Guide Z-125

Sawssan Boufous, Brian Hurd, and Rajan Ghimire.

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Authors: Respectively, Assistant Professor, Extension Specialist and Natural Resources Economist, Department of Extension Economics; Professor, Agricultural Economist, Department of Agricultural Economics and Agricultural Business; Associate Professor, Cropping Systems and Soil Management, Department of Plant and Environmental Sciences. All from New Mexico State University. (Print-friendly PDF)

Photo by D.F. NMSU, 2022

Despite progress, recent reports show that global greenhouse gas emissions continue to rise12,24. Global emissions of all major greenhouse gases increased by 58% between 1990 and 2020, with East Asia and the Pacific, Europe and Central Asia, and the United States responsible for more than 75% of these increases26.

Agriculture, accounting for 10.6% percent of U.S. greenhouse gas emissions and 75% of the non-carbon dioxide greenhouse gases, plays a dynamic role as both a source and sink for atmospheric greenhouse gases8,16. Farms, ranches, and rangelands can be instrumental in enhancing carbon storage. Research is shedding light on how land-use management and practices can improve soil carbon and contribute to climate change mitigation29.

The Department of Agriculture (USDA) and several non-governmental organizations promote enhanced soil carbon practices and sustainable agriculture through numerous programs encouraging carbon sequestration, reduced greenhouse gas emissions, and improved agricultural productivity and commodity marketability. Carbon credit markets are among these programs. A carbon credit is a certificate attesting that a specific amount of carbon dioxide has been removed or that an equivalent amount of other non-carbon greenhouse gases has been removed from the atmosphere for a substantive period of time. In agriculture, such carbon farming results from using certain practices that allow for carbon sequestration in exchange for payment for carbon credits11.

This paper aims to introduce carbon credit market concepts and mechanisms to help Extension professionals, farmers, and the interested public better understand how these markets work and contribute to climate change effects’ mitigation. This effort is part of a larger body of work initiated by the National Center on Carbon Management and Soil Health (NCCMSH) in Arid and Semi-Arid Environments that informs a general audience about climate issues and mitigation strategies.

What is a Carbon Credits Market?

A carbon credit market is a trading system where carbon credits are produced, bought, and sold. This type of market allows companies or individuals to purchase carbon credits from entities that reduce or remove greenhouse gas emissions. This market approach creates a balance between greenhouse gas emitters and those whose activities contribute to storing carbon. For example, certain land-use strategies and management approaches often enhance soil carbon. Two kinds of carbon credit markets exist: (a) Compliance Carbon Markets, and (b) Voluntary Carbon Markets.

Mandatory or compliance market

In these marketplaces, governments set limits on emissions and grant allowances to large emitters (e.g. oil refiners, large industries, natural gas plants, etc.) in the form of carbon credits (called also carbon allowances) to meet their legal climate goals2. One carbon credit represents the right to emit one ton of CO2. In these markets, prices are a function of local economies and systems, and since they are regulated, prices tend to be higher than prices of credits (offsets) created in voluntary markets5.

In the United States, only twelve states have instituted carbon-pricing programs: California, Washington, Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania (currently not participating due to litigation), Rhode Island, and Vermont. The last eleven Northeast States form the Regional Greenhouse Gas Initiative (RGGI), created in December 2005, the first mandatory cap-and-trade program in the United States to limit carbon dioxide emissions from the power sector6. The program sets an annual regional limit on emissions (cap), and each state gets its own allocation of CO2 allowances under the cap. Then, each state implements it through its own regulation (Department of Environmental Management, Rhode Island). The most current carbon price was set at $20.03 per metric ton of carbon dioxide on June 7th, 202422,23.

In California, the cap-and-trade program started in 2013 and covers approximately 80% of the state’s greenhouse gas emissions4. The program is linked to the Canadian province of Quebec’s cap-and-trade system through the Western Climate Initiative, which allows businesses from one jurisdiction to use emissions issued by the other for compliance6. As of June 2024, California’s cost per ton of CO2 was $36.1419.

Trading allowances from a cap-and-trade system offer an alternative to carbon offset credits for claiming emission reductions. However, unlike offsets, the purchase of allowances would not allow the purchaser to select activities with sustainable development benefits5.

