Guide Z-503

Ereney Hadjigeorgalis, Assistant Professor

Jay M. Lillywhite, Assistant Professor

Esteban Herrera, Extension Horticulturist

College of Agriculture, Consumer and Environmental Sciences New Mexico State University. (Print Friendly PDF)

World Production

The United States is the world’s largest producer of pecans. Although exact numbers for world pecan production are not known, it is estimated that the United States produces 75 percent of total world production followed by Mexico with an estimated 20 percent (Johnson 1997). Minor pecan production occurs in countries such as Australia, Israel, Peru and South Africa (Johnson 1997 and USDA-FAS 2003).

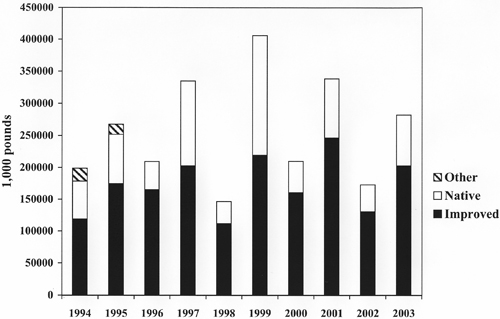

While cyclical, pecan production in the United States has remained fairly constant over the last 10 years with a 10-year average production of 252 million pounds per year (figure 1). In 2003 the United States produced 262 million pounds of pecans with an estimated value of $263 million. Improved varieties accounted for approximately 78 percent of total production and 86 percent of total value (USDA-NASS 1998-2004).

Figure 1. U.S. utilized production, by variety.

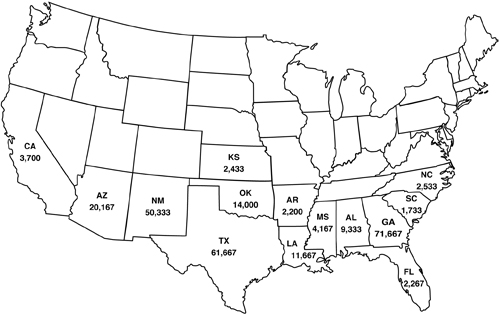

Unlike other tree nut production that is concentrated in geographical regions, U.S. pecan production is dispersed throughout the South and Southwest. There are 14 states that produce pecans commercially: Alabama, Arizona, Arkansas, California, Florida, Georgia, Kansas, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, South Carolina and Texas. Improved varieties production is concentrated in Georgia, New Mexico, and Texas, and native seedling production is greatest in Texas, Oklahoma and Georgia. Pecan production by state is shown in figure 2 (USDA-NASS 2003).

Figure 2. U.S. 2001-2003 utilized pecan production average, by state in thousand pounds.

Mexico is the second largest world producer of pecans. Mexico’s pecan production comes primarily from improved varieties. High quality pecans from Mexico are the product of optimal growing conditions including high light intensity, well-drained soil and sufficient water supplies. The main pecan varieties grown are Western and Wichita, which account for 80 percent of new variety production. A majority of Mexico’s pecan production occurs in the states of Chihuahua, Coahuila, Sonora, Durango and Nuevo Leon. Pecan production for the 2003-2004 production year is estimated at 141 million pounds (USDA-FAS 2003).

U.S. Pecan Exports

In 2002, the United States exported 19,875 short tons of shelled and unshelled pecans. Major U.S. export markets for shelled pecans include: Canada, China, Hong Kong, Mexico, Netherlands and the United Kingdom. Canada and Mexico dominate other countries in terms of U.S. exports, accounting for nearly 43 percent of all U.S. exports in 2002. Large pecan exports to Mexico (8,519 short tons in 2002) are a result, in part, of shipments to Mexican maquiladoras that shell the U.S. pecans and re-export them to the United States. It is estimated that up to one-half of pecans shipped to Mexico from the United States are shipped back to the United States after being shelled (Johnson 1997). Top export markets for U.S. pecans are shown in table 1.

Table 1. Top U.S. Pecan Export Markets

| 1998 | 1999 | 2000 | 2001 | 2002 | 5-Year Avg | Percent of Avg | |

| Short tons | |||||||

| Mexico | 3,657 | 1,403 | 2,595 | 1,820 | 8,519 | 3,599 | 26.7% |

| Canada | 3,568 | 3,860 | 4,209 | 4,168 | 3,476 | 3,856 | 28.6% |

| Netherlands | 1,770 | 1,397 | 1,581 | 1,574 | 1,917 | 1,648 | 12.2% |

| Hong Kong | 26 | 89 | 5 | 3 | 1,604 | 345 | 2.6% |

| United Kingdom | 1,726 | 880 | 1,997 | 1,680 | 1,494 | 1,555 | 11.5% |

| China | 0 | 20 | 0 | 10 | 849 | 176 | 1.3% |

| Others | 2,782 | 1,995 | 2,430 | 2,336 | 2,016 | 2,312 | 17.1% |

| World | 13,527 | 9,644 | 12,818 | 11,591 | 19,875 | 13,491 | |

| Source: Economic Research Service / USDA Fruit and Tree Nuts Situation and Outlook Yearbook / FTS-2003/ October 2003 | |||||||

