Research and Promotion Program Prospects in the Chile Industry

New Mexico Chile Association: Report 31

J.M. Lillywhite and J.E. Simonsen

College of Agriculture and Home Economics, New Mexico State University

Authors: Respectively, Assistant Professor (575-646-5321; fax: 575-646-3808; lillywhi@nmsu.edu) and Graduate Research Assistant, Department of Agricultural Economics and Agricultural Business, New Mexico State University.

Introduction

The chile pepper industry in the Southwestern United States is facing increasing pressure from foreign competition. In order to make the industry more competitive, participants throughout the production chain have joined forces with New Mexico State University to identify and develop new technologies and procedures to increase the industry’s viability. To date, much of this work has focused on reducing production costs. For example, collaborative efforts have resulted in improvements in plant breeding, mechanical thinning, and mechanical harvesting.

While reduced production costs are essential for the Southwestern chile industry to survive, they are not necessarily sufficient. That is, it is doubtful that mechanization and improvements in plant genetics alone will allow the industry to compete with imported chile on a price basis—other countries have access to lower-cost labor, and labor makes up a large portion of production costs (approximately 50–60% in 2007 [Crawford, personal communication, July 25, 2007]). Thus, additional marketing and demand development will likely play an important role in the U.S. industry’s future success.

The USDA’s Agricultural Marketing Service (AMS) has several avenues available for agricultural industries interested in creating programs to fund research and marketing. AMS programs have been successfully implemented in other vegetable industries, such as the Hass avocado industry. In this paper, we examine the different avenues available to agricultural industries to create such programs.

Marketing Avenues

Two distinct methods of creating marketing programs are available through the AMS: marketing orders and research and promotion programs. Each has its own set of guidelines and intended purposes. Interested parties should examine particular features of each avenue before deciding if it is right for their industry.

Marketing Orders

The Agricultural Marketing Agreement Act of 1937 granted the USDA power to authorize and administer marketing orders. Marketing orders are voluntary agreements that are developed to encourage stable market conditions. Once adopted, a marketing order is binding on all individuals and businesses classified as “handlers” in a geographic area covered by the order (AMS, 2006a). The order can serve up to five functions: 1) maintain high produce quality standards, 2) standardize packages or containers, 3) regulate the flow of product to market, 4) establish reserves of storable commodities, and 5) authorize production research, marketing research and development, and advertising (AMS, 2006a).

Unfortunately, marketing orders do not authorize the collection of research or promotion assessments from importers (Carman, 2006). Domestic producers finance orders through domestic assessments that are used to pay for market stabilization. If an industry wishes to have importers assist with domestic market development, they must turn to research and promotion programs administered by the AMS.

Research and Promotion Programs

Research and promotion programs (RPPs) authorized by the USDA are similar to marketing orders but are concerned primarily with market development rather than stabilization. Sometimes called “check-off” programs, they allow assessments on both domestic and imported production of specific commodities. Through the program, a national board is created to “conduct promotion, market research, production research, and new product development under the supervision of the Agricultural Marketing Service” (AMS, 2006c). The board is funded through assessments; domestic assessments are collected by the board, while importer assessments are collected by U.S. Customs. Industries can decide whether or not to assess imports when creating their proposal.

Currently, there are RPPs for avocados, beef, cotton, dairy, eggs, pork, soybeans, and wool/lamb, as well as for nine fruit and vegetable industries (AMS, 2006c) (Table 1). Eight of the fruit and vegetable programs assess both domestic and imported production, while one assesses only domestic production. When all RPPs are examined, five assess only domestic production, while the remaining eleven assess domestic production as well as imports (Carman, 2006).

Table 1. Assessment Types Regulated by AMS Research and Promotion Programs

| Industry | Domestic Assessment Only | Domestic & Imported Assessment |

| Beef | X | |

| Blueberries | X | |

| Cotton | X | |

| Dairy | X | |

| Eggs | X | |

| Hass Avocados | X | |

| Honey | X | |

| Mangos | X | |

| Mushrooms | X | |

| Peanuts | X | |

| Popcorn | X | |

| Pork | X | |

| Potatoes | X | |

| Soybeans | X | |

| Watermelon | X | |

| Wool/lamb | X |

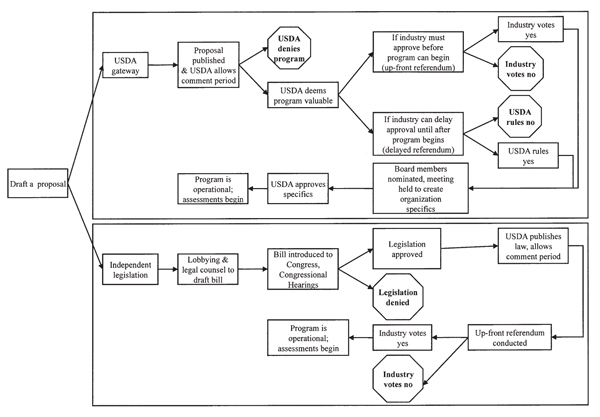

Creating an RPP

For those interested in pursuing an RPP, there are two pathways to develop a tailored program for a specific commodity or industry. The first involves submitting a proposal for approval directly to the USDA’s Agricultural Marketing Service. A complete proposal addresses issues concerning the industry’s need for and purposes of an RPP (for a complete description of proposal requirements by the AMS, see Appendix 1). The RPP must have widespread industry support, as evidenced through a referendum voted on by the industry. This referendum can either be up-front (must be approved before assessments can begin) or delayed (must be approved a set time after assessments have begun). A general timeline is then followed by the USDA after the proposal has been submitted (AMS, 2006c):

- The proposal is published in the Federal Register to allow public comment. The USDA may hold public meetings to discuss its merits.

- If the USDA decides the program is valuable, a final rule is implemented, either a) right away (if the referendum is delayed), or b) following approval by voters (if the referendum is up-front).

- Board members are nominated and an organizational meeting held to create by-laws, a budget, and a marketing plan, and to set an assessment rate, all of which are approved by the USDA.

- Following USDA approval of the Board specifics, the program becomes operational and assessments begin.

The second way to develop an RPP is to create independent legislation. Rather than working through the USDA’s system, the industry creates legislation and works to pass their bill through Congress. Recent government legislation has allowed the avocado industry to assess growers and first handlers of the Hass variety of avocado and create funding for a national board that oversees both a unified domestic Hass avocado marketing campaign and the industry’s domestic research funding allocation. Examining the Hass Avocado Promotion, Research, and Information Act of 2000 (the Hass Act) may shed light on parallel opportunities in the chile industry as well as on areas that may cause concern within the industry.

The Hass Act

Prior to legislative action, the California Avocado Commission spent several months in intense strategic planning. They first pursued assessment through the USDA’s research and promotion program application before deciding to work through independent legislation. The California Avocado Commission estimates that it spent approximately $250,000 to prepare the bill for Congress (Wolk, personal communication, December 20, 2006). Once the bill was proposed, it was sent to the House Committee on Agriculture (for a timeline, see Figure 1; for a copy of the bill, see Appendix II).

Figure 1. Timeline of Hass Act of 2000.

During the legislative hearings of the House of Representatives, speakers from the California Avocado Commission, the domestic industry, Mexican growers and exporters, Chilean exporters, a New Zealand ambassador, and an agricultural attaché from the Mexican Embassy were present. California Representatives Randy Cunningham and Ken Calvert prepared statements in support of the legislation with the support of co-sponsor California Representative Gary Condit1. Charley Wolk, chairman of the California Avocado Commission, also spoke on behalf of the legislation.

Support for the bill was justified with five major reasons (Table 2). First and foremost, the program was not to be funded by taxpayers. Also, growers would charge and manage their own assessments to improve their industry. The assessment was deemed necessary due to changes in both import levels and domestic market growth potential. The bill would be approved by an up-front referendum, which would highlight its industry support. Finally, the assessment would create a “level playing field” for all suppliers in the U.S. market. It was argued that all parties who would benefit should pay for the market development.

