Technical Report 32

Lowell B. Catlett, Professor, Department of Agricultural Economics & Agricultural Business and Extension Economist

College of Agriculture, Consumer and Environmental Sciences New Mexico State University. (Print Friendly PDF)

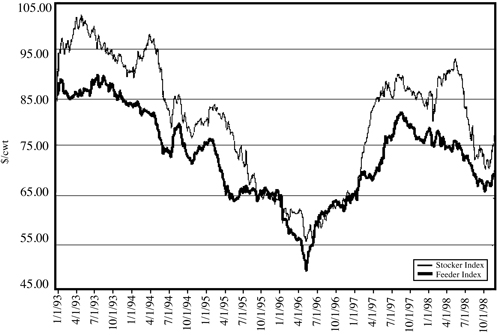

Cow-calf operators, winter wheat grazers and other cattle operators have a new tool to manage the risk of price changes with stocker cattle. The Chicago Mercantile Exchange now offers a new contract on stocker cattle in addition to the live fed cattle and feeder cattle futures and options contracts. Before this new contract, stocker cattle operations had to use either the fed (live) cattle or feeder cattle futures or options contacts to cross hedge their price risk. The new 25,000-pound Stocker Cattle contract will allow for better price risk protection than previously available via cross hedging with the Feeder Cattle contract. The price relationship between the price index of stocker cattle and feeder cattle is shown (Figure 1). Hedgers that currently use the Feeder Cattle contract to cross hedge their stockers find a substantial amount of difference between the movements of the two prices. Note that the stocker index trends fairly closely with the feeder index but differs enough that a hedge with stocker futures/options would be more effective than a cross hedge with feeder futures/options. Additionally, the new stocker futures/options contracts call for 25,000 pounds instead of 50,000 pounds for the feeder cattle contracts. The small contract allows for smaller-scale producers to use futures/options contracts to manage price risk. The new Stocker Cattle futures contract can help stocker cattle producers/users have a better price risk management tool than the old Feeder Cattle futures contract because of better price correlations and the smaller contract size.

Figure 1. Feeder cattle index vs. stocker cattle index, January 1993 to October 1998. (Source: Chicago Mercantile Exchange)

The Contract

The futures contract calls for 25,000 pounds of 500–599 pound (approximately 45–50 head) of Medium Frame #1 and Medium and Large Frame #1 feeder cattle (steers). The months traded are January, February, March, October, November and December. The trading months correspond to the two major marketing periods—winter/early spring and late fall/winter. The contract has a minimum trading price of 5 cents per hundredweight ($12.50 per contract, $0.05 × 25,000 = $12.50). Traders can only submit bids in 5-cent increments, meaning a bid of $89.54 would be changed to $89.55 or $89.50. The limit move for the day is $2 per hundredweight (cwt). In other words, from the previous day’s settle price, the most that prices can move up or down is $2/cwt. For example, if the previous day’s settle price was $87/cwt, then the most that prices can move up the next day is to $89/cwt, and the lowest they can fall is to $85/cwt. Option contracts are on the futures contracts and have the same trading months.

Although the contract is called a stocker cattle contract, the cattle that it is based on are really light feeders. Most people in the cattle business think of stockers as weighing about 350–450 pounds. Thus, a cow-calf operator who normally sells calves at weaning will need to have weaning weights to match the contract or carry the animals past weaning to heavier weights. Likewise, buyers of stocker cattle that weigh 350–450 pounds will have to adjust to heavier weights to match the contract, or buy the same size cattle and know that the futures contract will not match their cash position.

Simple Hedging with Futures

The idea of hedging is to transfer the risk of price changes from the hedger to some other person in the futures market who is willing to accept the risk. Some people who own cattle are worried that at some point in the future when they sell the cattle, the price will have decreased and they’ll have lower-valued cattle. A proper hedge to protect against such a problem is to have a futures contract on cattle that will gain in value if cattle prices fall. Therefore, hedgers are people who have a cash position and a futures position at the same time. When the cash position loses money, the futures position will make money for an appropriately placed hedge.

There are two major types of hedges—short hedges protect against price decline; long hedges protect against increasing prices. Those who own stocker cattle and will later sell those cattle in the cash market are said to have a “long cash position.” They would worry that during the time they owned the stockers, the price would decrease. Then they would sell them at a price lower than current levels and would need to be short hedgers. Similarly, those who anticipate buying stocker cattle at some point in the future, are worried that they will have to pay more than they could buy them for today, and would need to be long hedgers. Producers who have cow-calf operations that sell the stocker calves would be worried about price declines during the growing season and would, therefore, need to be short hedgers. Farmers who have winter wheat pastures and regularly buy stockers to put on the wheat pastures would be worried about increasing stocker prices before purchasing them and would need to be long hedgers.

