U. S. Imports and Exports of Chile Peppers and Pepper Products: Frequently Asked Questions1,2

New Mexico Chile Task Force: Report 15

Leslee Morris and Rhonda Skaggs

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Authors: Respectively, former graduate research assistant and professor, Department of Agricultural Economics and Agricultural Business, College of Agriculture and Home Economics, New Mexico State University. Address correspondence or questions to Rhonda Skaggs, rskaggs@nmsu.edu.

What is this report’s objective?

In recent years, New Mexico Chile Task Force members have raised questions about the magnitude of U.S. chile pepper imports and exports. Much of these data are available on the World Wide Web; however, finding and interpreting them can be confusing. This report consolidates import and export information for chile peppers. It also provides an introduction to the harmonized codes used for international trade data and to the U.S. system of tracking transactions in the international marketplace.

Who is in charge of recording U.S. trade data?

The U.S. Customs Service uses the Automated Commercial System (ACS) to keep track of information on U.S. imports. The ACS tracks, controls and processes data for 95 percent of all U.S. imports. The ACS may be accessed on the Web at www.itds.treas.gov/it06npr.html. The system electronically receives and processes entry documentation and provides cargo disposition information. U.S. importers file data electronically to the ACS and can pay import taxes electronically. The ACS also is used to keep track of the quantities of items imported under quotas.

The Automated Export System (AES) is the electronic system used to keep track of information on U.S. exports. The AES is the central point through which data required for exporting commercial goods from the United States are reported to the U.S. government. Shipping declarations are filed electronically with the AES, which also monitors exports of controlled items. The AES currently receives data for waterborne, overland and airborne exports. Electronic filing through AES is expected to be mandatory by January 2005.

Trade data for U.S. imports and exports are organized using the Harmonized Tariff System (HTS). The United States adopted this global classification system for traded goods in 1986. The HTS classifies goods according to a system that the World Customs Organization adopted internationally in 1983. Almost all countries use the system, allowing businesses, researchers and negotiators from around the world to study trade flows and negotiate trade agreements using the same framework for traded goods classification. The system has been used to improve collection of import and export statistics, and is harmonized with the tariff schedules of the world’s major trading countries. These countries all use the same basic structure for their trade data and tariff schedules. Each country lists its own duty rates and specific trade provisions within the standard harmonized structure. The harmonized system thus allows for cross-country comparison of tariffs on identical goods.

Why is there such a large demand for United States international trade data?

Federal agencies and the private sector need up-to-date trade data to enforce trade regulations, account for revenues and support U.S.’ trade efforts throughout the global marketplace. Researchers and marketing specialists use data to identify market trends and opportunities. The U.S. government uses trade data to formulate new trade policies and enforce existing policies.

How are U.S. imports and exports classified?

All imports to and exports from the United States are classified using the HTS. The HTS assigns a code to all goods and commodities that enter and exit the United States during global trade transactions and notes the import tariffs assigned to goods entering the United States from specific countries under various trade agreements.

The coding method used by the system is explained in detail below. The internationally harmonized system assigns six-digit codes for categories of goods. These codes are common among all major trading countries. Nations can define products using more digits, and the United States uses 10-digit codes; however the additional four digits are not harmonized with other countries’ systems.

Where can I find information about the U.S. Harmonized Tariff System?

The HTS codes for products exported from the United States are administered by the U.S. Census Bureau and are called Schedule B Codes. Import codes are administered by the U.S. International Trade Commission.

How is the Harmonized Tariff System organized?

The HTS divides goods into almost 100 chapters, each covering different groups of products. For example, live animals are covered under Chapter 1, pharmaceuticals are in Chapter 30, footwear in Chapter 64, clocks in Chapter 91. The complete lists of all chapters and the goods included in them are presented at the Web sites listed above.

How are chile peppers and pepper products covered in the HTS?

Chile peppers are classified under three HTS chapters: 07 (edible vegetables and certain roots and tubers), 09 (coffee, tea, mate and spices) and 33 (essential oils and resinoids, perfumery, cosmetics or toilet preparations). Each chapter is divided into categories that are coded with up to 10 digits. The greater the number of digits, the more details about the product, and the less aggregated the data. Data reported at six digits are more aggregated than data reported at eight digits, while eight-digit data are more aggregated than 10-digit data.

Chapter 07 of the harmonized schedule applies to “edible vegetables and certain roots and tubers.” The four-digit code 0709 applies to “other vegetables, fresh or chilled.” The six-digit code 0709.60 includes “fruits of the genus Capsicum (peppers) or of the genus Pimenta” (e.g., allspice).

The eight-digit code 0709.60.20 is for “chili peppers” while 0709.60.40 is for “other.” Table 1 presents chile pepper codes in Chapter 07, and the codes as they are shown at the U.S. International Trade Commission Web site with relevant tariffs applying to U.S. imports of these items.