Table 2. Primary Support and Opposition Points Raised During the Legislative Hearing Concerning the Hass Avocado Promotion, Research, and Information Act of 2000

| Support | Opposition |

| Not funded by taxpayers | Board dominated by domestic producers despite the majority of market share being held by importers |

| Increased quantity of avocado imports | Importer assessment funds could be used for California-grown avocado promotion |

| Growth potential present in the domestic market | Assessment would be ineffective at growing market demand |

| Up-front referendum proves industry support | Assessing imports would be a violation of the First Amendment, GATT, and WTO principles |

| Would create a "level playing field" for all suppliers to enter the market |

Major opposition to the bill included three major concerns from the Chilean Exporters Association. First was that the majority of the market volume of avocados is supplied by imports, but the proposed domestic board would be dominated by domestic producers. A senator expressed concern that assessment funds from importers could be used to focus promotion for California-grown avocados. The Chilean importer association felt that an assessment would be unnecessary, ineffective, inherently biased against importers, and that the assessment would be in violation of the First Amendment’s foreign commerce clause as well as the General Agreement on Tariffs and Trade and World Trade Organization principles.

The California Avocado Commission addressed these concerns within the legislation and during the legislative hearing. Current estimates suggested that demand was increasing and would continue to increase with the use of additional promotion, which by the proposed law would not mention the commodity’s origin if funded through the Hass Avocado Board (HAB). The proposed Board would consist of both importers and domestic producers. The legislation was also examined and deemed to satisfy WTO and GATT concerns (U.S. Congress, 2000).

Once passed, the Hass Act allowed a mandatory assessment of 2.5¢ per pound to be paid by growers, first handlers, and importers, and to be allocated for generic marketing and research strategies via the Hass Avocado Board. States and import countries can receive 85% of their assessments back if they form an association which follows the guidelines set out by the Hass Act. This 85%, determined through industry dialogue, is sent back to the appropriate state or country association to be used only for promotion or research; additional costs incurred by the association (e.g., management and overhead costs) must be funded externally. The remaining 15% of assessments go to the Hass Avocado Board for generic Hass avocado promotion and research.

The Board earmarked $2.6 million for promotion expenses in the 2005–2006 fiscal year (HAB, 2005). According to Mr. Wolk, former chair of the Board, the HAB has produced many benefits, including expanding demand through seamless promotion to accommodate all suppliers, helping to create top quality homogenous avocados, and spurring dialogue among producers.

Similarities Between the Hass Avocado Industry and the Southwest Chile Industry

Many promising similarities exist between the Hass avocado industry and the Southwest chile industry that may make a program similar to the Hass Act feasible for the U.S. chile industry (Table 3). Neither industry is currently subsidized by the national government, unlike several other agricultural industries. Domestic production for both industries is centered in one state each: California and New Mexico (90% and 39% of avocado and chile acreage, respectively). The United States chile industry is a net importer; 7% of total U.S. chile supply is exported while 72% of domestic supply is imported (USDA ERS, 2006a). The avocado industry faced a similar net import situation; 6% of domestic avocados are exported, while 60% of domestic supply comes from abroad, mainly Chile, Mexico, and New Zealand (USDA ERS, 2006a, 2006b). Imports in the chile industry come from Mexico (99%), as well as from China, India, Peru, and Chile (1%).

Domestic per capita consumption is greater for chile than for avocados, possibly because chile has a wider variety of uses and domestic demand is growing at a rate comparable to that of avocados. The average annual U.S. consumption reached 5.9 pounds (fresh weight equivalent) of chile from 2003–2005, and 2.6 pounds of avocados from 2001–2006 (USDA ERS, 2006a).

Table 3. Similarities Among Various Aspects of the Avocado and Chile Industries

| Aspect | Avocado Industry | Chile Industry |

| Subsidies | None prior to RPP | None |

| Imports | More imports into U.S. than U.S. production exported | More imports into U.S. than U.S. production exported |

| U.S. per capita consumption | Increasing | Increasing |

| Competitors | Few (Chile, Mexico, New Zealand) |

Few (Mexico, China, India, Peru, Chile) |

| Concentration of production | Primarily California | Primarily New Mexico |

Disparities Between the Hass Avocado Industry and the Southwest Chile Industry

The industries differ in some important areas that may make similar legislation difficult (see Table 4). The chile industry has estimated national crop value of $107.6 million, while the avocado industry has an annual U.S. crop value of $360.9 million (5-year average; USDA ERS, 2006c, 2007). While the primary goal of the Hass legislation was to fund and operate a coordinated marketing effort, this may not be feasible in the chile industry. Previous work within the chile industry suggests that industry participants are primarily interested in seeking an RPP for research efforts. Since importers would be contributing to this research funding, U.S. producers would not be able to protect the research findings from these competitors.

Table 4. Disparities Among Various Aspects of the Avocado and Chile Industries

| Aspect | Avocado Industry | Chile Industry |

| Size | $360.9 million crop value | $107.6 million crop value |

| Primary goal | Marketing | Research |

| Season of production | Majority of imports do not overlap with U.S. production season | Majority of imports overlap with U.S. production season |

| Harmonized tariff schedule | In place | Not properly configured |

| Assessment costs | Low per-acre cost | Higher per-acre cost that varies by variety |

| Number of varieties | One | Many |

In addition, the major competitors have a similar growing season; rather than forming complimentary marketing strategies to create a continuous supply, the domestic and import production of fresh chile will be competing at key times of the year. Since ground and processed chile can be stored and have no inherent seasonality, competition from dried imports can occur year-round. In addition, the chile industry is comprised of many heterogeneous products. The avocado legislation dealt with one specific type of avocado, the Hass variety, which dominates the domestic market. Many varieties of chile are grown for a variety of uses in the United States. Legislation would need to craft a conceivably more complex solution than the straight assessment charged by the Hass Act.

There are several possible assessment methods the chile industry may consider, including per-acre assessments, assessments as a percentage of production value, or assessments based on production weight. Eighty-three percent of avocado orchards are at least 15 acres in size, with average production of 4,861 lb/acre (USDA ERS, 2006a). This means the average avocado producer spends approximately $122/acre/year towards promotion. If the chile industry seeks to raise $2.6 million annually (the avocado industry’s current annual post-refund amount3 a flat per-acre assessment would cost U.S. producers between $80 and $90 per acre. Due to differences in varietal harvest weight and harvest weight equivalency calculations, assessing production on a percentage of value basis may be more equitable.

A straight assessment process that mirrors the avocado industry’s current program (2.5¢ per pound) would need to be established on a green equivalent basis and would affect chile producers differently depending on the varieties they produce, unlike in the avocado industry. Yields are far more variable both between varieties and between years in the chile industry; proposed assessment costs would also vary significantly depending on the variety produced. If a research and promotion assessment were based on a harvest weight or harvest weight equivalent, these equivalencies would need to be standardized; currently there are no regulated standards to equate dried production to harvest weight equivalencies.

Legislation would need to include specific identifiers for the types of chile to be assessed, and at what rate each variety will be assessed. Unfortunately, imported chile products are not currently well differentiated. Chile products are categorized as fresh, dried, or extracted oleoresins. Each category has suffixes that break down the category further for a harmonized tariff schedule (see Appendix III for the tariff schedule). The U.S. does not keep clear records on products being imported beyond this schedule; for the assessments to be fair, additional recordkeeping practices would need to be implemented.

The three current major categories of chile products are fresh/chilled/canned, dried/ground, and paprika oleoresin. A research and promotion program could also assess imports of these categories of chile. Several countries export large amounts of multiple chile products to the U.S. and could consider themselves adversely affected by an assessment (see Tables 5, 6, and 7 for a breakdown by chile product category). The cooperation and support of these countries will be critical to the success of any assessment program.