Voluntary carbon market

In voluntary carbon markets, emitters are allowed to offset their emissions by purchasing carbon credits that are also called offsets when traded in voluntary markets. In other words, carbon offsetting allows to own one carbon credit through an agricultural activity (e.g., planting trees, implementing a carbon sequestration practice, etc.) that compensates for greenhouse gas emissions by removing or preventing the same amount of emissions from entering the atmosphere2. Prices are volatile since they are set by the market, meaning that they are subject to various factors such as the project type (in agricultural carbon credits, this refers to the type of agricultural conservation practice that the farmer accepts to adopt to sequester soil carbon); the project’s age (or the length of the carbon contract); and the size of the transaction (or the volume of acres enrolled in the contract).

Who Are the Key Players in the Agricultural Carbon Credits Markets?

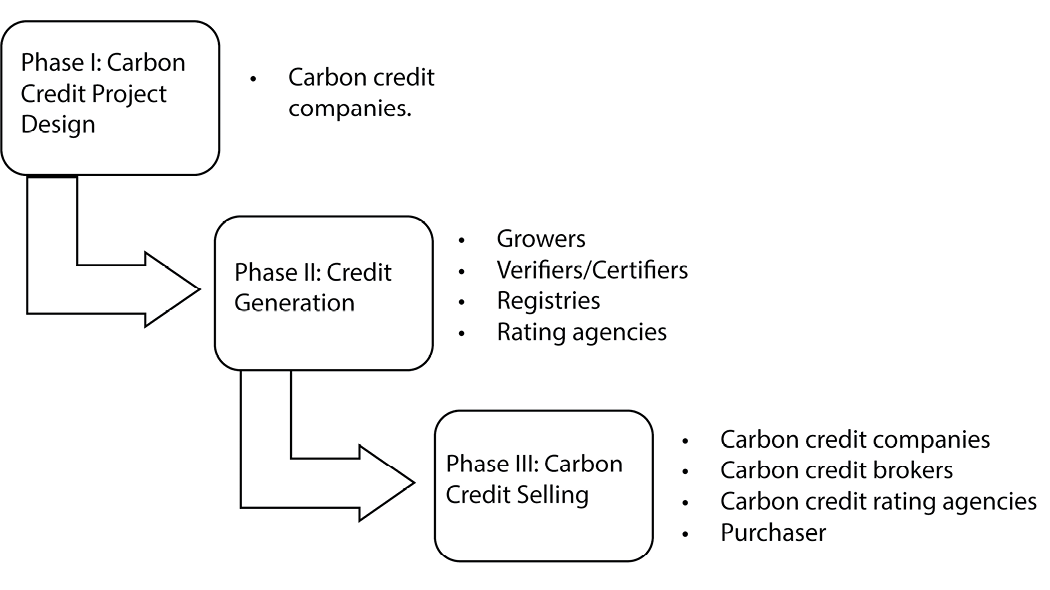

In agriculture, carbon credits are created from projects that aim to remove/reduce greenhouse gas emissions from the atmosphere, such as reforestation and regenerative agriculture efforts, engineered solutions (e.g. combustion of methane emissions from landfills, new solar and wind power plants), and implementation of climate-smart agricultural practices (e.g. cover crops, no-till, reduced tillage...etc)27. However, generating a tradable carbon offset in the voluntary carbon credit markets is a complex process that requires detailed protocols, quality checks, certifications, and interventions of third parties in addition to the carbon farmer and the final purchaser:

- Carbon credit companies: Carbon credit companies are the carbon credit program generators. These entities create carbon credit projects that growers contract. Each company has its methodologies (e.g., measuring quantifying sequestered carbon), protocols (requirements/rules that a company sets to ensure the quality of its programs), payment structure, and regional coverage. Some companies may perform carbon credit verification and certification in their program (e.g., Vera), while others will delegate these steps to independent third parties (verifiers/certifiers).

- Growers/landowners: Once they contract for a carbon project, growers and landowners become central players in this system. They initiate the process of carbon credit generation by implementing a practice that stores carbon or reduces/avoids carbon emissions under the requirements of their carbon project agreement.