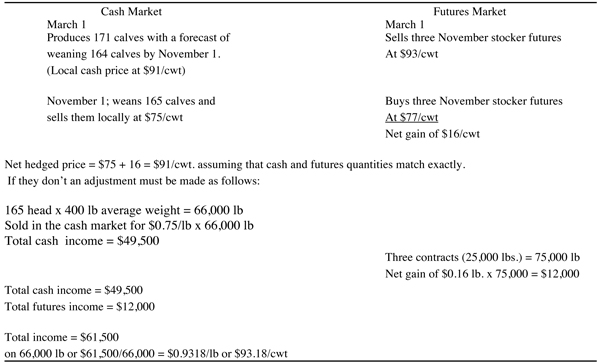

Cow-Calf Producers—A Short Hedge Example

Cow-calf producers who normally calve in the winter/early spring and then wean in the late fall when the calves are stockers run the risk that the price will decrease, while the calves are growing during the spring, summer and fall. Assume that a cow-calf producer has 180 producing cows and a calving rate of 95%. Thus, 171 calves will be born in the early winter months. Assume the operator has a 96% weaning rate, which would yield approximately 164 stockers that could be sold in the fall. Since one contract is for approximately 45–50 head, the operator would need three contracts. Assume that after calving in the winter (March), the operator notices that the November stocker futures price is $93/cwt. The operator is worried that the price will fall between March 1 and November when the stocker cattle are ready for sale. On March 1, the operator could sell three stocker futures contracts at $93/cwt. The operator now is hedged against the potential of declining stocker prices. If the price falls, then the operator will buy the contracts back at a cheaper price and earn the difference, increasing the actual price the operator receives in the cash market (table 1).

Table 1. Cow-calf operator short hedge.

The difference between the $91/cwt and the actual amount received of $93.18/cwt is accounted for by the difference in the cash and futures positions. This is one of the problems with hedging. Futures contracts are standardized and cash positions are not, so there will almost always be a difference. Hedging with futures almost always produces a situation that is over or under hedged. The example was an over hedge with the cash position at 66,000 pounds and the futures at 75,000 pounds. Instead of hedging with three contracts, the producer could have hedged with two, yielding a futures position of 50,000 pounds. This would put the producer in an under hedged position with a net hedged price of $87.12/cwt. Neither is right or wrong, but the hedger must always make a decision to be over or under hedged. In this example, over hedging ($93.18/cwt) was better than under hedging ($87.12/cwt). But that is not always the case. Check the section near the end of this report for some ideas about over or under hedging.

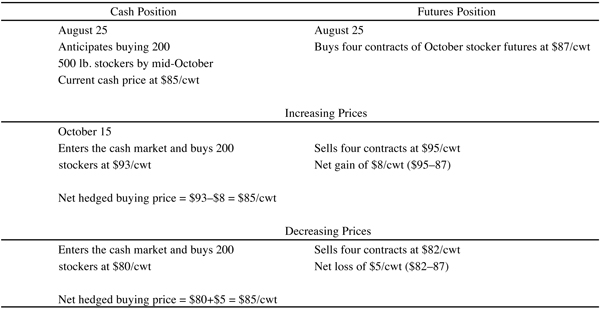

Winter Wheat Pasture-A Long Hedge Example

Farmers who have winter wheat pasture and want to put stockers on the wheat for several months could use the futures contracts to help fix their buying prices. Assume, as an example, that a farmer has enough pasture for 3 months for approximately 200 stockers. The farmer finishes planting the wheat in late August and plans, barring any weather delays, on putting the stockers on the pasture by October 15. On August 2, he observes that the October Stocker Futures price is at $87/cwt. He won’t buy the stockers until mid-October, so he is worried that during the next two months the price of stockers will increase. Table 2 shows an example of how to hedge to protect against the potential of an increase in the price of stockers.

Table 2. Wheat pasture long hedge example.

The farmer paid $85/cwt for the cattle, whether the prices went up or down while waiting for the wheat pasture to mature enough to be grazed. When prices went up, the farmer really paid $93/cwt in the cash market for the stockers. But he made $8/cwt on his hedge, effectively paying only $85/cwt when considering both the cash and futures transactions. When prices went down, the farmer paid only $80/cwt in the cash market, but suffered a loss in the futures markets of $5/cwt, for an effective price of $85/cwt.

This last example, in which money was lost in the futures market, causes many producers to shun the futures markets. They believe that they shouldn’t hedge, which is true when prices decreased (table 2). Had the farmer not been hedged, he would have paid only $80/cwt for the stockers. Because he hedged, he had to pay $85/cwt. Of course, when prices increased, the farmer was glad he hedged. The real issue is knowing what the prices will do in order to make decisions about hedging.