Table 5. Fresh and Chilled U.S. Chile Imports by Country of Origin As a Percent of Import Quantity (Harmonized Tariff Schedule Heading 0709.60)

| Country | Imported (metric tons)3 | % of Total4 |

| Mexico | 300,012 | 83.96 |

| Canada | 28,692 | 8.03 |

| Netherlands | 20,325 | 5.69 |

| Israel | 4,790 | 1.34 |

| Dominican Republic | 1,247 | 0.35 |

| All others | 2,261 | 0.63 |

Table 6. Dried and Ground U.S. Chile Imports by Country of Origin As a Percent of Import Quantity (Harmonized Tariff Schedule Heading 0904.20)

| Country | Imported (metric tons)5 | % of Total4 |

| Mexico | 21,051 | 36.92 |

| India | 12,716 | 22.30 |

| China | 9,231 | 16.19 |

| Spain | 4,310 | 7.56 |

| Peru | 3,189 | 5.59 |

| All others | 6,524 | 1.44 |

Table 7. Paprika Oleoresin U.S. Imports by Country of Origin As a Percent of Import Quantity (Harmonized Tariff Schedule Heading 3301.90.10.10)

| Country | Imported (metric tons)3 | % of Total4 |

| Mexico | 11,602 | 77.64 |

| Columbia | 1,070 | 7.16 |

| China | 667 | 4.46 |

| Costa Rica | 282 | 1.89 |

| Peru | 191 | 1.28 |

Conclusion

There are two major avenues to achieving a marketing program through the AMS: marketing orders and research and promotion programs. For those who favor global support of domestic market development, research and promotion programs can be valuable tools to increase demand for an agricultural commodity. Two pathways exist to creating an RPP: submitting a proposal to the USDA’s Agricultural Marketing Service or creating independent legislation.

This paper has reviewed the process that the avocado industry decided to follow and has made some basic comparisons between the avocado industry and the chile industry. The Hass avocado industry decided to create independent legislation instead of a marketing order due in part to the difficulties involved in the marketing order development process. The chile industry must weigh the costs and benefits both of a marketing order and of legislation before attempting to implement either. Such action is a long-term decision that will take many financial, political, and industry resources to accomplish. While many similarities exist between the avocado and chile pepper industries, the differences are large and may make achieving a similar assessment difficult.

Footnotes

1While California’s delegation has 55 members, New Mexico has only 5 delegates in the U.S. Congress. (back to top)

2Due to the size differences between the industries, it may not be appropriate to fund a similar-scale program. In the event that the chile industry decides a research and promotion program is a viable option, the size of the program is also at the industry’s discretion. (back to top)

3Dry weight equivalent, based on ten-year average imports (Global Trade Information Services,2008) (back to top)

4Percent of production for the top ten chile-importing countries (back to top)

5Dry weight, based on ten-year average imports (GTIS, 2008) (back to top)

References

Agricultural Marketing Service. 2004. Marketing orders [Pamphlet]. Washington, D.C.: Author.

Agricultural Marketing Service. 2006a. Overview of marketing agreements and orders. Retrieved February 22, 2007, from http://www.ams.usda.gov/fv/moview.html

Agricultural Marketing Service. 2006b. Steps in developing a fruit and vegetable marketing order or marketing agreement program. Retrieved February 22, 2007, from http://www.ams.usda.gov/fv/moabsteps.html

Agricultural Marketing Service. 2006c. Research and promotion programs. Retrieved February 22, 2007, from http://www.ams.usda.gov/fv/rpb.html

Carman, H.F. 2006. Offsetting price impacts from imports with generic advertising and promotion programs: The Hass Avocado Promotion and Research Order. Rev. Ag. Econ. 28: 463-481.

Global Trade Information Services. 2008. Global Trade Atlas® 1995–2005. Available from http://www.gtis.com/gta/

Hass Avocado Board. 2005. Annual report. Retrieved February 22, 2007, from http://www.avohq.com/i_archive.php

Hass Avocado Promotion, Research, and Information Act, 7 U.S.C. §§ 7801-7813. 2000.

Hearing of the Hass Avocado Promotion, Research, and Information Act of 1999 before the Subcommittee on Livestock and Horticulture, House of Representatives, 106th Cong., 2nd session. 2000.

Morris, L. and Skaggs, R. 2003. U.S. imports and exports of chile peppers and pepper products: frequently asked questions. New Mexico Chile Task Force Report 15, p.13-26. Las Cruces, NM: New Mexico State University.

USDA Economic Research Service. 2006a. Vegetables and melons outlook. VSG-313, p. 25-30. Washington, D.C.: Author.

USDA Economic Research Service. 2006b. Fruit and tree nuts outlook. FTS-321, p. 22-30. Washington, D.C.: Author.

USDA Economic Research Service. 2006c. Fruit and tree nuts situation and outlook yearbook. FTS-2006, p. 51. Washington, D.C.: Author.

USDA Economic Research Service. 2007. Vegetable and melons situation and outlook yearbook. VSG-2007, p. 20. Washington, D.C.: Author.

Appendix I (AMS, 2006b)

AMS Guidelines: How to Submit a Proposal for a Research and Promotion Program

A complete proposal submitted to the USDA should include an overview of the industry and address objectives and details of the proposed program. Specific requirements are listed below. Contact the Research and Promotion Branch of the Fruit and Vegetable Programs for additional guidance at any time before the proposal is officially submitted.

| 1. | Industry Analysis: Develop a profile of the industry, including such information as the volume, value, and geographic distribution of domestic production; the volume, value, and countries of origin of imports; and the number of large and small businesses. |

| 2. | Justification: Determine the justification for a national program. Address questions, such as: |

|

|

| 3. | Objectives: Identify what the industry expects to achieve through the program. |

| 4. | Impact on Small Business: Describe how the program’s reporting, record keeping, and other compliance requirements would affect small businesses. The description should include an estimate of the types of small businesses that would be subject to the order and the type of professional skills necessary to prepare reports and otherwise comply with the program. This analysis should describe each compliance requirement, including the payment of assessments, and estimate the costs, comparing large and small entities. Distinguish initial costs from recurring or operating costs and indicate where different compliance requirements may be necessary for small businesses. In addition, identify all relevant federal rules that may duplicate, overlap, or conflict with the proposed program. |

| 5. | Industry Support: Determine the level of industry support for the program. USDA will not consider a proposal for which there is not substantial industry support. |

| 6. | Text of the Proposal: Draft the text for the proposed order. It should provide the details of the proposed program. Address all aspects of the program, such as who would pay the assessment (e.g., producers, first handlers, processors, importers), what the assessment rate would be (amount per unit of trade) or a maximum assessment rate, and whether small businesses would be exempt and, if so, the exemption level. An outline is attached in this website for your convenience. |

| 7. | Submission: In summary, the package submitted should include: (1) industry analysis, (2) justification, (3) objectives, (4) impact on small business, (5) evidence of industry support for the program, and (6) the text of the proposed order. Submit the completed package to the Administrator of AMS at the following address: Administrator, Agricultural Marketing Service, USDA, STOP Code 0201, 1400 Independence Avenue, S.W., Washington, D.C. 20250-0201. |

Important: Once the proposal is published in the Federal Register, ex parte communication about the substance of the proposal between any U.S. Department of Agriculture representative involved in the decision process and interested persons about the substance of the proposed order is prohibited. Discussion about procedural matters and status reports are permitted.

Appendix II

Hass Avocado Promotion, Research, and Information Act of 2000

Short Title

This title may be cited as the “Hass Avocado Promotion, Research, and Information Act of 2000” (7 U.S.C. §§ 7801-7813).