- Carbon credit registries: Carbon registries are another central component of carbon credit trading. Mostly third parties, registries (e.g. VERRA’s Verified Carbon Standard (VCS), Gold Standard, Climate Action Reserve, American Carbon Registry (ACR), Puro Earth, etc.) are an organized system that tracks, manages and trades carbon credits for the grower and ensures that one credit is not sold in multiple places to multiple buyers13. Registries provide verified carbon credits with unique serial numbers allowing their tracking2.

- Carbon credit verifiers/certifiers: Because there are no regulations in the voluntary market, these entities are set to undergo rigorous verification of projects from the adoption of carbon reduction practice to the generation of the credits. The verification process might be achieved using several tools that differ from one company to another. However, the process needs to check for any data inconsistencies or errors and account for all aspects of greenhouse gas production and soil carbon sequestration. Various analytical methods exist for measuring carbon, such as the life cycle analysis, the Laser-Induced Breakdown Spectroscopy (LIBS), the empirical methods, etc. The life cycle analysis method is increasingly used as a new approach to assess and upscale greenhouse gas emissions from agricultural fields because this approach considers all the resources used in agriculture and estimates the carbon balance15,2. This approach also accounts for all aspects of greenhouse gas production. The LIBS method uses a high-energy laser pulse focused on a soil sample, while empirical methods use linked mathematical equations to model conceptual ecosystem processes14.

Once the practice’s ability to sequester carbon is verified, a certification is needed to generate the carbon credit. The process is either completed by the company that verifies carbon sequestration or by another accredited third party (the verifier). The certificate serves as proof that the practice’s ability to store carbon was verified and corresponds to market standards. Currently, there are numerous certifiers in the carbon credit market such as Scientific Certification Systems Global Services and DNV. - Carbon credit brokers: Like traditional brokers, carbon credit brokers are intermediaries (e.g., Degrees, Lune, Terrapass, etc.) that facilitate transactions between carbon credit generators (the companies) and buyers.

- Carbon credit rating agencies: These are independent third-party agencies that evaluate the accuracy of the amount of carbon companies claim to have removed from their business operations. Like debt ratings, carbon credit ratings help buyers understand the risk associated with a specific credit. Numerous agencies operate in the U.S. carbon credits markets (e.g. BeZero, Calyx, and Sylvera), and each uses its proper approach to evaluate the quality and risk associated with carbon projects. Ratings are then generally sold via a subscription model to prospective credit buyers27. A high-quality carbon credit is an asset generated following rigorous methodologies, including multiple rounds of quality control and work with third parties to get it certified (e.g., Vera, Calyx, Carbon Plan, Sylvera)3.

- Purchaser: A carbon credits purchaser can be an individual, a company, or any other entity that needs to offset its emissions and “owns” the stored carbon to satisfy its low carbon strategy.

Figure 1: Phases of Carbon Credit Generation & Key Players

What Are the Concepts of Additionality and Permanence?

Additionality and permanence are two key concepts in carbon credit markets that help ensure the accuracy of carbon offsets. Under additionality, carbon savings that would normally occur under non-program conditions must not be counted as a program benefit. In other words, to be additional, a practice needs to be distinct from those that are already adopted in the acreage enrolled in the carbon project. Carbon sequestration practices that are already adopted and implemented or are part of normal business considerations do not satisfy the necessary additionality criteria.

However, while all programs require additionality in its strict sense to generate credits, some require a change of practices for past practices in the same field; others require that practices in the field be different from common practices in the area18, while some programs consider existing practices or practices adopted within the last 10 years (such as Nori and 2024 Truterra Carbon Program).

In the context of agricultural carbon credits, permanence is a principle that requires stored carbon to last for a long period in soil and not be released into the atmosphere, voiding the credit28. Permanence is necessary because nature-based carbon credits have a high risk of carbon reversal due to natural disasters like fires, tornadoes, and hurricanes, as well as human-related activities that result in dis-adoption of conservation practices20. Therefore, the permanence principle ensures that carbon credits are not purchased on a short delay to allow the lasting impact of the reduced emissions9.

What Farming Practices Are Considered for So-Called ‘Carbon Farming’?

