New Mexico's Chile Pepper Industry: Chile Types and Product Sourcing1

New Mexico Chile Task Force Report 8

T.Y. Hall and R.K. Skaggs

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Authors: Respectively, Former graduate research assistant, Department of Agricultural Economics and Agricultural Business, New Mexico State University, Las Cruces, professor, Department of Agricultural Economics and Agricultural Business, New Mexico State University, Las Cruces. E-mail: rskaggs@nmsu.edu.

Introduction

Chile peppers have been cultivated in New Mexico’s Rio Grande Valley for four centuries. Considered the state’s signature crop, chile peppers are the basis of a very complex and differentiated industry that includes fresh, preserved and value-added products. In 2000, the crop ranked fifth in the state for cash receipts from agricultural commodities. The chile pepper industry contributes to New Mexico’s economy and employs numerous workers engaged in manual farm labor, processing, marketing and other related areas.

This report describes the New Mexico chile pepper industry, including pepper types produced, the nature of pepper processing in the state, and sources of raw peppers that flow into the state’s processing facilities. The information reported here is the result of graduate thesis research conducted by T. Y. Hall (Hall, 2001). The research was performed in coordination with and support of other New Mexico Chile Task Force activities.

Differentiation among chile types

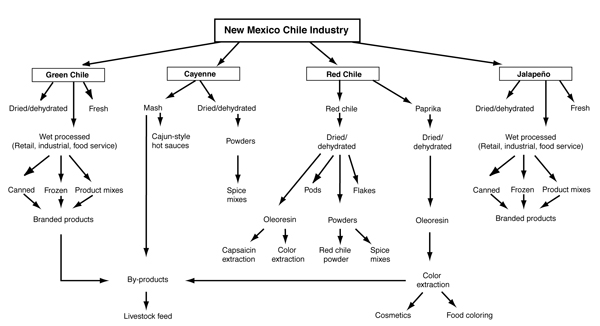

Chile peppers are direct-seeded in March and April, or transplants are started in greenhouses in February and planted in fields in April or May, depending on weather and other factors. Traditionally, green chiles were harvested beginning in late summer and continuing into the fall. In the past, pods left to mature on the plant after the green harvest comprised the red chile crop. Today, the industry is highly segmented, and varieties have been developed specifically for green or red processing. The majority of red and paprika chiles produced are varieties specifically grown for that purpose. Currently, green chile and jalapeños are harvested from mid-summer into the fall, usually peaking in late summer. Red chile harvest begins in late fall and continues into the winter months (sometimes even into the next calendar year). In addition, the cayenne, paprika and jalapeño sectors make up a large portion of the market and have distinct marketing and processing patterns. Fig. 1 shows the flow of the various chile types to their final markets.

Green chile

New Mexico green chile is sold as fresh, dehydrated or wet processed. The fresh market consists of numerous roadside stands and grocery stores, where vendors commonly roast the green chile for customers while they wait. Consumers take the roasted chile home for immediate consumption or to freeze for later use. When green chile is dehydrated, it primarily is used as a component of spice mixes or as flavoring for soups, dips and other processed food items.

Wet-processed products usually are canned, frozen or pickled. Large quantities of wetprocessed green chile are sold directly to the retail sector, the industrial sector and the food service sector. Chiles sold to the industrial and food service sectors usually undergo further processing before being sold to the final consumers. Some of the chile undergoes additional processing into product mixes and ready-to-eat items. Product mixes are items, such as sauces, Mexican-style salsas and meal flavoring kits. Consumer-ready items include prepared enchiladas, tamales and chile rellenos, usually found in supermarket freezer cases.

At all stages in green chile processing, the product may be sold as a branded product. Examples of consumer-ready brands using green chile peppers are Hatch Green Chile, Bueno Foods, Old El Paso and Roberto’s.