Table 2 presents chile pepper codes in Chapter 09, “coffee, tea, mate and spices.” “Pepper of the genus Piper, dried, crushed, or ground fruits of the genus Capsicum (peppers) or of the genus Pimenta (e.g., allspice)” are given the general code of 0904. “Dried, crushed or ground fruits of the genus Capsicum or genus Pimenta (including allspice), dried, crushed or ground” are further classified as 0904.20. Dried paprika of the genus Capsicum (including cayenne pepper, paprika and red pepper) is further classified as 0904.20.20. Dried, crushed or ground Anaheim and Ancho peppers are further coded as 0904.20.40. Dried, but not ground, peppers of the genus Capsicum are classified as 0904.20.60. Dried, but not ground, bell peppers are 0904.20.60.10; dried, but not ground, jalapeño peppers are 0904.20.60.20; and dried, but not ground, “other” peppers are 0904.20.60.90. Ground mixtures of mashed or macerated hot red peppers (of the genus Capsicum) and salt are 0904.20.73.00, while ground “other” peppers of the genus Capsicum are classified as 0904.20.76.00 and peppers of the genus Pimenta are classified as 0904.20.80.00.

Table 3 presents chile pepper codes in chapter 33 (essential oils and resinoids; perfumery, cosmetic or toilet preparations). Chapter 33 includes many codes at all levels (i.e., numbers of digits); however, the code relevant to the chile pepper industry is 3301.90.10.10 and pertains to extracted oleoresins from paprika.

| Table 1. The harmonized tariff schedule for fresh chile peppers (Chapter 07). | ||||||

| Heading/ Subheading |

Stat- Suffix |

Article Description | Unit of Quantity |

Rates of Duty | ||

| 1 | 2 | |||||

| General | Special | |||||

| 709.60 | Fresh or chilled fruits of Genus Capsicum (peppers) or of the genus Pimenta (e.g., allspice) | |||||

| 709.60.20 | 00 | Chile Peppers | kg | 4.4¢/kg | Free (A, CA, E, IL, J, JO) See 9906.07.41-9906.07.43 (MX) |

5.5¢/kg |

| 10 | Greenhouse | kg | ||||

| 90 | Other | kg | ||||

| 0709.60.40 | 00 | Other | kg | 4.7¢/kg | Free (A, CA, E, IL, J, JO) See 9906.07.44-9906.07.45 (MX) |

5.5¢/kg |

| 10 | Greenhouse | kg | ||||

| 90 | Other | kg | ||||

| Table 2. The harmonized tariff schedule for dried chile peppers (Chapter 09). | ||||||

| Heading/ Subheading |

Stat- Suffix |

Article Description | Unit of Quantity |

Rates of Duty | ||

| 1 | 2 | |||||

| General | Special | |||||

| 0904 | Pepper of the genus Piper; dried or crushed or ground fruits of genus Capsicum (peppers) or of the genus Pimenta (e.g., allspice) | |||||

| 0904.20 | Fruits of the genus Capsicum or of the genus Pimenta (including allspice), dried or crushed or ground: Of the genus Capsicum (including cayenne pepper, paprika and red pepper) | |||||

| 0904.20.20 | 00 | Paprika | kg | 3¢/kg | Free (A, CA, E IL, J, JO, MX) | 11¢/kg |

| 0904.20.40 | 00 | Anaheim and Ancho pepper | kg | 5¢/kg | Free (A+, CA, D,E, IL, J, JO) 1.1¢/kg (MX) |

11¢/kg |

| 0904.20.60 | Other: Not ground |

2.5¢/kg | Free (A, CA, E, IL, J, JO, MX) | 11¢/kg | ||

| 10 | Bell peppers | kg | ||||

| 20 | Jalapeño peppers | kg | ||||

| 90 | Other | kg | ||||

| 0904.20.73 | 00 | Ground: Mixture of mashed or macerated hot red peppers and salt |

kg | Free | 17.6¢/kg | |

| 0904.20.76 | 00 | Other | kg | 5¢/kg | Free (A,CA, E, IL,J, JO, MX) | 17.6¢/kg |

| 0904.20.80 | 00 | Of the genus Pimenta (including allspice) | kg | Free | Free | |

Table 3. The harmonized tariff schedule for extracted oleoresins (chapter 33).

| Heading/ Subheading |

Stat- Suffix |

Article Description | Unit of Quantity |

Rates of Duty | ||

| 1 | 2 | |||||

| General | Special | |||||

| 3301 | Essential oils (terpeneless or not), including concretes and absolutes; resinoids; extracted oleoresins; concentrates of essential oils in fats, in fixed oils, in waxes or the like, obtained by enfleurage or maceration, terpenic by-products of the deterpenation of essential oils; aqueous distillates and aqueous solutions of essential oils. | |||||

| 3301.90 | Other: | |||||

| 3301.90.10 | Extracted oleoresins | 3.8% | Free (A*, CA, CL, E, IL, J, JO, MX, SG) | 25% | ||

| 3301.90.10.10 | Paprika | kg | ||||

Where can I locate harmonized trade data for the United States?