Depending on the regulations of a specific carbon credit program (and defined by state-level regulations), practices that are generally considered include:

- Cover crops

- No-till management

- Strip-till

- Nitrogen management

- Living roots

- Minimal till

- Fertilizer management

- Grazing management

- Biodiversity

How Much Does ‘Carbon-Farming’ Cost to Growers?

Farming carbon results from agreeing to adopt new carbon-sequestration agricultural practices (additionality). Depending on the carbon program, most programs do not cover the costs of the new implementation (e.g., ESMC, Nori, CIBO, Agoro). Growers might have to pay fees to cover soil sampling* or third-party verification, insurance, and/or transaction fees16 in addition to bearing the costs of the new equipment.

*Soil sampling is used to estimate a baseline of carbon levels in a field.

How and How Much Will a Carbon Farmer Be Paid?

Payment rates and structures vary from one program to another, but available information shows that payments range from $10 to $35 per metric ton of CO2-eq16 for programs that pay for generated carbon offsets, and are issued either upon the carbon offset sale (e.g., Corteva and CIBO Carbon Credits), on a specific date after enrollment in the project (e.g., Cargill’s RegenConnect, and Soil and Water Outcomes Fund), or right after signing the contract (2024 Truterra Carbon Program). Other programs will choose to pay growers per adopted practice, so payments will differ from one practice to another, and payments will be per enrolled acres of the specific practice, for example, for cover crops rates range from $6 to $55 per acre per year while for no-till from $5 to $25 per acre per year16.

Other initiatives will offer payments for the generated carbon and the adopted practice. For example, carbon sequestered resulting from nitrogen reduction is valued at a minimum of $18 per metric ton or ranges from $0.05 to $2.50 per lbs (of the reduced nitrogen) per acre per year. Some other initiatives will offer to pay flat fees or as a percentage of the profit made from carbon credit sales10.

Summary and Conclusions

The lack of uniform guidelines to standardize voluntary carbon credit markets led to heterogeneous programs, using heterogeneous protocols and measurement methods complicating the decision-making of carbon credit investing. Therefore, for growers interested in farming carbon, many considerations must be taken before the final decision. Little is known about the implementation costs of carbon-sequestering practices. Only a few papers focused on budgeting these practices7,11,1 as most available budgets are for specific crops rather than practices. Also, a thoughtful search is needed on the specifics of the to-be-adopted carbon farming practice, the carbon project, and the operation’s needs and ability to bear this investment. Specifics can be current market prices, regional coverage of the program, soil, and labor needs, and any other detail that might have an economic and/or environmental impact on the operation. Also, given the differences among the available carbon initiatives, before signing, growers need to understand requirements, terms, and breaches before signing a contract and preferably consult an attorney. Moreover, since carbon credit markets are voluntary and continuously evolving, it is important to consider uncertainty regarding the costs of the new implementation that might differ from one region to another, as well as the offset prices and their variation over time, especially since most contracts’ length ranges from one year to 10 years of engagement.

For more informed opinions and/or decisions about carbon farming and carbon initiatives, numerous resources are available, from publications to direct consultations with professionals and educators. Among these resources are publicly available publications (e.g., Extension, academic journal articles, etc.), educational videos, and consulting Extension specialists, attorneys, and/or outreach personnel.

Additional Resources

For more about carbon credit markets:

- Boufous, S.; Wade, T. (2022, June 6). Overview of Carbon Markets and the Potential for Florida Pepper Producers. Extension Paper. Conference Proceedings of the 135th Annual Meeting of Florida State Horticultural Society. Sarasota, FL. Publication scheduled for May 2023

- Plastina, Alejandro, 2022. Overcoming Barriers to the Development of an Agricultural Carbon Market. Farm Foundation. https://www.farmfoundation.org/2022/04/25/overcoming-barriers-the-development-of-an-agricultural-carbon-market/

- Plastina, A. (2022). How Do Data and Payments Flow through Ag Carbon Programs? [A1-77]. Ag Decision Maker. Iowa State University Extension and Outreach. https://www.extension.iastate.edu/agdm/crops/pdf/a1-77.pdf

For more about carbon farming practices implementation

- Idowu, J., Angadi, S., Darapuneni, M., & Ghimire, R. (2017, April). Reducing Tillage in Arid and Semi-Arid Cropping Systems: An Overview [A-152]. New Mexico State University Cooperative Extension Service. https://pubs.nmsu.edu/_a/A152/