Cayenne Peppers

Cayenne peppers primarily have two uses in New Mexico: They are made into mash or dehydrated. A hammer-mill process is used to turn fresh cayenne peppers into mash. This process involves crushing the peppers with salt and large quantities of vinegar. After the process is complete, the mash is shipped in large tanks moved by truck or rail to out-of-state locations where the mash is used to create Cajun-style hot sauces. One company that purchases New Mexico mash for hot sauce is Lousiana-based McIlhenny’s. The by-products from making mash frequently are sold as livestock feed. A small amount of cayenne pepper is used for dehydrated products. Chile powder from dried cayenne pepper also is incorporated into spice mixes.

Red chile

The red chile sector in New Mexico is large and complex. The industry can be divided into two distinct categories: red chile and paprika. Red chile is a pepper of bright red color that usually has different heat levels and many different uses. Red chile usually is dehydrated after harvest. After dehydration, it can be left as a whole chile pod, processed into flakes or processed into powder. Dried whole red chile pods are sold wholesale, then packaged and distributed to consumers. Dried red chile is further processed into red chile sauces for items, such as enchiladas, chile con carne and burritos. Whole red chile pods are made into decorative chile ristras, popular among residents and tourists and often considered the state’s unofficial symbol. Dehydrated red chile processed into flakes is sold as a spice or seasoning. Large food chains, such as Pizza Hut and Papa John’s Pizza, buy this product so consumers can add additional spice to their pizza and other foods. Finally, red chile can be processed into powder. The red chile powder is used as a seasoning and to make various sauces. Red chile powder also is used to make spice mixes, including combinations requested by specific customers (such as Taco Bell or various brand-named chile powder products).

Figure 1. New Mexico chile pepper industry flow chart (Source: processor interviews, 2001).

Paprika is a type of red chile that has little or no heat. It is grown primarily for its color and, after harvest and dehydration, is processed in one of two ways. In the first, the dehydrated paprika pods are ground into powder that can be further processed into spice mixes. Paprika spices primarily are used for color in foods due to the peppers’ low heat levels. Paprika also is processed for oleoresin extraction. Oleoresin is a dark red, oily substance extracted from paprika powder through a chemical or physical process. After extraction, oleoresin is used as a natural red colorant for products, such as barbeque sauce, potato chips and prepared meats.

Capsaicin, the substance that makes chile peppers hot, also can be extracted from the more pungent varieties. Capsaicin is used in self-defense sprays by individuals, law enforcement personnel and outdoors enthusiasts.

Jalapeño peppers

The jalapeño sector mirrors the green chile sector. Jalapeños can be classified into three different postharvest categories: fresh, dehydrated or wet processed. Some jalapeños are sold in the fresh market, but the majority are wet processed (i.e., pickled, canned). When jalapeños are dried or dehydrated, they are used in spice mixes and prepared food products. Jalapeños sold directly to consumers at roadside stands and farmers’ markets dominate the small fresh market. Mass quantities of wet-processed jalapeños are sold directly to retail markets, industrial markets and food service markets. In each of the three categories, jalapeños are canned, pickled or frozen, and/or incorporated into product mixes. Canned or pickled jalapeños are used in nachos, salads and sandwiches. The product mixes include stuffed jalapeños and Mexican-style salsas. At all postharvest stages, jalapeños may be sold as branded products.

Table 1. New Mexico chile pepper acreage harvested by county.

| County | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| Chaves | 2,500 | 1,400 | 2,200 | 1,700 | 1,650 | 1,500 | 1,400 |

| Doña Ana | 8,200 | 6,000 | 6,900 | 7,000 | 6,300 | 4,000 | 4,900 |

| Eddy | 1,800 | 6,000 | 6,900 | 7,000 | 6,300 | 4,000 | 4,900 |

| Hidalgo | 2,300 | 2,200 | 3,100 | 2,600 | 2,500 | 1,250 | 2,600 |

| Lea | 1,200 | 1,100 | 1,100 | 900 | 800 | 1,000 | 700 |

| Luna | 8,000 | 8,200 | 9,400 | 7,600 | 7,300 | 6,500 | 6,500 |

| Sierra | 2,000 | 1,000 | 1,500 | 900 | 850 | 600 | 700 |

| Socorro | 400 | 300 | 600 | 350 | 400 | 200 | 300 |

| Other counties | 1,500 | 1,200 | 2,000 | 850 | 900 | 650 | 800 |

| Total New Mexico | 27,900 | 22,400 | 28,700 | 23,000 | 21,500 | 16,200 | 19,000 |

| Source: New Mexico Agricultural Statistics, 1994-2000. |

Several green chile pepper and jalapeño processors perform various other operations in addition to processing chile peppers. Some examples of other items that are processed in New Mexico include tomatillos, onions, refried beans, Mexican-style salsas and other prepared foods. After processing, these products are sold in industrial-size quantities or under private labels at the retail level.