The U.S. International Trade Commission (USITC) provides harmonized data for U.S. imports and exports in the Interactive Tariff and Trade DataWeb at dataweb.usitc.gov/. This database provides U.S import and export statistics (e.g. quantities and values), tariffs, future tariffs and tariff preference information. The data are provided at no charge, on a self-service, interactive basis. Users define their own queries for specific product codes. Data are available for 1989 to the present. Users must create an account with the DataWeb, but there is no cost for the account or for accessing data. Users should print a copy of the relevant pages from the U.S. harmonized tariff schedule from the U.S. International Trade Commission before attempting to use the USITC DataWeb. The Web site, dataweb.usitc.gov/, also includes general information related to trade agreements.

What is a rate of duty?

A duty is the charge (tariff or tax) levied on a product as it enters another country. Rates of duty are levied on a per unit imported basis for Chapter 07 and Chapter 09 products, and on a percentage of value imported basis for Chapter 33 products (tables 1-3). The General Rate of Duty is the general or normal trade relations rate that is applicable to products from countries that are not entitled to special tariff treatment. The only countries that do not have normal trade relations status with the United States are Cuba, Laos and North Korea.

The Special Rate of Duty subcolumn shows rates of duty determined by special tariff treatment programs, such as the North American Free Trade Agreement (NAFTA) and the United States-Chile Free Trade Agreement. For most of the chile pepper or pepper products, the Special Rate of Duty is “free,” meaning no tariff is levied on imports from the countries receiving special treatment. Column 2 rates of duty apply to countries that do not have normal trade relations with the United States.

What special tariff treatment programs does the United States have for chile peppers and pepper products?

The following codes (tables 1-3, “Special Rates of Duty”) refer to special trade arrangements between the United States and other countries that affect chile peppers and pepper products.

| A, A*, A+ | Generalized system of preferences | |

| CA | North American Free Trade Agreement—Goods of Canada | |

| D | African Growth and Opportunity Act | |

| E | Caribbean Basin Economic Recovery Act | |

| IL | United States-Israel Free Trade Area | |

| J | Andean Trade Preference Act | |

| JO | United States-Jordan Free Trade Area Implementation Act | |

| MX | North American Free Trade Agreement—Goods of Mexico | |

| SG | United States-Singapore Free Trade Agreement | |

| CL | United States-Chile Free Trade Agreement |

What is the Generalized System of Preferences?

The Generalized System of Preferences extends duty-free or preferential tariff treatment to certain products imported from many developing countries.

There are a few exceptions to the Generalized System of Preferences. One that pertains to chile peppers and pepper products is the exclusion of extracted oleoresins (3301.90.10), imported to the United States from Argentina and India from the Generalized System of Preferences. These products do not enter the United States duty-free. This exception is noted in the United States HTS available from the U.S. International Trade Commission or on the Web.

What kinds of chile peppers and pepper products does the United States import?

The basic chile types imported into the United States are classified primarily under the genus Capsicum (tables 1-3). Capsicum includes sweet (also known as bell), cayenne, paprika and red peppers. The United States imports Anaheim chiles, similar to New Mexico long green chile, and Ancho chiles, known in the dried form as poblano peppers. Imported chiles can be whole, ground or in mashed or macerated mixtures. The United States also imports oleoresins, which are extracted from paprika. Oleoresins are a naturally occurring mixture of resin and essential oil obtained from chile fruits and used primarily for color.

Why does the United States import chile peppers and pepper products?

U.S. industries import them when domestic production is unable to meet domestic demand at prevailing world prices. When the U.S. market for a product is relatively open with minimal trade restrictions, U.S. producers must compete with their foreign counterparts, whose production costs are often lower. Domestic industries, seeking lower-cost inputs, buy foreign chile.

What are the main uses for imported chiles?

Chile peppers imported into the United States are used primarily in foods. However, peppers and related products (such as oleoresin) also are used in food colorings and dyes for cosmetics and clothing.

What has happened to U.S. chile pepper exports in recent years?