Hedging can help control price risk, because prices cannot be forecasted with certainty. The farmer paid $85/cwt, regardless of the price and didn’t have to worry about price instability. From a business management standpoint, what is more valuable–knowing in advance what stockers will cost ($85/cwt) or not knowing whether or not they will be $80 or $97/cwt? The farmer who knows in August that stockers will cost close to $85/cwt can do some financial planning to determine if he can make any money at that price. If he determines that he cannot, then he might want to reconsider putting stockers on the wheat pasture and rent it out as pasture instead. In addition to helping control price risk, hedging helps producers do better financial and business planning.

Simple Hedging with Options

If traders buy options, they are buying the right (but not the obligation) to have a futures contract on stocker cattle. If traders buy put options, they buy the right (but not the obligation) to have a short (sell) position in stocker cattle futures. If they buy call options, they buy the right (but not the obligation) to have a long (buy) position in stocker cattle futures. The seller of the option has agreed to provide the futures position, in the event the option buyer exercises the option. The buyer can let the option expire, so a futures position is not needed. The buyer pays a premium to the seller for the right (but not the obligation) to have a futures position. The seller gets the premium for taking the risk of having to deliver a futures contract to the buyer.

Hedging with options involves only buying options, not selling. Options buyers have the potential for unlimited gains, with limited losses (the premium). Options sellers have just the opposite. They face limited gains (the premium) and the potential of unlimited losses. Therefore, in this report, the selling options will not be considered. Futures hedgers who need to short hedge do so by selling futures contracts. Option hedgers buy put options to short hedge to buy the right (but not the obligation) to receive short futures positions. Similarly, long futures hedgers would hedge with options by buying calls with the right (but not the obligation) to have long positions in the futures.

The Contract

Option contracts for stocker cattle are on the futures contracts and have the same contract months. The price of a futures contract is determined by open outcry auction at the exchanges, however the price of the option is fixed at various intervals (10 cents per pound) around the settle price of the futures contract the previous day. Thus, if the November stocker futures settled at $82/cwt yesterday, then today there would be November options with strike prices ranging from $72/cwt to $92/cwt. What trades at the exchanges is what people are willing to buy or sell the various strike prices for–the premium, for example.

If you buy a $92/cwt strike price put option, then you have purchased the right (but not the obligation) to have a sell position in November stocker futures at $92/cwt when the market for November stocker futures is at $82/cwt. If you exercise the option, you have a sell position at $92/cwt and could buy it back for $82/cwt. Therefore, the seller of a $92/cwt strike price put option will demand at least a $10 premium. The $92/cwt strike price put option is said to be “in-the-money” by $10. If the premium is traded at $12, the option premium is said to have “$10 intrinsic value” and “$2 time value.” On the other hand, an $82/cwt strike price put option, when the underlying November stocker futures is at $82/cwt, is said to be “at-the-money” and has no intrinsic value, only time value. It has value only if the market moves. Thus, its premium is said to be composed of only “time value.” A $72/cwt strike price put option is “out-of-the-money.” If the buyer exercises the option he will receive a short futures position at $72/cwt, and the market is at $82/cwt. Thus, if he buys a futures option to offset the sell he will have a loss of $10/cwt. Why would a $72/cwt strike price have any value when the market is at $82/cwt? Because the market price can move. If it moves down, the $72/cwt could become valuable. Out-of-the-money options have premiums that reflect whether there is enough time for the market to move and whether there is enough price volatility to move the market. What trades at the exchanges is buyers’ and sellers’ ideas of what time means to the marketplace. Other things being equal, the longer the time to maturity of the option, the higher the premium. The more volatile the price movements of the underlying futures contract, the higher the premium of the option.

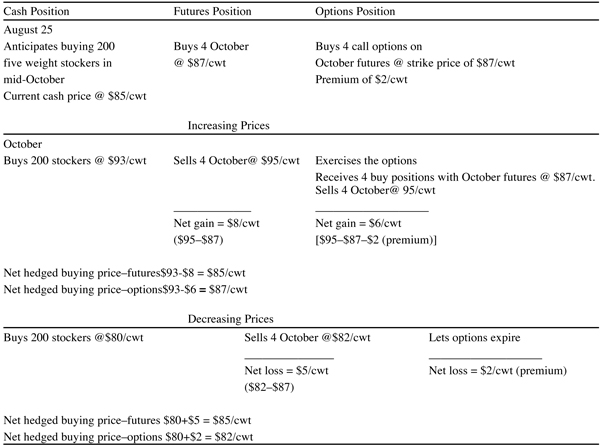

Winter Wheat Pasture–a Long Hedge Example with Options

Let’s go back to the wheat pasture farmer who hedges with futures and replaces his hedge with options. The example (table 3) shows the effects of both the original futures hedge and the replacement options hedge. When prices increase, the futures hedge and the options hedge are equally as good, except that the options hedge results in a net hedge price that is less than the futures hedge by the premium amount. However, when prices decrease, the options hedge becomes more valuable than the futures hedge, because the option buyer can let the option expire and not take a futures position.

