Guide G-260

Fahzy Abdul-Rahman

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Author: Extension Family Resource Management Specialist, Department of Extension Family and Consumer Sciences, New Mexico State University. (Print friendly PDF)

The goal of this guide is to explain the main types of predatory lending in New Mexico. The guide will describe each loan type and identify the features that make them predatory. Last, possible alternatives and solutions to using predatory loans are offered.

Between 1992 and 2000, the number of predatory lenders in New Mexico grew from one per 66,000 citizens to one for every 5,212 citizens (Prushnok, 2004). These statistics signal an increased demand for fringe banking services—non-traditional loans with excessive fees for a small short-term loan principal, which translates to high annual percentage rates (APRs). In 2010, the New Mexico State Attorney General sued two small installment lenders for predatory lending practices that provided loans with APRs beyond 1,000% (Kane, 2010). In New Mexico, the highest concentrations of predatory lending stores tend to be in smaller cities and cities with high minority populations and/or high poverty rates, such as Gallup (880 people per lender), Grants (881 people per lender), and Farmington (1,647 people per lender), which collectively represent six times the rate in the rest of New Mexico in 2000 (Kane, 2010).

The results of a survey (conducted in 2009) showing estimated population percentages that have used payday lending, auto title loans, pawnshops, refund anticipation loans, and rent-to-own services in the last five years are shown in Table 1.

Table 1. Percent of New Mexico and US Population that Used Alternative Financial Service Products in the Last Five Years (McKernan et al., 2010)

| Payday Loan |

Auto Title Loan |

Pawnshop | Refund Anticipation Loan |

Rent- to-Own |

|

| NM | 15% | 10% | 13% | 7% | 7% |

| US | 10% | 6% | 13% | 6% | 8% |

New Mexico has very high payday lending (at 15%) and auto title loan (10%) usage rates compared to the national average (10% and 6%, respectively). For the other products and services, New Mexico’s percentages were very close to the national average. A Federal Deposit Insurance Corporation (FDIC, 2009) study showed that one-third of New Mexico households do little or no mainstream banking, but instead rely on payday loans, rent-to-own plans, and check-cashing services. For minorities, the rate is even higher—more than half of Native American households and nearly 41% of Hispanic households use these alternative financial services.

What Makes These Products and Services Predatory?

The main things that make these products predatory are their costs and the deceptive practices involved in selling them. The US General Accounting Office (2004) defines predatory lending activities as ones that involve “charging excessive fees and interest rates, lending without regard to borrowers’ ability to repay, refinancing borrowers’ loans repeatedly over a short period of time without any economic gain for the borrower, and committing outright fraud or deception—for example, falsifying documents or intentionally misinforming borrowers about the terms of a loan”.

What are These Products?

The following product descriptions outline why these financial services are often associated with predatory lending.

- Payday Loan: This is a small-dollar, short-term loan that uses your next paycheck as collateral. An average payday loan is for about $325 with a fee of $15 per every $100 borrowed. It is to be paid in full in two weeks. Proponents maintain that these loans are designed to help people in the short-term until customers get themselves out of financial difficulties, such as getting their cars fixed to enable them to commute to work. While this may be true in some cases, many of payday clients extend or carry forward their loans beyond the typical two-week period (known as “flipping”). Payday loans are also known by many other names, such as payday advances, payday cash advances, cash advance loans, check advance loans, post-dated check loans, deferred deposits, short-term loans, cash loans, fast cash, fast loans, and bad credit loans.

- Auto Title Loans: For this type of loan, your car title is used as collateral. If you fail to pay your loans, including all interest and fees, your car becomes the property of the lender. Auto title loans have been banned in 26 states, while 12 others have caps on rates and fees. Members of the military have a nationwide cap of 36% APR on any loan.

- Pawnshop Loan: This loan uses other valuable items besides your car as collateral. You must physically bring your valuables to the pawnshop for their value to be assessed. Normally, a pawnshop will lend you 50% of the estimated value. If borrowers do not pay back the loan plus interest and fees by the agreed time, the pawnshop has the right to sell the pawned items.

- Refund Anticipation Loan (RAL) or Refund Anticipation Check (RAC): Both RALs and RACs are loans based on expected tax returns. The main difference between the two is that RALs use your expected tax refund as collateral while RACs use access to a temporary bank account, which they help you set up for the purpose of receiving your tax refund as a direct deposit from the IRS. According to McKernan et al. (2010), fees for RALs and RACs include tax preparation (about $187), account setup ($30 to $35), document preparation, processing, e-filing, and technology fees (e.g., $40 for “data and document storage”); these costs may translate to an effective APR of up to 700%. It is estimated that about 18% of tax filers have used RALs or RACs (McKernan et al., 2010). Sadly, these costly loans only save a typical borrower between 9 and 15 days of waiting as compared to a traditional tax refund via check. Consumers can avoid these charges and still receive their tax refunds by having a bank account and completing their taxes with free tax preparation sites (e.g., Volunteer Income Tax Assistance from the IRS).