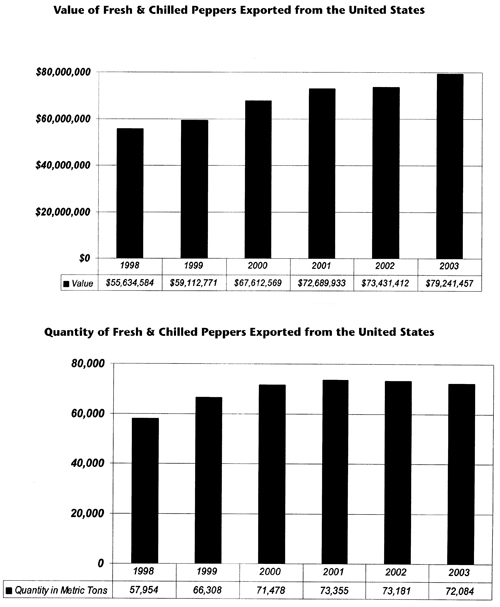

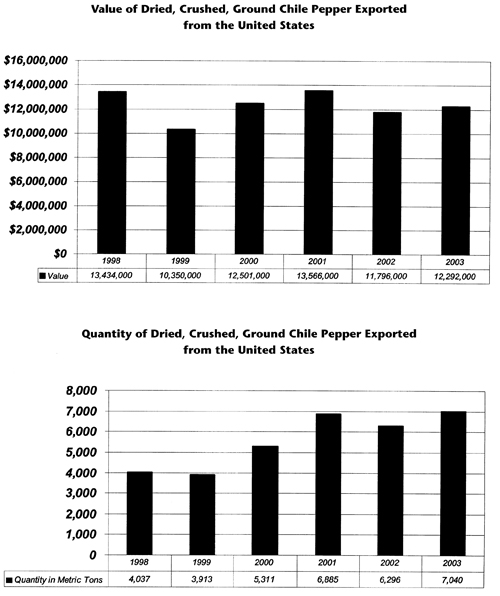

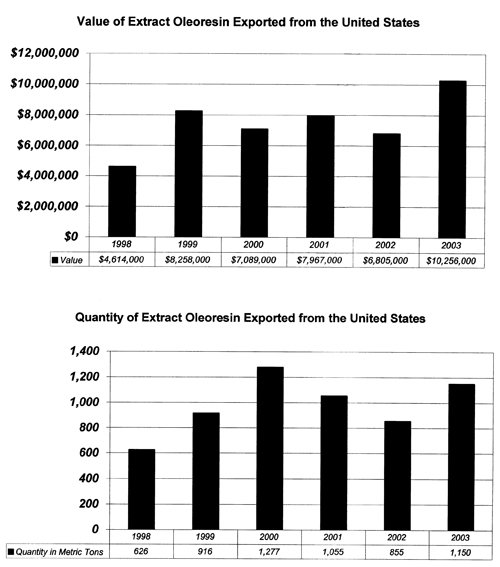

U.S. exports of fresh and dried chile have increased over the last few years. Exports of fresh and chilled chile peppers (0709.60.00.00) were valued at more than $79 million in 2003. The quantity exported that year was 72,084 metric tons (fig. 1). Seven thousand metric tons of dried, crushed and ground chile peppers (0904.20.00.00) were exported from the United States in 2003, with a value of $12.3 million (fig. 2). The 1,150 metric tons of extracted oleoresin exports from the United States were valued at $10.3 million in 2003 (fig. 3). All data were obtained from dataweb.usitc.gov/.

To what regions or countries does the United States export chile peppers and pepper products?

Fresh peppers and chiles are exported to North America, the Caribbean region, Central America, the European Union and other western European countries, the former Soviet Union, the Middle East, North Africa and other African nations, South Asia and other Asian countries and Australia.

What has happened to U.S. fresh and chilled chile pepper imports in recent years?