Chile Sources for the New Mexico industry

In 2000, there were 18,827,882 metric tons of chile peppers (including bell peppers) produced worldwide. The world’s largest producer of chile peppers was China at 8,141,175 metric tons. Other major producing countries listed in order of total production were Mexico, Turkey, Spain and the United States (FAO-UN, 2000).

In 2000, there were 19,000 chile pepper acres harvested in New Mexico (NMDA, 2000), yielding 80,500 tons of green chile and cayenne peppers (wet weight) and 18,500 tons of red chile peppers (dry weight). The following New Mexico counties produce significant quantities of chile peppers: Chaves, Doña Ana, Eddy, Hidalgo, Lea, Luna, Sierra and Socorro. Doña

Ana, Hidalgo and Luna counties accounted for approximately 86 percent of the state’s chile pepper production and 74 percent of the state’s harvested chile acreage in 2000. Doña Ana and Luna counties alone produced almost 70,000 tons of chile peppers in 2000, or 71 percent of the state’s total (NMDA, 2000). Other counties that produce much smaller amounts are Bernalillo, Guadalupe, Grant, Otero, Quay, Rio Arriba, Roosevelt, Sandoval, San Juan, Santa Fe and Valencia. Harvested chile pepper acreages for 1994-2000 are shown (table 1) for the primary producing counties.

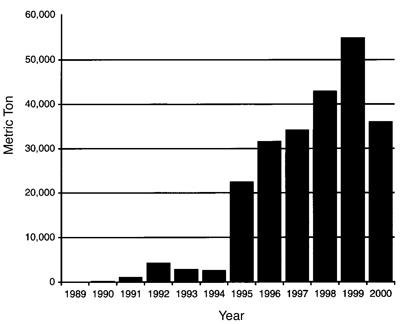

The chile pepper processing industry in New Mexico imports large quantities of chile peppers from Mexico. Fig. 2 shows the growth in chile pepper imports from Mexico through New Mexico’s ports of entry over the past decade. Imports of chile peppers from Mexico have grown because of the North American Free Trade Agreement (NAFTA), relatively low labor costs in Mexico as compared with the United States and devaluation of the Mexico peso relative to the U.S. dollar. Many chile pepper industry observers and participants believe that the recent increases in chile pepper imports from Mexico threaten market shares held by New Mexico farmers. Chile peppers that enter the United States from Aug. 1 to Sept. 30 have been duty free since Jan.1, 1994 (Eastman and Orta, 2001). Chile peppers entering the United States at other times of the year are subject to import quotas and varying import tariffs. However, as of Aug. 1, 2003, fresh or chilled Mexican chile pepper imports will be completely free of import tariffs or quotas (Eastman and Orta, 2001). This will further increase the Mexican chile peppers’ competitiveness with New Mexico-produced crops.

To better understand the sourcing of chile peppers for the New Mexico processing

industry, informal interviews were held with chile pepper processors in New Mexico and western Arizona during summer 2001. Questions related to raw product sourcing included type of chile pepper products processed, tons processed and sources of raw materials. Nine green chile, cayenne and jalapeño pepper processors provided information for this research. Because many processors were reluctant to provide exact numbers due to privacy concerns, the figures obtained should be considered rough estimates. Data for firms that declined to provide information were imputed based on information obtained from individuals knowledgeable about the New Mexico chile pepper industry. These estimates were combined with data from firms that participated in the research. The master’s thesis research project, under which this research was conducted, was focused on obtaining chile processing information specific to Doña Ana County. Thus, results for that county are discussed in some detail later. Results of the interviews are aggregated to avoid disclosing information about individual firms.