- Ghimire, R., Clay, D.E., Thapa, S., & Hurd, B. (2022). More carbon per drop to enhance soil carbon sequestration in water-limited environments. Carbon Management, 13(1), 450-462. https://doi.org/10.1080/17583004.2022.2117082

For more about carbon credit initiatives

- CIBO https://www.cibotechnologies.com/getcarbon/

- Verra https://www.cverra.org/

- Bayer https://www.bayer.com/en/agriculture/carbon-program-united-states

- Agoro Carbon Alliance https://agorocarbonalliance.com/

References

- Acharya, R.N., Ghimire, R., Apar, G.C., & Blayney, D. (2019). Effect of cover crop on farm profitability and risk in the Southern High Plains. Sustainability, 11(24), 7119. https://doi.org/10.3390/su11247119

- Boufous, S., Wade, T., Chakravarty, S., Andreu, M., Bhadha, J.H., Her, Y.G, & Yu, Z. (2024). Introduction to Carbon Credit Markets and their Potential for Florida Agricultural Producers [FE1154]. EDIS, 2024(5). https://doi.org/10.32473/edis-fe1154-2024

- Braconi, L. (2023, December 8). Who Buys Carbon Credits and Why- An Overview. eAgronom. https://blog.eagronom.com/who-buys-carbon-credits-and-why-an-overview

- California Air Resources Board. (n.d.). FAQ Cap-and-Trade Program. https://ww2.arb.ca.gov/resources/documents/faq-cap-and-trade-program

- Carbon Offset Guide. (n.d.). Understanding Carbon Offsets: Allowances. https://offsetguide.org/understanding-carbon-offsets/other-instruments-for-claiming-emission-reductions/allowances/

- Center for Climate and Energy Solutions. (2024, May). U.S. State Carbon Pricing Policies. https://www.c2es.org/document/us-state-carbon-pricing-policies/

- Chakravarty, S., & Wade, T. (2023). Cost Analysis of Using Cover Crops in Citrus Production. HortTechnology, 33(3), 278-285. https://doi.org/10.21273/HORTTECH05126-22

- Economic Research Service. (2024, October 17). Climate Change. U.S. Department of Agriculture. https://www.ers.usda.gov/topics/natural-resources-environment/climate-change/

- Fulwider, W., Mayerfeld, D., & Shelley, K. (n.d.). Agricultural Carbon Credits: A Deeper Dive into Key Concepts for Farmers and Landowners. University of Wisconsin-Madison, Crops and Soils, Division of Extension. https://cropsandsoils.extension.wisc.edu/articles/agricultural-carbon-credits-a-deeper-dive-into-key-concepts-for-farmers-and-landowners/

- Havens, D., Perrin, K.R., Fulginiti, E.L. (2023, March 22). Carbon Farming: A Preliminary Economic Analysis of Carbon Credits for No-Till and Cover Crops. Cornhusker Economics, Agricultural Economics, University of Nebraska-Lincoln. https://agecon.unl.edu/carbon-farming-preliminary-economic-analysis-carbon-credits-no-till-and-cover-crops

- Intergovernmental Panel on Climate Change. (2022). Climate Change 2022: Mitigation of Climate Change. Working Group III Contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_FullReport.pdf

- Johnston, M. (2022, September 25). What is a Carbon Registry? Decode 6. https://decode6.org/articles/carbon-registry/

- Melkani, S., Manirakiza, N., Baker, S., & Bhadha, J.H. (2023). Current and Emerging Protocols for Carbon Measurement in Agricultural Soils [SL508 SS721]. EDIS, 2023(5). https://doi.org/10.32473/edis-ss721-2023

- Nayak, A.K., Mohammad, M.R., Ravi, N., Dhal, B., Swain, C.K., Nayak, A.D., Tripathi, R., Shahid, M., Islam, M.R., & Pathak, H. (2019). Current and emerging methodologies for estimating carbon sequestration in agricultural soils: A review. Science of the total environment, 665, 890-912. https://doi.org/10.1016/j.scitotenv.2019.02.125