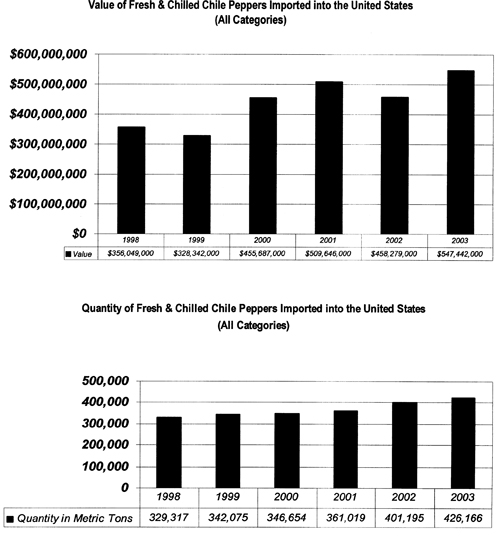

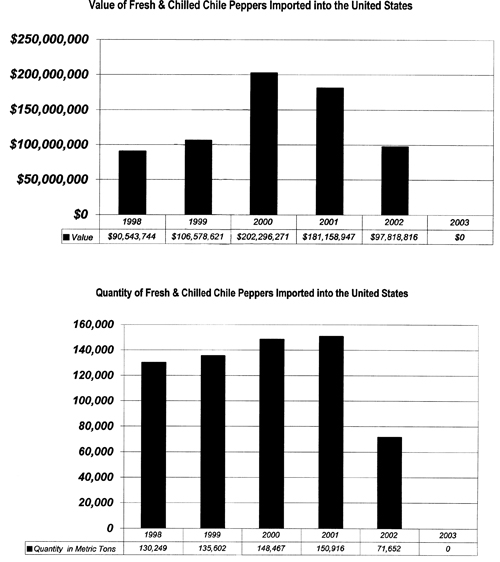

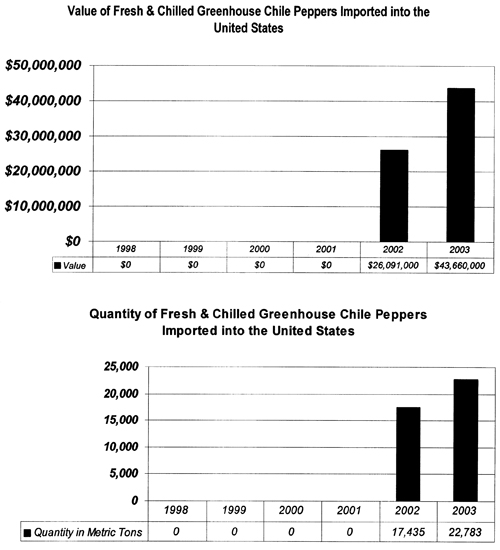

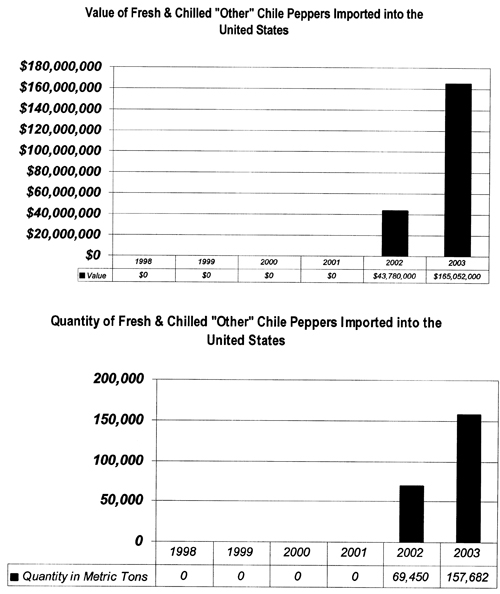

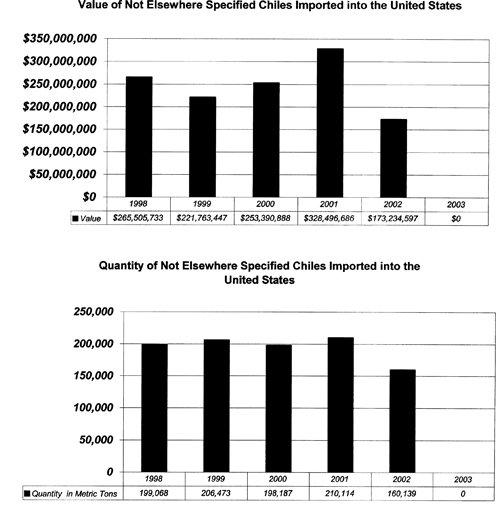

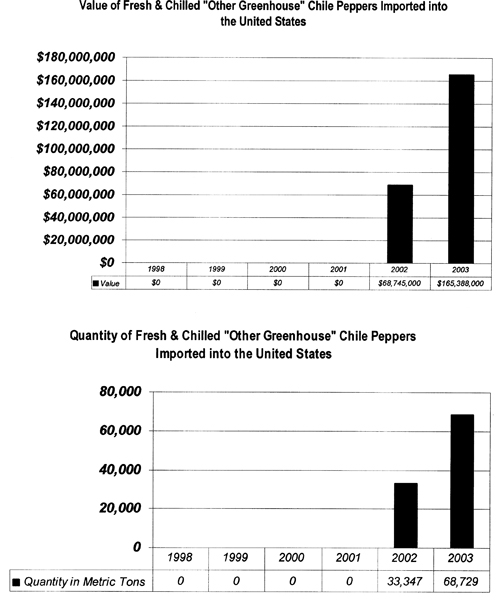

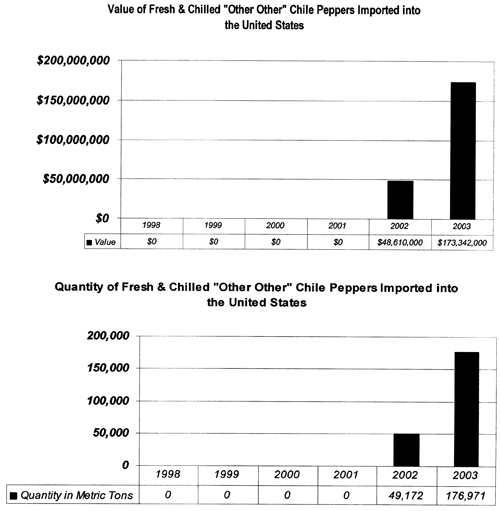

Figures 4-10 present U.S. imports of fresh and chilled chile peppers from 1998 through 2003. Fresh and chilled chile pepper import code 0709.60 includes all categories of fresh and chilled peppers. The value of these imports in 2003 was $547,442,000, with 426,166 metric tons imported (fig. 4). Fresh chile pepper imports have increased steadily since 1998, while the value of these imports has fluctuated over the 1998-2003 period. Figures 5-10 present disaggregated data for fresh and chilled pepper imports for 10-digit product codes. The value and quantity data presented in figures 5-10 add up to the aggregated value and quantity data presented in figure 4. Fresh and chilled chile pepper imports into the United States apparently were shifted between reporting categories in 2002 and 2003, with some 10-digit categories showing zero imports in 2003, and other 10-digit categories showing large increases in imports in 2002 and 2003. All data were obtained from dataweb.usitc.gov/.