Figure 2. Chile pepper imports from Mexico through New Mexico ports of entry (Sources: Medrano, 2001; Coppenbarger, 2001).

Table 2. Chile peppers processed in southern New Mexico by chile type and pepper growing region.

| Green chile, cayenne and jalapeño peppers (wet tons) | Red chile peppers (dry tons) | |

| Mexico | 33,750 | 1,500 |

| United States1 | 7,590 | 0 |

| Texas | 0 | 67 |

| New Mexico (county not identified)2 | 33,650 | 7,243 |

| Doña Ana County, N.M. | 22,446 | 15,675 |

| Not identified3 | 14,573 | 12,250 |

| Total | 112,009 | 36,735 |

| 1Data for the United States may include Arizona, Texas, New Mexico and Doña Ana County, N.M. 2 Data for New Mexico may include Doña Ana County, N.M. 3Data for "not identified" may include Mexico, United States, Texas, Arizona, New Mexico, and Doña Ana County, N.M , because some processors declined to provide separate estimates. Source: Data compiled through processor interviews conducted May through September 2001. |

The estimates of processed tons developed through the processor interviews are significantly larger than the most recent estimates reported in the New Mexico Agriculture Statistics. The 1998 New Mexico Agriculture Statistics reports a total of 55,408 tons of green chile, jalapeño and cayenne peppers (as harvested weight) processed in New Mexico in 1998, without referring to the origin of the chile peppers (NMDA, 1998). Results of the summer 2001 processor interviews indicate that 112,009 tons of green chile, jalapeño and cayenne peppers were processed in 2000. Members of the state’s chile pepper industry have expressed concern that data reported by the New Mexico Department of Agriculture (NMDA) underestimate the industry’s size (Phillips, 2001). However, the amount of processed chile reported in 1998 New Mexico Agriculture Statistics is only for chile peppers grown in New Mexico; the figures do not include peppers grown outside the state and processed in New Mexico (Lucero, 2002). Processed chile data have not been released or published since 1998 due to concerns about revealing data for individual processors (Hand, 2002).

Although the cayenne pepper is a type of red chile pepper, it is included in and discussed below with the green chile sector. This is due to wet tonnage reporting for cayenne and green chile peppers versus dry tonnage reporting used for most red chile peppers. The interview data reported here for red chile (in dry tons) also are notably lower than the tonnages reported processed in the 1998 New Mexico Agriculture Statistics.

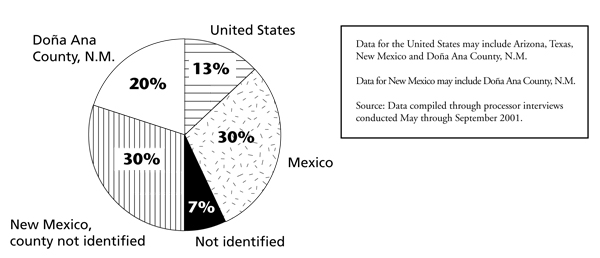

Interview results are presented in table 2, which shows the numbers and breakdown of processed chile pepper tons in New Mexico. Using table 2 information, fig. 3 further illustrates the sourcing by location of processed green chile, cayenne and jalapeño peppers. Unprocessed chile peppers going into the fresh market are not included in these estimates. An estimated 22,446 tons of green chile, cayenne and jalapeño peppers were grown and processed in Doña Ana County in 2000. Several processors who provided information declined to report the specific origin of their raw materials, either within or outside of New Mexico.

Fig. 3 shows New Mexico and/or Doña Ana County as the source of 50 percent of the green chile, cayenne and jalapeño peppers processed in the state. Based on processor interviews, it appears that about 50 percent of green chile and cayenne peppers processed in New Mexico are grown in the United States, and about 50 percent of the jalapeños processed in New Mexico are grown in the United States.

Figure 3. Sources of green chile and cayenne peppers used by New Mexico chile pepper processors.