§ 7801. Findings and Declaration of Policy |

|||||

| (a) | Findings—Congress finds the following: | ||||

| (1) | Hass avocados are an integral food source in the United States that are a valuable and healthy part of the human diet and are enjoyed by millions of persons every year for a multitude of everyday and special occasions. | ||||

| (2) | Hass avocados are a significant tree fruit crop grown by many individual producers, but virtually all domestically produced Hass avocados for the commercial market are grown in the State of California. | ||||

| (3) | Hass avocados move in interstate and foreign commerce, and Hass avocados that do not move in interstate or foreign channels of commerce but only in intrastate commerce directly affect interstate commerce in Hass avocados. | ||||

| (4) | In recent years, large quantities of Hass avocados have been imported into the United States from other countries. | ||||

| (5) | The maintenance and expansion of markets in existence on the date of enactment of this title, and the development of new or improved markets or uses for Hass avocados are needed to preserve and strengthen the economic viability of the domestic Hass avocado industry for the benefit of producers and other persons associated with the producing, marketing, processing, and consuming of Hass avocados. | ||||

| (6) | An effective and coordinated program of promotion, research, industry information, and consumer information regarding Hass avocados is necessary for the maintenance, expansion, and development of domestic markets for Hass avocados. | ||||

| (b) | Purpose—It is the purpose of this title to authorize the establishment, through the exercise of the powers provided in this title, of an orderly procedure for the development and financing (through an adequate assessment on Hass avocados sold by producers and importers in the United States) of an effective and coordinated program of promotion, research, industry information, and consumer information, including funds for marketing and market research activities, that is designed to: | ||||

| (1) | strengthen the position of the Hass avocado industry in the domestic marketplace; and | ||||

| (2) | maintain, develop, and expand markets and uses for Hass avocados in the domestic marketplace. | ||||

| (c) | Limitation—Nothing in this title may be construed to provide for the control of production or otherwise limit the right of any person to produce, handle, or import Hass avocados. | ||||

§ 7802. Definitions |

|||||

| As used in this title: | |||||

| (1) | Board—The terms “Avocado Board” and “Board” mean the Hass Avocado Board established under section 7804. | ||||

| (2) | Conflict of interest—The term “conflict of interest” means a situation in which a member or employee of the Board has a direct or indirect financial interest in a person that performs a service for, or enters into a contract with, the Board for anything of economic value. | ||||

| (3) | Consumer information—The term “consumer information” means any action or program that provides information to consumers and other persons on the use, nutritional attributes, and other information that will assist consumers and other persons in making evaluations and decisions regarding the purchase, preparation, and use of Hass avocados. | ||||

| (4) | Customs—The term “Customs” means the United States Customs Service. | ||||

| (5) | Department—The term “Department” means the United States Department of Agriculture. | ||||

| (6) | Hass avocado | ||||

| (A) | In general—The term “Hass avocado” includes: | ||||

| (i) | the fruit of any Hass variety avocado tree; and | ||||

| (ii) | any other type of avocado fruit that the Board, with the approval of the Secretary, determines is so similar to the Hass variety avocado as to be indistinguishable to consumers in fresh form. | ||||

| (B) | Form of fruit—Except as provided in subparagraph (C), the term includes avocado fruit described in subparagraph (A) whether in fresh, frozen, or any other processed form. | ||||

| (C) | Exceptions—In any case in which a handler further processes avocados described in subparagraph (A), or products of such avocados, for sale to a retailer, the Board, with the approval of the Secretary, may determine that such further processed products do not constitute a substantial value of the product and that, based on its determination, the product shall not be treated as a product of Hass avocados subject to assessment under the order. In addition, the Board, with the approval of the Secretary, may exempt certain frozen avocado products from assessment under the order. | ||||

| (7) | Handler | ||||

| (A) | First handler—The term “first handler” means a person operating in the Hass avocados marketing system that sells domestic or imported Hass avocados for United States domestic consumption, and who is responsible for remitting assessments to the Board. The term includes an importer or producer who sells directly to consumers Hass avocados that the importer or producer has imported into the United States or produced, respectively. | ||||

| (B) | Exempt handler—The term “exempt handler” means a person who would otherwise be considered a first handler, except that all avocados purchased by the person have already been subject to the assessment under section 7804(h). | ||||

| (8) | Importer—The term “importer” means any person who imports Hass avocados into the United States. | ||||

| (9) | Industry information—The term “industry information” means information and programs that are designed to increase efficiency in processing, enhance the development of new markets and marketing strategies, increase marketing efficiency, and activities to enhance the image of Hass avocados and the Hass avocado industry domestically. | ||||

| (10) | Order—The term “order” means the Hass avocado promotion, research, and information order issued under this title. | ||||

| (11) | Person—The term “person” means any individual, group of individuals, firm, partnership, corporation, joint stock company, association, cooperative, or other legal entity. | ||||

| (12) | Producer—The term “producer” means any person who | ||||

| (A) | is engaged in the domestic production of Hass avocados for commercial use; and | ||||

| (B) | owns, or shares the ownership and risk of loss, of such Hass avocados. | ||||

| (13) | Promotion—The term “promotion” means any action to advance the image, desirability, or marketability of Hass avocados, including paid advertising, sales promotion, and publicity, in order to improve the competitive position and stimulate sales of Hass avocados in the domestic marketplace. | ||||

| (14) | Research—The term “research” means any type of test, study, or analysis relating to market research, market development, and marketing efforts, or relating to the use, quality, or nutritional value of Hass avocados, other related food science research, or research designed to advance the image, desirability, and marketability of Hass avocados. | ||||

| (15) | Secretary—The term “Secretary” means the Secretary of Agriculture. | ||||

| (16) | State—The term “State” means each of the several States of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, the United States Virgin Islands, Guam, American Samoa, the Republic of the Marshall Islands, and the Federated States of Micronesia. | ||||

| (17) | United States—The term “United States” means the United States collectively. | ||||

§ 7803. Issuance of Orders |

|||||

| (a) | In General | ||||

| (1) | Issuance—To effectuate the policy of this title specified in section 7801(b), the Secretary, subject to the procedures provided in subsection (b), shall issue orders under this title applicable to producers, importers, and first handlers of Hass avocados. |

||||

| (2) | Scope—Any order shall be national in scope. | ||||

| (3) | One order—Not more than one order shall be in effect at any one time. | ||||

| (b) | Procedures | ||||

| (1) | Proposal for an order—An existing organization of avocado producers established pursuant to a State statute, or any other person who will be affected by this title, may request the issuance of, and submit a proposal for an order. | ||||

| (2) | Publication of proposal—The Secretary shall publish a proposed order and give notice and opportunity for public comment on the proposed order not later than 60 days after receipt by the Secretary of a proposal for an order from an existing organization of avocado producers established pursuant to a State statute, as provided in paragraph (1). | ||||

| (3) | Issuance of order | ||||

| (A) | In general—After notice and opportunity for public comment are provided in accordance with paragraph (2), the Secretary shall issue the order, taking into consideration the comments received and including in the order such provisions as are necessary to ensure that the order is in conformity with this title. | ||||

| (B) | Effective date—The order shall be issued and become effective only after an affirmative vote in a referendum as provided in section 7805, but not later than 180 days after publication of the proposed order. | ||||

| (c) | Amendments—The Secretary, from time to time, may amend an order. The provisions of this title applicable to an order shall be applicable to any amendment to an order. | ||||