- Rent-to-Own (RTO) Agreement: The concept of an RTO agreement is simple: You rent a good at a very low periodic (e.g., weekly, monthly) rental amount for a specified amount of time to own the good. Under this agreement, goods return to the store if (1) a renter decides to discontinue renting the goods or (2) a renter cannot fulfill the rental as agreed. An example of a rent-to-own agreement is getting a $220-television by paying $10 per month for 78 months. That translates to paying $780 for that television, or paying 220% APR interest on the loan.

As consumer advocacy groups try to curb these predatory practices, the predatory lending industry has evolved. For instance, there have been online payday loan companies owned and operated by Native American tribes that claim to be sovereign from state and federal laws, although they make loans to non-Native Americans living outside of Indian lands. Bottom line: Payday loans come from many places and can be called many things. Look for red flags such as large fees (relative to the loans made), penalties for paying loans off early, questionable marketing practices, and exploding interest rate clauses.

Advantages of Small-Dollar Loan Services

Overall, people like to use these small-dollar loan services because of their convenience. The small-dollar loan establishments are usually located in high-traffic areas. You can obtain the small loans quite quickly compared to banks because these small-dollar loan providers do not require any credit or background check. With the right collaterals, you may obtain your loans in 30 minutes. This is especially useful for individuals who are in need of money instantly (e.g., for prescriptions, car repairs). Used correctly, some of these small-dollar loan services may be a lifesaver.

Disadvantages of Small-Dollar Loan Services

The main problems with these small-dollar loans are their high costs. Often times, customers who can’t repay their loans tend to extend them, which only adds to the total costs. Their transactions may result in their collateral or rented items being possessed and high fees charged.

Alternatives to Small-Dollar Loans

There are less-risky alternatives to these fast, small-dollar loans.

- Asking your employer for a payday advance. Some companies will advance your paycheck to you without charging fees or interest. Talk to your human resource manager for more details.

- Getting assistance with paying your bills. Talk to others about your financial needs. You may be referred to churches, other faith-based organizations, or governmental agencies. Those with low income may obtain assistance for food expenses, utility bills, child-care expenses, and housing. Benefits.gov is a one-stop website that focuses on welfare assistance at the federal level.

- Getting a payday-like loan from a credit union. Credit unions have come up with affordable payday loans that are supposed to be non-predatory. Currently, Guadalupe Credit Union offers payday loans up to $500 with a fee of $12 per $100 borrowed for 150 days; you must submit proof of direct deposit to a bank account that you have held for at least 90 days. This non-confusing fee structure translates to 29.2% APR. Not all credit union payday loans are the same. In fact, the National Consumer Law Center (Saunders et al., 2010) has divided these credit union payday loans into those that “come close” to being truly affordable and those that are “very problematic.”

- Taking a cash advance from a credit card. Under normal circumstances, utilizing a credit card cash advance must be avoided due to high interest rates (e.g., 20-25% for cash advance vs. 14.91% for regular credit card charges), fees associated with initiating its use (e.g., the greater between $10 and 5% of total cash advance), interest charges that begin immediately (i.e., without a grace period), and sometimes being required to pay down your credit card balance before you pay down the higher-interest cash advance balance. Depending on the loan amount and payment plan, a cash advance APR may be very high (e.g., 50%), but it would be a lot lower than a typical 391% APR with payday lending. Your credit card cash advance may be obtained by drawing cash using your credit card from a participating bank’s ATM or cashing convenience checks, which are usually inserted with your credit card statements.

- Borrowing from relatives and friends. Depending on your reputation, you may be able to borrow from your relatives and friends. On the one hand, they may give you a better deal with lower borrowing costs. On the other hand, this can hurt long-term relationships with family and friends if the loan is not paid back within a few weeks.

Better Alternatives to Borrowing

If you have resorted to using these small-dollar loan institutions, it should be a sign of financial trouble and that you need to get your finances in order. Ideally, you should have enough emergency savings to cover at least three months of basic living expenses, which includes rent/mortgage, food, electricity, water, gas, insurance, and typical maintenance. This emergency savings works best when separated from your long-term retirement savings and investments.

These small-dollar loan establishments make money from your immediate need for cash. If you prepare for the unexpected, you can avoid these high-interest loans. The following are ideas for managing your finances so you can eliminate the need to borrow quick cash at high costs. More in-depth information on managing your money can be found in the Managing Your Money series (Circulars 591–596), available at https://pubs.nmsu.edu/_g/.