Twenty dried red chile processors were questioned in the series of informal interviews. The processing plants included 14 plants in Doña Ana County and others located elsewhere in New Mexico, West Texas and Arizona. The complex marketing chain of the regional red chile industry made it necessary to contact processors in counties outside New Mexico that are integral components of the state’s red chile sector.

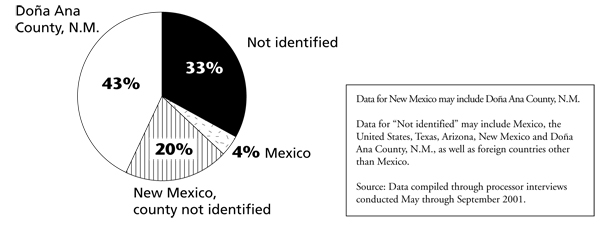

The red chile pepper processors indicated using peppers or powders produced in several different locations, as shown in fig. 4. From the processor interviews, an estimated total of 36,735 tons of red chile peppers was processed in Doña Ana County in 2000. Fig. 4 gives the breakdown of red chile peppers processed by production region. Doña Ana County and New Mexico produced an estimated 63 percent of the red chile peppers processed in the region, with Mexico accounting for about 4 percent. Thirty-three percent of the processed red chile could not be identified by growing location.

Conclusion

Numerous factors have prompted chile growers, processors, researchers and others involved in the New Mexico chile pepper industry to take a closer look at all aspects of the industry. Reductions in chile acreage and an increased inflow of raw product from Mexico and other foreign countries have caused the industry to look for ways to reduce farm-level chile pepper production costs and increase productivity throughout the industry. This report is a first step in documenting the many facets of New Mexico’s complex chile pepper industry. The information provided here is limited by industry members’ desire to maintain their privacy and the fact that the data provided were rough estimates (i.e., processors were not asked to consult their records during the course of interviews). As indicated above, data provided by processors were aggregated to avoid disclosing information about individual firms. However, even with these limitations, it is hoped that the information can be used by the New Mexico chile industry to address its current market problems and to inform interested parties about the industry.

Figure 4. Sources of red chile peppers used by New Mexico chile processors.

Footnote

1This report was reviewed by Lowell Catlett and Constance Falk, professors, Department of Agricultural Economics and Agricultural Business; Richard Phillips, manager, New Mexico Chile Task Force, Department of Extension Plant Sciences; and Stephanie Walker, research specialist, Department of Agronomy and Horticulture, all with New Mexico State University, Las Cruces; and David Layton, agriculture manager, Border Foods Inc., Deming, N.M. New Mexico State University's Agricultural Experiment Station and New Mexico Chile Task Force supported this research.

References

Eastman, C. and Orta, L. (2001). “Farm Labor Dynamics in Southern New Mexico: A Transborder Phenomenon.” Journal of Borderlands Studies 16(1):51-65.

Food and Agriculture Organization of the United Nations (FAO-UN). Chillies and Peppers, Green Production. (2000). World Wide Web site: www.fao.org. Food and Agriculture Organization. Accessed: 6-20-2001.

Hall, T. Y. (2001). The New Mexico Chile Pepper Industry: Description, Labor Issues and Economic Impacts. Unpublished master’s thesis, Department of Agricultural Economics and Agricultural Business, College of Agricultural, Consumer and Environmental Sciences, New Mexico State University, Las Cruces, N.M.

Hand, J. (2002). Deputy State Statistician, United States Department of Agriculture, New Mexico Agricultural Statistics Service, Las Cruces, N.M. Personal communication. New Mexico Department of Agriculture (NMDA). (1994—2000). New Mexico Agricultural Statistics (various years). Las Cruces, N.M., New Mexico Agricultural Statistics Service.

Lucero, D. (2002). Specialist, Marketing and Development Division, New Mexico Department of Agriculture, Las Cruces, N.M. Personal communication.

Phillips, R. (2001). Project Manager, Extension Plant Sciences, New Mexico Chile Task Force, New Mexico State University, Las Cruces, N.M. Personal communication.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at aces.nmsu.edu

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

May 2003, Las Cruces, NM