§ 7804. Required Terms in Orders |

|||||

| (a) | In General—An order shall contain the terms and provisions specified in this section. | ||||

| (b) | Hass Avocado Board | ||||

| (1) | Establishment and membership | ||||

| (A) | Establishment—The order shall provide for the establishment of a Hass Avocado Board, consisting of 12 members, to administer the order. | ||||

| (B) | Membership | ||||

| (i) | Appointment—The order shall provide that members of the Board shall be appointed by the Secretary from nominations submitted as provided in this subsection. | ||||

| (ii) | Composition—The Board shall consist of participating domestic producers and importers. | ||||

| (C) | Special definition of importer—In this subsection, the term “importer” means a person who is involved in, as a substantial activity, the importation, sale, and marketing of Hass avocados in the United States (either directly or as an agent, broker, or consignee of any person or nation that produces or handles Hass avocados outside the United States for sale in the United States), and who is subject to assessments under the order. | ||||

| (2) | Distribution of appointments— | ||||

| (A) | In general—The order shall provide that the membership of the Board shall consist of the following: |

||||

| (i) | Seven members who are domestic producers of Hass avocados and are subject to assessments under the order. | ||||

| (ii) | Two members who represent importers of Hass avocados and are subject to assessments under the order. | ||||

| (iii) | Three members who are domestic producers of Hass avocados and are subject to assessments under the order, or are importers of Hass avocados and are subject to assessments under the order, to reflect the proportion of domestic production and imports supplying the United States market, which shall be based on the Secretary’s determination of the average volume of domestic production of Hass avocados proportionate to the average volume of imports of Hass avocados in the United States over the previous three years. | ||||

| (B) | Adjustment in board representation—Three years after the assessment of Hass avocados commences pursuant to an order, and at the end of each three-year period thereafter, the Avocado Board shall adjust the proportion of producer representatives to importer representatives on the Board under subparagraph (A)(iii) on the basis of the amount of assessments collected from producers and importers over the immediately preceding three-year period. Any adjustment under this subparagraph shall be subject to the review and approval of the Secretary. | ||||

| (3) | Nomination process—The order shall provide that | ||||

| (A) | 2 nominees shall be submitted for each appointment to the Board; | ||||

| (B) | nominations for each appointment of a producer or an importer shall be made by domestic producers or importers, respectively. | ||||

| (i) | in the case of producers, through an election process which utilizes existing organizations of avocado producers established pursuant to a State statute, with approval by the Secretary; and | ||||

| (ii) | in the case of importers, nominations are submitted by importers under such procedures as the Secretary determines appropriate; and | ||||

| (C) | in any case in which producers or importers fail to nominate individuals for an appointment to the Board, the Secretary may appoint an individual to fill the vacancy on a basis provided in the order or other regulations of the Secretary. | ||||

| (4) | Alternates—The order shall provide for the selection of alternate members of the Board by the Secretary in accordance with procedures specified in the order. | ||||

| (5) | Terms—The order shall provide that | ||||

| (A) | each term of appointment to the Board shall be for 3 years, except that, of the initial appointments, 4 of the appointments shall be for 2-year terms, 4 of the appointments shall be for 3-year terms, and 4 of the appointments shall be for 4-year terms; and | ||||

| (B) | no member of the Board may serve more than 2 consecutive terms of three years, except that any member serving an initial term of 4 years may serve an additional term of 3 years. | ||||

| (6) | Replacement | ||||

| (A) | Disqualification from board service—The order shall provide that if a member or alternate of the Board who was appointed as a domestic producer or importer ceases to belong to the group for which such member was appointed, such member or alternate shall be disqualified from serving on the Board. | ||||

| (B) | Manner of filling vacancy—A vacancy arising as a result of disqualification or any other reason before the expiration of the term of office of an incumbent member or alternate of the Board shall be filled in a manner provided in the order. | ||||

| (7) | Compensation—The order shall provide that members and alternates of the Board shall serve without compensation, but shall be reimbursed for the reasonable expenses incurred in performing duties as members or alternates of the Board. | ||||

| (c) | General Responsibilities of the Avocado Board—The order shall define the general responsibilities of the Avocado Board, which shall include the responsibility to | ||||

| (1) | administer the order in accordance with the terms and provisions of the order; | ||||

| (2) | meet, organize, and select from among the members of the Board a chairperson, other officers, and committees and subcommittees, as the Board determines to be appropriate; | ||||

| (3) | recommend to the Secretary rules and regulations to effectuate the terms and provisions of the order; | ||||

| (4) | employ such persons as the Board determines are necessary, and set the compensation and define the duties of the persons; | ||||

| (5) | |||||

| (A) | develop budgets for the implementation of the order and submit the budgets to the Secretary for approval under subsection (d); and | ||||

| (B) | propose and develop (or receive and evaluate), approve, and submit to the Secretary for approval under subsection (d) plans or projects for Hass avocado promotion, industry information, consumer information, or related research; | ||||

| (6) | |||||

| (A) | implement plans and projects for Hass avocado promotion, industry information, consumer information, or related research, as provided in subsection (d); or | ||||

| (B) | contract or enter into agreements with appropriate persons to implement the plans and projects, as provided in subsection (e), and pay the costs of the implementation, or contracts and agreement, with funds received under the order; | ||||

| (7) | evaluate on-going and completed plans and projects for Hass avocado promotion, industry information, consumer information, or related research and comply with the independent evaluation provisions of the Commodity Promotion, Research, and Information Act of 1996 (subtitle B of title V of Public Law 104–127; 7 U.S.C. 7411 et seq.); | ||||

| (8) | receive, investigate, and report to the Secretary complaints of violations of the order; | ||||

| (9) | recommend to the Secretary amendments to the order; | ||||

| (10) | invest, pending disbursement under a plan or project, funds collected through assessments authorized under this title only in | ||||

| (A) | obligations of the United States or any agency of the United States; | ||||

| (B) | general obligations of any State or any political subdivision of a State; | ||||

| (C) | any interest-bearing account or certificate of deposit of a bank that is a member of the Federal Reserve System; or | ||||

| (D) | obligations fully guaranteed as to principal and interest by the United States, except that income from any such invested funds may be used only for a purpose for which the invested funds may be used; | ||||

| (11) | borrow funds necessary for the startup expenses of the order; and | ||||

| (12) | provide the Secretary such information as the Secretary may require. | ||||

| (d) | Budgets; Plans and Projects | ||||

| (1) | Submission of budgets—The order shall require the Board to submit to the Secretary for approval budgets, on a fiscal year basis, of the anticipated expenses and disbursements of the Board in the implementation of the order, including the projected costs of Hass avocado promotion, industry information, consumer information, and related research plans and projects. | ||||

| (2) | Plans and projects | ||||

| (A) | Promotion and consumer information—The order shall provide | ||||

| (i) | for the establishment, implementation, administration, and evaluation of appropriate plans and projects for advertising, sales promotion, other promotion, and consumer information with respect to Hass avocados, and for the disbursement of necessary funds for the purposes described in this clause; and | ||||

| (ii) | that any plan or project referred to in clause (i) shall be directed toward increasing the general demand for Hass avocados in the domestic marketplace. | ||||

| (B) | Industry information—The order shall provide for the establishment, implementation, administration, and evaluation of appropriate plans and projects that will lead to the development of new markets, maintain and expand existing markets, lead to the development of new marketing strategies, or increase the efficiency of the Hass avocado industry, and activities to enhance the image of the Hass avocado industry, and for the disbursement of necessary funds for the purposes described in this subparagraph. | ||||

| (C) | Research—The order shall provide for | ||||

| (i) | the establishment, implementation, administration, and evaluation of plans and projects for market development research, research with respect to the sale, distribution, marketing, use, quality, or nutritional value of Hass avocados, and other research with respect to Hass avocado marketing, promotion, industry information or consumer information; | ||||

| (ii) | the dissemination of the information acquired through the plans and projects; and | ||||

| (iii) | the disbursement of such funds as are necessary to carry out this subparagraph. | ||||

| (D) | Submission to secretary—The order shall provide that the Board shall submit to the Secretary for approval a proposed plan or project for Hass avocados promotion, industry information, consumer information, or related research, as described in subparagraphs (A), (B), and (C). | ||||

| (3) | Approval by Secretary—A budget, plan, or project for Hass avocados promotion, industry information, consumer information, or related research may not be implemented prior to approval of the budget, plan, or project by the Secretary. Not later than 45 days after receipt of such a budget, plan, or project, the Secretary shall notify the Board whether the Secretary approves or disapproves the budget, plan, or project. If the Secretary fails to provide such notice before the end of the 45-day period, the budget, plan, or project shall be deemed to be approved and may be implemented by the Board. | ||||