U.S. Pecan Imports

Among tree nuts, pecan imports rank third behind coconut meat and cashews. The United States imports both shelled and in-shell pecans primarily from Mexico, which accounted for more than 98 percent of all pecan imports in 2002. Imports from Mexico totaled 30,008 short tons in 2002 (table 2). Other countries that have entered the U.S. market include: Australia, Brazil, Canada, China, Israel, Italy, Peru, Spain, Zimbabwe and South Africa. Imports into the United States from all countries totaled 30,355 short tons in 2002. Like exports, pecan imports exhibit cyclical behavior, averaging 27,902 short tons per year over the years 1998–2002.

Table 2. Top U.S. Pecan Import Markets

| 1998 | 1999 | 2000 | 2001 | 2002 | 5-Year Avg | Percent of Avg | |

| Short tons | |||||||

| Mexico | 32,974 | 22,204 | 32,294 | 19,680 | 30,008 | 27,432 | 98.3% |

| South Africa | 0 | 44 | 0 | 70 | 207 | 64 | 0.2% |

| Australia | 281 | 528 | 123 | 0 | 78 | 202 | 0.7% |

| Peru | 0 | 328 | 430 | 125 | 48 | 186 | 0.7% |

| Israel | 8 | 6 | 7 | 11 | 13 | 9 | 0.0% |

| Others | 0 | 0 | 12 | 31 | 0 | 9 | 0.0% |

| World | 33,263 | 23,110 | 32,866 | 19,917 | 30,355 | 27,902 | |

| Source: Economic Research Service / USDA Fruit and Tree Nuts Situation and Outlook Yearbook / FTS-2003/ October 2003 | |||||||

Mexico-U.S. Pecan Trade

Since 1992, Mexican imports of U.S. pecans have decreased while exports have remained stable. This can be attributed to new plantings by Mexican growers in the late 1980s and early 1990s in response to high export prices in U.S. markets. Bearing pecan tree stocks in Mexico have increased by 17 percent since 1993, while production has increased by 36%. Meanwhile Mexican imports of lower quality pecans from the United States have decreased by 64% since 1993. This trend is expected to continue as more nonbearing trees come into production. New production will likely be channeled toward exports first, whereas domestic consumption gaps will be met with lower quality pecan imports from the United States.

Policy measures that may have affected net trade in pecans between the United States and Mexico over the past decade include phytosanitary issues and the establishment of the North American Free Trade Agreement (NAFTA). In 1991, Mexico began requiring methyl bromide treatment of imported pecans. In 1994, concerned about possible introduction of the pecan weevil, Mexico banned imports of in-shell pecans from Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Oklahoma, South Carolina and Tennessee. It also temporarily requested phytosanitary certificates for imports coming from New Mexico and Texas until these last two states were declared free from pecan weevil later that year.

The passage of NAFTA likely had little impact on trade since tariff rates were sufficiently low prior to NAFTA. United States’ tariff rates for in-shell pecans from Mexico were set at 5 cents per pound and at 10 cents per pound for shelled pecans. Although Mexico had a higher duty rate of 20 cents per pound on U.S. imports, these were of lower quality than Mexican pecans, and hence lower priced. Further information on Mexican production and trade in pecans can be found at the Foreign Agricultural Services Web site at www.fas.usda.gov.

Sources

Johnson, Doyle C. “United States is World Leader in Tree Nut Production and Trade.” USDA-ERS Fruit and Tree Nuts Situation and Outlook. FTS-280. August 1997.

USDA-ERS. “Commodity Highlight.”

USDA-ERS. Fruit and Tree Nuts Situation and Outlook Yearbook. FTS-2003. October 2003.

USDA-FAS. Gain Report: Mexico Tree Nuts Annual–Revised 2003. Gain Report Number: MX3107.

USDA-NASS. “Crop Production.” Report released December 11, 2003. http://usda.mannlib.cornell.edu (February 23, 2004).

USDA-NASS. 1997 U.S. Census of Agriculture. http://www.nass.usda.gov/census (02/27/04).

USDA-NASS. “Noncitrus Fruits and Nuts: 2003 Preliminary Summary.” NASS Report Fr Nt 1-3 (04) January 2004.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at pubs.nmsu.edu.

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

Printed and electronically distributed March 2005, Las Cruces, NM.