- Plastina, A. (2023). The Emergence of Agricultural Carbon Credits. American Affairs, 7(1), 50-63. https://americanaffairsjournal.org/2023/02/the-emergence-of-agricultural-carbon-credits/

- Plastina, A. (2024, May). How to Grow and Sell Carbon Credits in US Agriculture [A1-76]. Ag Decision Maker. Iowa State University Extension and Outreach. https://www.extension.iastate.edu/agdm/crops/pdf/a1-76.pdf

- Plastina, A., Chand, H., & Johanns, A. (2022). How to Benefit from Agricultural Carbon Markets? Proceedings of the 2022 Wisconsin Agribusiness Classic, 78-80. https://extension.soils.wisc.edu/wp-content/uploads/sites/68/2022/02/Plastina-Ag-Carbon-Markets.pdf

- Qin, B. (2023, August 3). California Carbon Price Hits a Peak as Supply Cuts Loom. BloombergNEF. https://about.bnef.com/blog/california-carbon-price-hits-a-peak-as-supply-cuts-loom/

- Sawadgo, W., & Plastina, A. (2022). The Invisible Elephant: Disadoption of Conservation Practices in the United States. Choices, Quarter 1. https://www.choicesmagazine.org/choices-magazine/submitted-articles/the-invisible-elephant-disadoption-of-conservation-practices-in-the-united-states

- Smith, P., Soussana, J., Angers, D., Schipper, L., Chenu, C., Rasse, D.P., Batjes, N.H., van Egmond, F., McNeill, S., Kuhnert, M., Arias-Navarro, C., Olesen, J.E., Chirinda, N., Fornara, D., Wollenberg, E., Álvaro-Fuentes, J., Sanz-Cobena, A., & Klumpp, K. (2019). How to measure, report and verify soil carbon change to realize the potential of soil carbon sequestration for atmospheric greenhouse gas removal. Global Change Biology, 26(1), 219-241. https://doi.org/10.1111/gcb.14815

- Statement of Rhode Island Department of Environmental Management. (n.d.). Regional Greenhouse Gas Initiative (RGGI). https://dem.ri.gov/environmental-protection-bureau/air-resources/regional-greenhouse-gas-initiative-rggi

- The Regional Greenhouse Gas Initiative. (n.d.). Allowance Prices and Volumes. https://www.rggi.org/auctions/auction-results/prices-volumes

- United Nations Development Programme Climate Promise. (2022, May 18). What are Carbon Markets and Why are They Important? https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important

- United States Department of Agriculture. (n.d.). Climate Solutions: Climate Change Affects U.S. Agriculture and Rural Communities. https://www.usda.gov/climate-solutions

- United States Environmental Protection Agency. (2024, June 27). Climate change indicators in the United States. www.epa.gov/climate-indicators

- Walsh, R.V., Toffel, W.M. (2023, December 15). What Every Leader Needs to Know about Carbon Credits. Harvard Business Review. https://www.hbs.edu/ris/Publication%20Files/RameshWalsh_Toffel_2023_HBR_ec7747e0-10af-40a8-b3df-37c421f7491e.pdf

- Wongpiyabovorn, O., & Plastina, A. (2023, July). Carbon Farming: Stacking Payments from Private Initiatives and Federal Programs [A1-40]. Ag Decision Maker. https://www.extension.iastate.edu/agdm/crops/pdf/a1-40.pdf

- Young Gu, H., Wade, T., Boufous, S., Bhadha, J., & Andreu, M. (2023, October 9). Florida’s Agricultural Carbon Economy as Climate Action: The Potential Role of Farmers and Ranchers [AE573]. EDIS, 2022(3). https://doi.org/10.32473/edis-AE573-2022

Sawssan Boufous is an Extension Specialist and Assistant Professor in the Extension Economics Department at the College of Agricultural, Consumer and Environmental Sciences. Her research focuses on sustainability, producer profitability, and the adoption of sustainable agricultural practices, including consumer demand and behavioral economics. She holds multiple advanced degrees in Agricultural and Applied Economics and Management Sciences.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at pubs.nmsu.edu.

Contents of publications may be freely reproduced, with an appropriate citation, for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication. New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

December 2024. Las Cruces, NM.