| (e) | Contracts and Agreements— | ||||

| (1) | Promotion, consumer information, industry information and related research plans and projects— | ||||

| (A) | In general—To ensure the efficient use of funds, the order shall provide that the Board, with the approval of the Secretary, shall enter into a contract or an agreement with an avocado organization established by State statute in a State with the majority of Hass avocado production in the United States, for the implementation of a plan or project for promotion, industry information, consumer information, or related research with respect to Hass avocados, and for the payment of the cost of the contract or agreement with funds received by the Board under the order. | ||||

| (B) | Requirements—The order shall provide that any contract or agreement entered into under this paragraph shall provide that | ||||

| (i) | the contracting or agreeing party shall develop and submit to the Board a plan or project, together with a budget that includes the estimated costs to be incurred for the plan or project; | ||||

| (ii) | the plan or project shall become effective on the approval of the Secretary; and | ||||

| (iii) | the contracting party or agreeing party shall | ||||

| (I) | keep accurate records of all transactions of the party; | ||||

| (II) | account for funds received and expended; | ||||

| (III) | make periodic reports to the Board of activities conducted; and | ||||

| (IV) | make such other reports as the Board or the Secretary shall require. | ||||

| (2) | Other contracts and agreements—The order shall provide that the Board, with the approval of the Secretary, may enter into a contract or agreement for administrative services. Any contract or agreement entered into under this paragraph shall include provisions comparable to the provisions described in paragraph (1)(B). | ||||

| (f) | Books and Records of Board | ||||

| (1) | In general—The order shall require the Board to | ||||

| (A) | maintain such books and records (which shall be available to the Secretary for inspection and audit) as the Secretary may require; | ||||

| (B) | prepare and submit to the Secretary, from time to time, such reports as the Secretary may require; and | ||||

| (C) | account for the receipt and disbursement of all the funds entrusted to the Board, including all assessment funds disbursed by the Board to a State organization of avocado producers established pursuant to State law. | ||||

| (2) | Audits—The Board shall cause the books and records of the Board to be audited by an independent auditor at the end of each fiscal year. A report of each audit shall be submitted to the Secretary. | ||||

| (g) | Control of Administrative Costs | ||||

| (1) | System of cost controls—The order shall provide that the Board shall, as soon as practicable after the order becomes effective and after consultation with the Secretary and other appropriate persons, implement a system of cost controls based on normally accepted business practices that: | ||||

| (A) | will ensure that the costs incurred by the Board in administering the order in any fiscal year shall not exceed 10 percent of the projected level of assessments to be collected by the Board for that fiscal year; and | ||||

| (B) | cover the minimum administrative activities and personnel needed to properly administer and enforce the order, and conduct, supervise, and evaluate plans and projects under the order. | ||||

| (2) | Use of existing personnel and facilities—The Board shall use, to the extent possible, the resources, staffs, and facilities of existing organizations, as provided in subsection (e)(1)(A). | ||||

| (h) | Assessments | ||||

| (1) | Authority | ||||

| (A) | In general—The order shall provide that each first handler shall remit to the Board, in the manner provided in the order, an assessment collected from the producer, except to the extent that the sale is excluded from assessments under paragraph (6). In the case of imports, the assessment shall be levied upon imports and remitted to the Board by Customs. | ||||

| (B) | Published lists—To facilitate the payment of assessments under this paragraph, the Board shall publish lists of first handlers required to remit assessments under the order and exempt handlers. | ||||

| (C) | Making determinations | ||||

| (i) | First handler status—The order shall contain provisions regarding the determination of the status of a person as a first handler or exempt handler. | ||||

| (ii) | Producer-handlers—For purposes of paragraph (3), a producer-handler shall be considered the first handler of those Hass avocados that are produced by that producer-handler and packed by that producer-handler for sale at wholesale or retail. | ||||

| (iii) | Importers—The assessment on imported Hass avocados shall be paid by the importer to Customs at the time of entry into the United States and shall be remitted by Customs to the Board. Importation occurs when Hass avocados originating outside the United States are released from custody of Customs and introduced into the stream of commerce within the United States. Importers include persons who hold title to foreign-produced Hass avocados immediately upon release by Customs, as well as any persons who act on behalf of others, as agents, brokers, or consignees, to secure the release of Hass avocados from Customs and the introduction of the released Hass avocados into the current of commerce. | ||||

| (2) | Assessment rates—With respect to assessment rates, the order shall contain the following terms: | ||||

| (A) | Initial rate—The rate of assessment on Hass avocados shall be $.025 per pound on fresh avocados or the equivalent rate for processed avocados on which an assessment has not been paid. | ||||

| (B) | Changes in the rate | ||||

| (i) | In general—Once the order is in effect, the uniform assessment rate may be increased or decreased not more than once annually, but in no event shall the rate of assessment be in excess of $.05 per pound. | ||||

| (ii) | Requirements—Any change in the rate of assessment under this subparagraph: | ||||

| (I) | may be made only if adopted by the Board by an affirmative vote of at least seven members of the Board and approved by the Secretary as necessary to achieve the objectives of this title (after public notice and opportunity for comment in accordance with section 553 of title 5, United States Code, and without regard to sections 556 and 557 of such title); | ||||

| (II) | shall be announced by the Board not less than 30 days prior to going into effect; and | ||||

| (III) | shall not be subject to a vote in a referendum conducted under section 7805. | ||||

| (3) | Collection by first handlers—Except as provided in paragraph (1)(C)(iii), the first handler of Hass avocados shall be responsible for the collection of assessments from the producer under this subsection. As part of the collection of assessments, the first handler shall maintain a separate record of the Hass avocados of each producer whose Hass avocados are so handled, including the Hass avocados produced by the first handler. | ||||

| (4) | Timing of submitting assessments—The order shall provide that each person required to remit assessments under this subsection shall remit to the Board the assessment due from each sale of Hass avocados that is subject to an assessment within such time period after the sale (not to exceed 60 days after the end of the month in which the sale took place) as is specified in the order. | ||||

| (5) | Claiming an exemption from collecting assessments—To claim an exemption under section 7802(6) as an exempt handler for a particular fiscal year, a person shall submit an application to the Board: | ||||

| (A) | stating the basis for such exemption; and | ||||

| (B) | certifying such person will not purchase Hass avocados in the United States on which an assessment has not been paid for the current fiscal year. | ||||

| (6) | Exclusion—An order shall exclude from assessments under the order any sale of Hass avocados for export from the United States. | ||||

| (7) | Use of assessment funds—The order shall provide that assessment funds shall be used for payment of costs incurred in implementing and administering the order, with provision for a reasonable reserve, and to cover the administrative costs incurred by the Secretary in implementing and administering this title, including any expenses incurred by the Secretary in conducting referenda under this title, subject to subsection (I). | ||||

| (8) | Assessment funds for state association—The order shall provide that a State organization of avocado producers established pursuant to State law shall receive an amount equal to the product obtained by multiplying the aggregate amount of assessments attributable to the pounds of Hass avocados produced in such State by 85 percent. The State organization shall use such funds and any proceeds from the investment of such funds for financing domestic promotion, research, consumer information, and industry information plans and projects, except that no such funds shall be used for the administrative expenses of such State organization. | ||||

| (9) | Assessment funds for importers associations | ||||

| (A) | In general—The order shall provide that any importers association shall receive a credit described in subparagraph (B) if such association is: | ||||

| (i) | established pursuant to State law that requires detailed State regulation comparable to that applicable to the State organization of United States avocado producers, as determined by the Secretary; or | ||||

| (ii) | certified by the Secretary as meeting the requirements applicable to the Board as to budgets, plans, projects, audits, conflicts of interest, and reimbursements for administrative costs incurred by the Secretary. | ||||

| (B) | Credit—An importers association described in subparagraph (A) shall receive 85 percent of the assessments paid on Hass avocados imported by the members of such association. | ||||