-

- Goal setting: The first step of financial planning is to set your goals. Not all of these goals need to be financial, but planning your goals helps you plan ahead financially. For instance, obtaining a summer internship may not be a financial goal, but you may need to set aside some money for temporary housing, living expenses, and getting a nice suit for the interview.

- Savings: Now that you have your goals, you can estimate the savings needed to reach these goals by a certain date. If you want to go on a spring break trip to the Grand Canyon in 10 months for three nights that you estimate will cost $400, you need to start saving $40 per month to reach this goal. Again, don’t forget your emergency savings of at least three months’ worth of living expenses.

- Budgeting: Your ability to achieve these goals should be reflected in your budget where you lay out your periodic (e.g., biweekly or monthly) income, savings plan, and expenses. More information on budgeting is available in Circular 592, Managing Your Money: Where Does All the Money Go? (https:/pubs.nmsu.edu/_circulars/CR592.pdf).

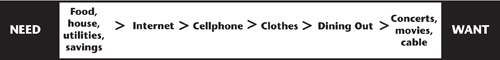

- Wants vs. Needs: Your initial budget is likely to show more expenses and savings than income. If this happens, you need to prioritize your goals and expenses—both of which lie on your need–want continuum, like the one illustrated in Figure 1. Items that are on the want side should be excluded or downgraded first so that you will have a manageable budget.

- Goal setting: The first step of financial planning is to set your goals. Not all of these goals need to be financial, but planning your goals helps you plan ahead financially. For instance, obtaining a summer internship may not be a financial goal, but you may need to set aside some money for temporary housing, living expenses, and getting a nice suit for the interview.

Figure 1. An example of a need–want continuum. If your budget shows excess expenses, your budget for concerts, movies, and cable service should be the first to go.

Use of these small-dollar financial institutions may also indicate a need to learn and exercise self-discipline. For the most part, you can avoid using payday lenders, RALs, RACs, and rent-to-own stores by filling out taxes early, having your own bank account, and/or saving for unexpected expenses. In fact, some of the items purchased via rent-to-own tend to be on the want side of the need-want continuum, such as entertainment centers, DVD players, TVs, computers, and furniture. For tax filing, low-income households can obtain free tax filing assistance from Volunteer Income Tax Assistance (VITA), Tax Counseling for the Elderly (TCE), AARP Foundation Tax-Aide, and other IRS-certified programs. Consumers who are in need of financial counseling can obtain free help from the National Foundation for Credit Counseling (https://www.nfcc.org, phone: 202-677-4300). Additionally, contact your local personal finance Extension educator for more information related to responsible borrowing and other personal finance topics.

References

Federal Deposit Insurance Corporation. 2009. FDIC national survey of unbanked and underbanked households [Online]. Retrieved March 2, 2012, from https://www.fdic.gov/householdsurvey/2009/full_report.pdf

Kane, M. 2010, February 2. Payday lenders use loopholes to continue high-interest loans [Online]. New Mexico Independent. Retrieved January 18, 2012.

McKernan, S., C. Ratcliffe, and D. Kuehn. 2010. Prohibitions, price caps, and disclosures: A look at state policies and alternative financial product use. Washington, D.C.: The Urban Institute.

New Mexico Regulation and Licensing Department. 2010. The debt trap - Don’t get caught! What you need to know before borrowing money [Online]. Retrieved March 5, 2010.

Prushnok, R. 2002. Payday, heyday! Measuring growth in New Mexico’s small loan industry (1990-2001) [Online]. Retrieved on January 5, 2010, from https://cdn.publicinterestnetwork.org/assets/qK5fOHM_o87IR4-f64ibPw/paydayheyday.pdf

Saunders, L.K., L.A. Plunkett, and C. Carter. 2010. Stopping the payday loan trap: Alternatives that work, ones that don’t [Online]. Retrieved from https://www.nclc.org/images/pdf/high_cost_small_loans/payday_loans/report-stopping-payday-trap.pdf

United States General Accounting Office. 2004. Consumer protection: Federal and state agencies face challenges in combating predatory lending [GAO Publication No. GAO-04-280, Online]. Retrieved from https://www.gao.gov/new.items/d04280.pdf

Fahzy Abdul-Rahman is the Extension Family Resource Management Specialist at New Mexico State University. He earned his Ph.D. and M.P.H. from The Ohio State University. His Extension programs focus on various personal finance topics, from basic banking to retirement planning.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at pubs.nmsu.edu.

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

Printed and electronically distributed November 2012, Las Cruces, NM.