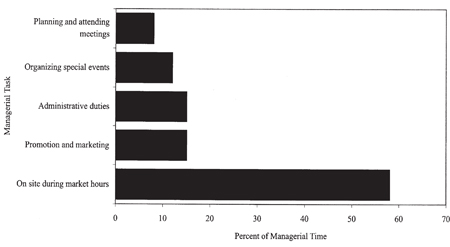

The average market manager surveyed in New Mexico was 49 years old and had completed high school with some additional college coursework. The average time on the job was 4.8 years, with an average work schedule of 10.2 hours per month over a 12-month period. The manager who dedicated the most time worked 32 hours per month, and the least time reported was one hour per month. On average, managers spent nine hours per week when the market was open to the public. Administrative duties, promotion and oversight were reported as the most time-consumptive tasks by managers. Figure 5 shows the breakdown of managers’ time as it relates to market management.

Figure 5. Managers' Time

Conclusion

Farmers’ markets are an important part of small-scale New Mexico agriculture. From an estimated three markets in 1971, the state now has 38 operating markets (Clevenger, 1987, New Mexico Farmers’ Marketing Association, 2002). The continued growth in the number of farmers’ markets in the state shows that there is interest from both farmers and consumers in the future of these markets. With continued effort, these markets can be improved to better fulfill the needs of the population they serve.

This initial report is aimed at describing New Mexico’s farmers’ markets and identifying key issues or problems that should be addressed to ensure that farmers’ markets continue to flourish in the state. The principal problems include declining grower numbers in the state and dwindling market participation from vendors. Urban markets have an advantage over rural markets both in terms of vendor numbers and average weekly sales.

Word of mouth is the most important advertising source for farmers’ markets in the state. Managers saw their largest competition source coming from traditional grocery stores; they rated its importance as almost double that of all other sources of competition.

There is currently little data regarding New Mexico farmers’ markets. Further work should focus on assessing and understanding the state of farmers’ markets in New Mexico. Potential areas of future research could include in-depth producer and consumer work at specified markets (although some work has been done on this topic in the Santa Fe area, other market areas could benefit from such studies) and an analysis of differences in markets located in urban versus rural areas.

References

Clevenger, Tom. A Preliminary Analysis of the Potential for Additional Retail Farmers Markets in New Mexico. New Mexico State University, Department of Agricultural Economics and Agricultural Business. Staff Report 49, November 1987.

Govindasamy, Ramu, Ferdaus Hossain and Adesoji Adelja. “Income of Farmers Who Use Direct Marketing.” Journal of Agricultural and Resource Economics, 28:76-83, April 1999.

New Mexico Farmers’ Marketing Association. “New Mexico’s Farmers Markets-Summary of 2001 Data on Customers, Vendors and Gross Sales.” May 2002.

Payne, 2002. “U.S. Farmers Markets-2000 A Study of Emerging Trends.” USDA Agricultural Marketing Service (AMS).

USDA-AMS, www.ams.usda.gov/farmersmarkets/FarmersMarketsGrowth.htm. Retrieved August 4, 2005.

USDA-Food and Nutrition Service (FNS). “WIC Farmers’ Market Nutrition Program.” http://www.fns.usda.gov/wic/FMNP/FMNPfaqs.htm. Accessed May 20, 2004.

USDA-National Agricultural Statistic Service (NASS), 2002 Census of Agriculture.

USDA. National Commission on Small Farms. “A Time to Act: A Report of the USDA national Commission on Small Farms.” Miscellaneous Publication 1545 (MP-1545). January 1998.

USDA/CREES. “Small Farms Selected Results and Impacts: CREES Contributions to Small Farmers Noted.” http://www.csrees.usda.gov/nea/ag_systems/sri/smallfarms_sri_time.html. Accessed July 2, 2004.

Footnotes

1 This number represents markets that were identified by state departments of agriculture or local, state, or regional farmers’ marketing associations. Farmers’ markets were defined as “a common facility or area were multiple farmers/growers gather on a regular recurring basis to sell a variety of fresh fruits, vegetables and other farm products directly to consumers” (Payne, 2002).

2 In 2000, the survey was mailed to the 2,863 identified markets in the country. Of these, a response rate of just over 50 percent was achieved. The survey asked questions in six general categories, which included physical characteristics of the market, market administration and operations, market sales, farmers using the market and customer demographics.

3 The agricultural workforce is that portion of the population that is directly involved in agriculture, forestry, fishing, hunting or mining.

4 Data from the New Mexico Farmers’ Marketing Association show that in 2001 gross sales from New Mexico farmers’ markets accounted for more than 74 percent of total direct sales in the state. (NMFMA, 2002).

5 WIC is a Special Supplemental Nutrition Program for Women, Infants and Children. The WIC Farmers’ Market Nutrition Act of 1992 established a program authorizing projects that provide participants in the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) with food coupons that can be used to purchase fresh, unprocessed foods, such as fruits and vegetables at farmers’ markets.

6 A population base is a geographic region from which customers are drawn.

7 Several managers declined to provide estimates of weekly sales figures in favor of indicating the relative importance of each food category. Averages provided here do not account for these markets. In some cases, managers provided ranges of approximate market sales; in these cases the mid-point of the range provided was used as an estimate for the market average.

8 Urban markets included markets located in or near Albuquerque, Las Cruces and Santa Fe. Farmington was not included in the urban classification.

9 Several managers indicated that while they saw increasing levels of interest in organic production by vendors, this interest did not necessarily translate into desires by the vendors to become certified organic producers.

10 Fees collected from vendors equaled expenses of running the market.

To find more resources for your business, home, or family, visit the College of Agriculture and Home Economics on the World Wide Web at aces.nmsu.edu

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

July 2006, Las Cruces, NM.