What has happened to U.S. dried chile pepper imports in recent years?

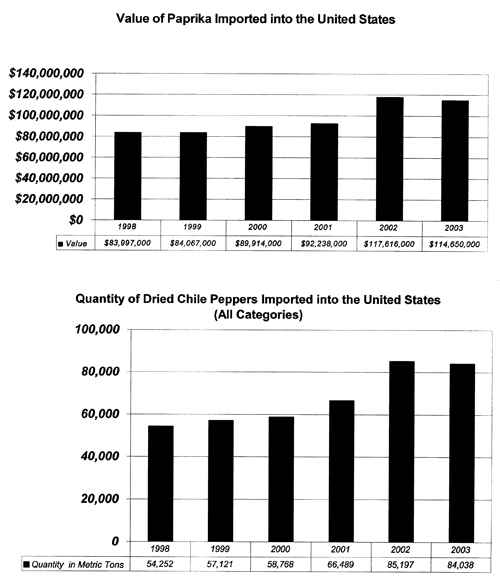

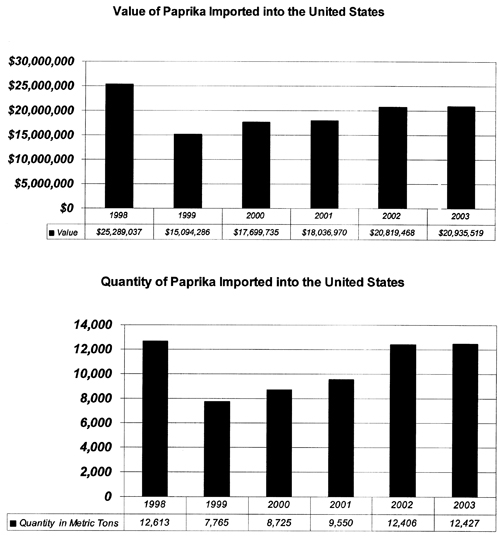

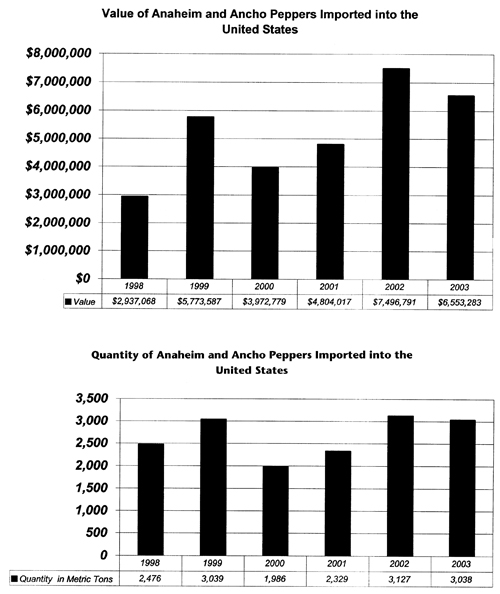

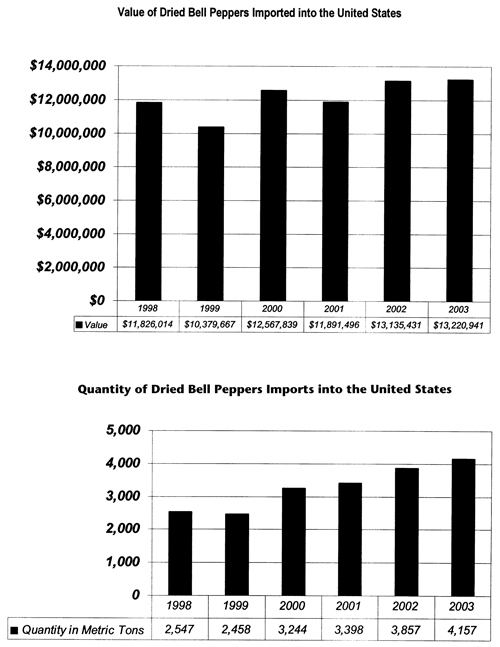

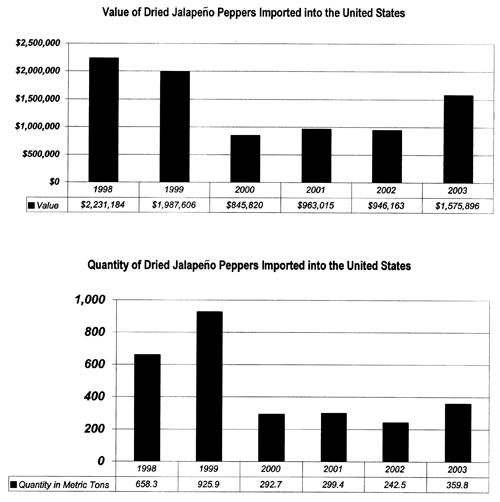

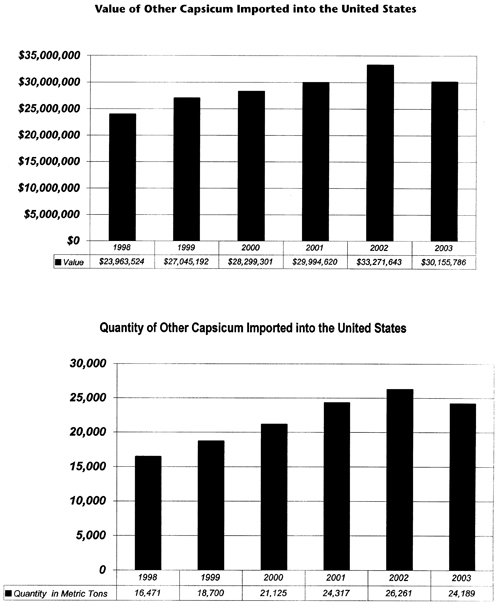

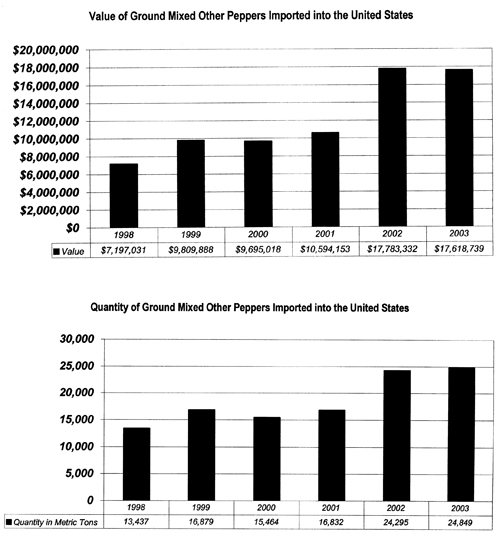

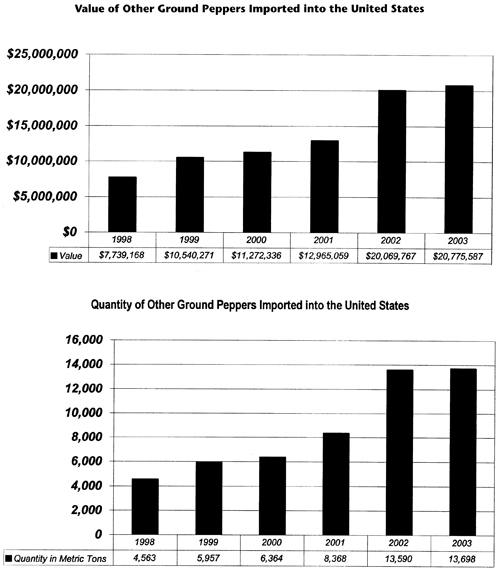

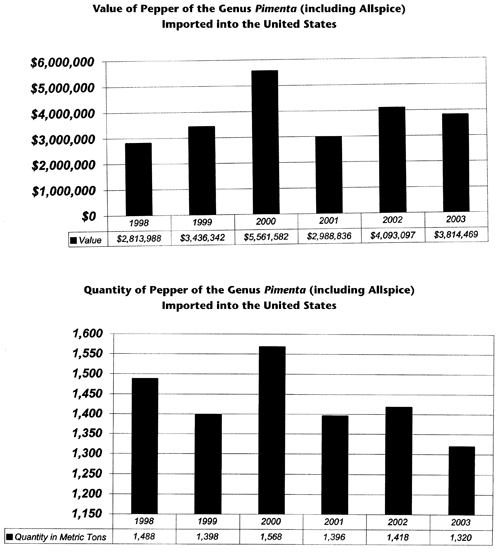

Figures 11-19 present U.S. imports of dried chile pepper products from 1998 through 2003. Dried chile pepper import code 0904.20 includes all categories of dried peppers. There were $114,650,000 in dried chile peppers imported into the United States in 2003 (fig. 11). More than 84,000 metric tons of dried chile peppers were imported into the United States in 2003. Dried chile pepper imports have increased since 1998, although the total quantity in 2003 was slightly less than in 2002. Figures 12-19 show dried chile pepper imports disaggregated to the 10-digit level. The value and quantity data presented in figures 12-19 for 10-digit dried chile pepper product codes add up to the six-digit data presented in figure 11. All data were obtained from dataweb.usitc.gov/.