| (C) | Use of funds | ||||

| (i) | In general—Importers associations described in subparagraph (A) shall use the funds described in subparagraph (B) and proceeds from the investment of such funds for financing promotion, research, consumer information, and industry information plans and projects in the United States. | ||||

| (ii) | Administrative expenses—No funds described in subparagraph (C) shall be used for the administrative expenses of such importers association. | ||||

| (i) | Reimbursement of Secretary Expenses—The order shall provide for reimbursing the Secretary | ||||

| (1) | for expenses not to exceed $25,000 incurred by the Secretary in connection with any referendum conducted under section 7805; | ||||

| (2) | for administrative costs incurred by the Secretary for supervisory work of up to 2 employee years annually after an order or amendment to any order has been issued and made effective; and | ||||

| (3) | for costs incurred by the Secretary in implementation of the order issued under section 7803, for enforcement of the title and the order, for subsequent referenda conducted under section 7805, and in defending the Board in litigation arising out of action taken by the Board. | ||||

| (j) | Prohibition on Brand Advertising and Certain Claims | ||||

| (1) | Prohibitions—Except as provided in paragraph (2), a program or project conducted under this title shall not | ||||

| (A) | make any reference to private brand names; | ||||

| (B) | make false, misleading, or disparaging claims on behalf of Hass avocados; or | ||||

| (C) | make false, misleading, or disparaging statements with respect to the attributes or use of any competing products. | ||||

| (2) | Exceptions—Paragraph (1) does not preclude the Board from offering its programs and projects for use by commercial parties, under such terms and conditions as the Board may prescribe as approved by the Secretary. For the purposes of this subsection, a reference to State of origin does not constitute a reference to a private brand name with regard to any funds credited to, or disbursed by the Board to, a State organization of avocado producers established pursuant to State law. Furthermore, for the purposes of this section, a reference to either State of origin or country of origin does not constitute a reference to a private brand name with regard to any funds credited to, or disbursed by the Board to, any importers association established or certified in accordance with subsection (h)(9)(A). | ||||

| (k) | Prohibition on Use of Funds To Influence Governmental Action | ||||

| (1) | In general—Except as otherwise provided in paragraph (2), the order shall prohibit any funds collected by the Board under the order from being used in any manner for the purpose of influencing legislation or government action or policy. | ||||

| (2) | Exception—Paragraph (1) shall not apply to the development or recommendation of amendments to the order. | ||||

| (l) | Prohibition of Conflict of Interest—The Board may not engage in, and shall prohibit the employees and agents of the Board from engaging in, any action that would be a conflict of interest. | ||||

| (m) | Books and Records; Reports | ||||

| (1) | In general—The order shall provide that each first handler, producer, and importer subject to the order shall maintain, and make available for inspection, such books and records as are required by the order and file reports at the time, in the manner, and having the content required by the order, to the end that such information is made available to the Secretary and the Board as is appropriate for the administration or enforcement of this title, the order, or any regulation issued under this title. | ||||

| (2) | Confidentiality requirement | ||||

| (A) | In general—Information obtained from books, records, or reports under paragraph (1) shall be kept confidential by all officers and employees of the Department of Agriculture and by the staff and agents of the Board. | ||||

| (B) | Suits and hearings—Information described in subparagraph (A) may be disclosed to the public only: | ||||

| (i) | in a suit or administrative hearing brought at the request of the Secretary, or to which the Secretary or any officer of the United States is a party, involving the order; and | ||||

| (ii) | to the extent the Secretary considers the information relevant to the suit or hearing. | ||||

| (C) | General statements and publications—Nothing in this paragraph may be construed to prohibit | ||||

| (i) | the issuance of general statements, based on the reports, of the number of persons subject to the order or statistical data collected from the reports, if the statements do not identify the information furnished by any person; or | ||||

| (ii) | the publication, by direction of the Secretary, of the name of any person who violates the order, together with a statement of the particular provisions of the order violated by the person. | ||||

| (3) | Lists of importers | ||||

| (A) | Review—The order shall provide that the staff of the Board shall periodically review lists of importers of Hass avocados to determine whether persons on the lists are subject to the order. | ||||

| (B) | Customs service—On the request of the Secretary or the Board, the Commissioner of the United States Customs Service shall provide to the Secretary or the Board lists of importers of Hass avocados. | ||||

| (n) | Consultations with Industry Experts | ||||

| (1) | In general—The order shall provide that the Board may seek advice from and consult with experts from the production, import, wholesale, and retail segments of the Hass avocado industry to assist in the development of promotion, industry information, consumer information, and related research plans and projects. | ||||

| (2) | Special committees | ||||

| (A) | In general—For the purposes described in paragraph (1), the order shall authorize the appointment of special committees composed of persons other than Board members. | ||||

| (B) | Consultation—A committee appointed under subparagraph (A) shall consult directly with the Board. | ||||

| (o) | Other Terms of the Order—The order shall contain such other terms and provisions, consistent with this title, as are necessary to carry out this title (including provision for the assessment of interest and a charge for each late payment of assessments under subsection (h). | ||||

§ 7805. Referenda. |

|||||

| (a) | Requirements for Initial Referendum | ||||

| (1) | Referendum required—During the 60-day period immediately preceding the proposed effective date of an order issued under section 7803(b)(3), the Secretary shall conduct a referendum among producers and importers required to pay assessments under the order, as provided in section 7804(h)(1). | ||||

| (2) | Approval of order needed—The order shall become effective only if the Secretary determines that the order has been approved by a simple majority of all votes cast in the referendum. | ||||

| (b) | Votes Permitted | ||||

| (1) | In general—Each producer and importer eligible to vote in a referendum conducted under this section shall be entitled to cast 1 vote if they satisfy the eligibility requirements as defined in paragraph (2). | ||||

| (2) | Eligibility—For purposes of paragraph (1), producers and importers, as these terms are defined in section 7802, shall be considered to be eligible to vote if they have been producers or importers with sales of Hass avocados during a period of at least 1 year prior to the referendum. | ||||

| (c) | Manner of Conducting Referenda | ||||

| (1) | In general—Referenda conducted pursuant to this title shall be conducted in a manner determined by the Secretary. | ||||

| (2) | Advance registration—A producer or importer of Hass avocados who chooses to vote in any referendum conducted under this title shall register with the Secretary prior to the voting period, after receiving notice from the Secretary concerning the referendum under paragraph (4). | ||||

| (3) | Voting—A producer or importer of Hass avocados who chooses to vote in any referendum conducted under this title shall vote in accordance with procedures established by the Secretary. The ballots and other information or reports that reveal or tend to reveal the identity or vote of voters shall be strictly confidential. | ||||

| (4) | Notice—The Secretary shall notify all producers and importers at least 30 days prior to the referendum conducted under this title. The notice shall explain the procedure established under this subsection. | ||||

| (d) | Subsequent Referenda—If an order is approved in a referendum conducted under subsection (a), effective beginning on the date that is 3 years after the date of the approval, the Secretary: | ||||

| (1) | at the discretion of the Secretary, may conduct at any time a referendum of producers and importers required to pay assessments under the order, as provided in section 7804(h)(1), subject to the voting requirements of subsections (b) and (c), to ascertain whether eligible producers and importers favor suspension, termination, or continuance of the order; or | ||||

| (2) | shall conduct a referendum of eligible producers and importers if requested by the Board or by a representative group comprising 30 percent or more of all producers and importers required to pay assessments under the order, as provided in section 7804(h)(1), subject to the voting requirements of subsections (b) and (c), to ascertain whether producers and importers favor suspension, termination, or continuance of the order. | ||||

| (e) | Suspension or Termination—If, as a result of a referendum conducted under subsection (d), the Secretary determines that suspension or termination of the order is favored by a simple majority of all votes cast in the referendum, the Secretary shall | ||||

| (1) | not later than 180 days after the referendum, suspend or terminate, as appropriate, collection of assessments under the order; and | ||||

| (2) | suspend or terminate, as appropriate, activities under the order as soon as practicable and in an orderly manner. | ||||