Table 3. Wheat pasture long hedge–options and futures.

In the example (table 3), the options hedge is less valuable than the futures hedge when prices increase because the option hedge has the cost of the premium ($2/cwt). When prices move in favor of the stocker buyer, the option hedge is best (by $3/cwt). The option is allowed to expire worthless, and the only cost of playing the game is the premium. That’s the beauty of options hedging, allowing a hedger to be hedged when need be. But if prices move in favor of the cash position, the option buyer can let the option expire and only lose the premium. Options hedging eliminates the problem discussed in the previous section on futures hedging. The futures hedger must be content with the price at hedging time, because regardless of what direction prices move, that’s the price he will receive. When prices move against the cash position, it’s nice to be hedged with futures. However, when they move in favor of the cash position, the hedger would prefer not to be hedged. Futures hedging does not allow for such flexibility, but options do-at a cost (the premium). Thus, options hedgers, for the price of the premium, have purchased price insurance. If they need it, they can exercise the option and be hedged. If they don’t need it, they let the option expire and lose the premium. The example (table 3) clearly shows that options are superior, only if prices move in favor of the cash position. Otherwise, the futures hedge is superior.

Option hedging is like buying auto insurance. The best situation is to not buy insurance and to never need it. If insurance is purchased and never needed, the only cost is the premium. But when needed, the insurance policy will pay far more than the premium. Option hedging is buying price insurance. It’s a great price risk management tool, but other tools such as futures hedging can sometimes offer a better deal.

What to Do?

Over/Under Hedging

Hedgers with futures and options run into the problem of over or under hedging as pointed out in the first example with futures. There is no wrong or right answer ahead of time-only after the fact. The rule of thumb for over or under hedging is this: If prices may move against the cash position, over hedge, because the futures position will make money. If prices may move in favor of the cash position, under hedge, because the cash side of the hedge will make money. If the differences are small between the size of the cash position and the futures position, then the decision is not critical. However, when the size difference is large enough, it is valuable to try to forecast prices or subscribe to a service that can help predict prices with some accuracy.

Options Hedging versus Futures Hedging

Neither options or futures are superior all of the time. Like over and under hedging, the rule of thumb is tied to forecasting price movements. If prices are forecasted to move in favor of the cash position, then hedge with options. If prices are forecasted to move against the cash position, then hedge with futures. As traders gain experience in the price risk management game, they can start using other futures and options tools to make decisions about what’s best.

For example, with options, hedgers can pick daily from several option strike prices that vary from deep “in-the-money” to deep “out-of-the-money” with corresponding differences in premiums. Deep “in-the-money” options provide for more price protection, but the premiums are expensive. Likewise, the deep “out-of-the-money” options provide for less price protection, perhaps covering only variable costs, but have a very cheap premium. Hedgers have many different levels of price protection to pick from when hedging with options.

Futures hedges can learn to use basis (the difference between the local cash price and a futures price) to more effectively place and lift their hedges. Proper timing with basis can provide not only price protection, but also the opportunity to profit from the hedge.

Different option premium levels and basis timing are tools that hedgers can use once they master the hedging basics. Most hedgers use either options or futures as they mature in price risk management strategies, depending on how comfortable they feel about each tool. Very few hedges switch back and forth between futures and options. It certainly is possible to do so, but most hedgers settle into a comfort zone with each tool and then learn more sophisticated ways to handle the tool. As a beginner, it is probably best to pick either options or futures, develop a hedging plan and try it a few times, rather than trying to learn about both at the same time.

Conclusion

The scope of this report is only to help cattle traders and producers get started using the new stocker cattle futures and options contracts. Stocker prices can be volatile, causing major financial problems. People who know how to handle the risk of price changes are in a better position to protect against adverse price movements and, thus, increase net profit. It really doesn’t take a lot of effort to learn how to use basic futures and options hedging. The simple examples given in this report are powerful tools and even if a user never moves beyond them, they can provide all of the tools necessary to be successful at managing price risks.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at aces.nmsu.edu.

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

Printed and electronically distributed May 1999, Las Cruces, NM.