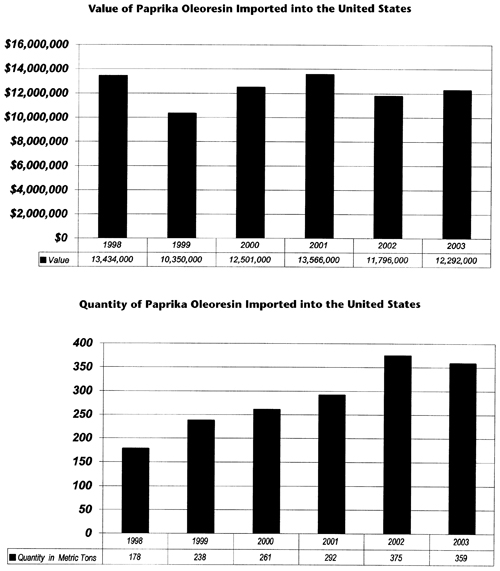

What has happened to U.S. paprika oleoresin imports in recent years?

Figure 20 shows the value and quantity of paprika oleoresin imported into the United States from 1998 through 2003. While the value of paprika oleoresin imports has increased steadily since 1998, there was a slight dip in the quantity of these imports in 2003, relative to 2002. These data were obtained from dataweb.usitc.gov/.

From what regions or countries does the United States import chile peppers and pepper products?

Chile peppers and pepper products are imported into the United States from many countries and regions, including North America, the Caribbean region, Central and South America, Europe, the former Soviet Union, the Middle East, Africa, Asia and Australia.

Where can I find more information about international trade in chile peppers and pepper products?

Other New Mexico Chile Task Force publications dealing with international trade in chile peppers and pepper products are available at the task force Web site: https://pubs.nmsu.edu/taskforce/.

Figure 1. Value and quantity of U.S. fresh/chilled chile pepper exports (0709.60.00.00).

Figure 2. Value and quantity of U.S. dried/crushed/ground chile pepper exports (0904.20.00.00).

Figure 3. Value and quantity of U.S. extract oleoresin exports (3301.90.10.00).

Figure 4. Value and quantity of U.S. fresh and chilled chile pepper imports (all categories) (0709.60).

Figure 5. Value and quantity of U.S. fresh and chilled chile pepper imports (0709.60.20.00).

Figure 6. Value and quantity of U.S. fresh and chilled greenhouse chile pepper imports (0709.60.20.10).

Figure 7. Value and quantity of U.S. fresh and chilled “other” chile pepper imports (0709.60.20.90).

Figure 8. Value and quantity of U.S. fresh, not elsewhere specified or indicated chile pepper imports (0709.60.40.00),

Figure 9. Value and quantity of U.S. fresh, not elsewhere specified or indicated chile pepper imports (0709.60.40.00).

Figure 10. Value and quantity of U.S. fresh and chilled “other other” chile pepper imports (0709.60.40.90).

Figure 11. Value and quantity of U.S. dried chile pepper imports (0904.20).

Figure 12. Value and quantity of U.S. paprika imports (0904.20.00).

Figure 13. Value and quantity of U.S. Anaheim and Ancho chile peppers imports (0904.20.00).

Figure 14. Value and quantity of U.S. dried bell pepper imports (0904.20.60.10).

Figure 15. Value and quantity of U.S. dried jalapeño pepper imports (0904.20.60.20).

Figure 16. Value and quantity of U.S. “other Capsicum” imports (0904.20.60.90).

Figure 17. Value and quantity of U.S. “ground, mixed other peppers” imports (0904.20.73.00).

Figure 18. Value and quantity of U.S. “other ground peppers” imports (0904.20.76.00).

Figure 19. Value and quantity of U.S. imports of pepper of the genus Pimenta (including allspice)

(0904.20.80.00).

Figure 20. Value and quantity of U.S. extract oleoresin imports (3301.90.10.10).

Footnotes

1 This manuscript was reviewed by Octavio Ramirez, department head, and James Libbin, professor, Department of Agricultural Economics and Agricultural Business; Rich Phillips, project manager, New Mexico Chile Task Force; Sam Gray, assistant professor, Department of Management, all with New Mexico State University; Dino Cervantes, General Manager, Cervantes Enterprises Inc., Vado, N.M.; and Shari Kosco, Agricultural Economist, USDA-Foreign Agriculture Service, Washington, D.C.

2 This report was prepared in partial fulfillment of requirements for the Master of Agriculture-Agribusiness degree. The report was prepared under the direction of Rhonda Skaggs, Professor, Department of Agricultural Economics and Agricultural Business, New Mexico State University.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at aces.nmsu.edu

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

December 2004