§ 7806. Petition and Review. |

|||||

| (a) | Petition and Hearing | ||||

| (1) | Petition—A person subject to an order may file with the Secretary a petition | ||||

| (A) | stating that the order, any provision of the order, or any obligation imposed in connection with the order is not in accordance with law; and | ||||

| (B) | requesting a modification of the order or an exemption from the order. | ||||

| (2) | Hearing—The petitioner shall be given the opportunity for a hearing on a petition filed under paragraph (1), in accordance with regulations issued by the Secretary. Any such hearing shall be conducted in accordance with section 7808(b)(2) and be held within the United States judicial district in which the residence or principal place of business of the person is located. | ||||

| (3) | Ruling—After a hearing under paragraph (2), the Secretary shall make a ruling on the petition, which shall be final if in accordance with law. | ||||

| (4) | Limitation—Any petition filed under this subsection challenging an order, any provision of the order, or any obligation imposed in connection with the order, shall be filed within 2 years after the effective date of the order, provision, or obligation subject to challenge in the petition. | ||||

| (b) | Review | ||||

| (1) | Commencement of action—The district courts of the United States in any district in which a person who is a petitioner under subsection (a) resides or conducts business shall have jurisdiction to review the ruling of the Secretary on the petition of the person, if a complaint requesting the review is filed no later than 20 days after the date of the entry of the ruling by the Secretary. | ||||

| (2) | Process—Service of process in proceedings under this subsection shall be conducted in accordance with the Federal Rules of Civil Procedure. | ||||

| (3) | Remand—If the court in a proceeding under this subsection determines that the ruling of the Secretary on the petition of the person is not in accordance with law, the court shall remand the matter to the Secretary with directions: | ||||

| (A) | to make such ruling as the court shall determine to be in accordance with law; or | ||||

| (B) | to take such further action as, in the opinion of the court, the law requires. | ||||

| (c) | Enforcement—The pendency of proceedings instituted under this section shall not impede, hinder, or delay the Attorney General or the Secretary from obtaining relief under section 7807. | ||||

§ 7807. Enforcement. |

|||||

| (a) | Jurisdiction—A district court of the United States shall have jurisdiction to enforce, and to prevent and restrain any person from violating, this title or an order or regulation issued by the Secretary under this title. | ||||

| (b) | Referral to Attorney General—A civil action brought under subsection (a) shall be referred to the Attorney General for appropriate action, except that the Secretary is not required to refer to the Attorney General a violation of this title, or an order or regulation issued under this title, if the Secretary believes that the administration and enforcement of this title would be adequately served by administrative action under subsection (c) or suitable written notice or warning to the person who committed or is committing the violation. | ||||

| (c) | Civil Penalties and Orders | ||||

| (1) | Civil penalties | ||||

| (A) | In general—A person who violates a provision of this title, or an order or regulation issued by the Secretary under this title, or who fails or refuses to pay, collect, or remit any assessment or fee required of the person under an order or regulation issued under this title, may be assessed by the Secretary: | ||||

| (i) | a civil penalty of not less than $1,000 nor more than $10,000 for each violation; and | ||||

| (ii) | in the case of a willful failure to remit an assessment as required by an order or regulation, an additional penalty equal to the amount of the assessment. | ||||

| (B) | Separate offenses—Each violation shall be a separate offense. | ||||

| (2) | Cease and desist orders—In addition to or in lieu of a civil penalty under paragraph (1), the Secretary may issue an order requiring a person to cease and desist from continuing a violation of this title, or an order or regulation issued under this title. | ||||

| (3) | Notice and hearing—No penalty shall be assessed, or cease and desist order issued, by the Secretary under this subsection unless the Secretary gives the person against whom the penalty is assessed or the order is issued notice and opportunity for a hearing before the Secretary with respect to the violation. Any such hearing shall be conducted in accordance with section 7808(b)(2) and shall be held within the United States judicial district in which the residence or principal place of business of the person is located. | ||||

| (4) | Finality—The penalty assessed or cease and desist order issued under this subsection shall be final and conclusive unless the person against whom the penalty is assessed or the order is issued files an appeal with the appropriate district court of the United States in accordance with subsection (d). | ||||

| (d) | Review by District Court | ||||

| (1) | Commencement of action | ||||

| (A) | In general—Any person against whom a violation is found and a civil penalty is assessed or a cease and desist order is issued under subsection (c) may obtain review of the penalty or order by, within the 30-day period beginning on the date the penalty is assessed or the order is issued: | ||||

| (i) | filing a notice of appeal in the district court of the United States for the district in which the person resides or conducts business, or in the United States District Court for the District of Columbia; and | ||||

| (ii) | sending a copy of the notice by certified mail to the Secretary. | ||||

| (B) | Copy of record—The Secretary shall promptly file in the court a certified copy of the record on which the Secretary found that the person had committed a violation. | ||||

| (2) | Standard of review—A finding of the Secretary shall be set aside under this subsection only if the finding is found to be unsupported by substantial evidence. | ||||

| (e) | Failure To Obey an Order | ||||

| (1) | In general—A person who fails to obey a cease and desist order issued under subsection (c) after the order has become final and unappealable, or after the appropriate United States district court had entered a final judgment in favor of the Secretary of not more than $10,000 for each offense, after opportunity for a hearing and for judicial review under the procedures specified in subsections (c) and (d). | ||||

| (2) | Separate violations—Each day during which the person fails to obey an order described in paragraph (1) shall be considered as a separate violation of the order. | ||||

| (f) | Failure To Pay a Penalty | ||||

| (1) | In general—If a person fails to pay a civil penalty assessed under subsection (c) or (e) after the penalty has become final and unappealable, or after the appropriate United States district court has entered final judgment in favor of the Secretary, the Secretary shall refer the matter to the Attorney General for recovery of the amount assessed in any United States district court in which the person resides or conducts business. | ||||

| (2) | Scope of review—In an action by the Attorney General under paragraph (1), the validity and appropriateness of a civil penalty shall not be subject to review. | ||||

| (g) | Additional Remedies—The remedies provided in this title shall be in addition to, and not exclusive of, other remedies that may be available. | ||||

§ 7808. Investigations and Power to Subpoena. |

|||||

| (a) | Investigations—The Secretary may conduct such investigations as the Secretary considers necessary for the effective administration of this title, or to determine whether any person has engaged or is engaging in any act that constitutes a violation of this title or any order or regulation issued under this title. | ||||

| (b) | Subpoenas, Oaths, and Affirmations | ||||

| (1) | Investigations—For the purpose of conducting an investigation under subsection (a), the Secretary may administer oaths and affirmations, subpoena witnesses, compel the attendance of witnesses, take evidence, and require the production of any records that are relevant to the inquiry. The production of the records may be required from any place in the United States. | ||||

| (2) | Administrative hearings—For the purpose of an administrative hearing held under section 7806(a)(2) or 7807(c)(3), the presiding officer may administer oaths and affirmations, subpoena witnesses, compel the attendance of witnesses, take evidence, and require the production of any records that are relevant to the inquiry. The attendance of witnesses and the production of the records may be required from any place in the United States. | ||||

| (c) | Aid of Courts | ||||

| (1) | In general—In the case of contumacy by, or refusal to obey a subpoena issued under subsection (b) to, any person, the Secretary may invoke the aid of any court of the United States within the jurisdiction of which the investigation or proceeding is conducted, or where the person resides or conducts business, in order to enforce a subpoena issued under subsection (b). | ||||

| (2) | Order—The court may issue an order requiring the person referred to in paragraph (1) to comply with a subpoena referred to in paragraph (1). | ||||

| (3) | Failure to obey—Any failure to obey the order of the court may be punished by the court as a contempt of court. | ||||