Guide G-255

Revised by Bryce Jorgensen and Michelle Stizza

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Authors: Respectively, Associate Professor and Bernalillo County Extension Family and Consumer Sciences Agent; and Assistant Professor and Family and Consumer Science Agent at Santa Fe Cooperative Extension. New Mexico State University. (Print friendly PDF)

Photo by Melinda Gimpel, 2018, on Unsplash.

INTRODUCTION

You are not required by law to have a will, but you are highly encouraged to have one to ensure that the property you leave behind upon your death will be distributed according to your wishes. If you decide to have a will, you also need to decide on whether to use a lawyer’s services or to do it yourself.

A will allows you to have a say on how your wealth will be distributed after your death. If you want to further design how your wealth will be utilized long after your death, or if your situations are complex (e.g., wealth, debt, family), you should consider a living trust. Unlike wills, living trusts should always be done by lawyers because they always involve technical details. Laws related to wills differ by state, but for a will to be valid in New Mexico it must be signed in front of two witnesses. Any individual who has reached the age of 18 and is of a sound mind can do this at any time after their 18th birthday.

According to Caring.com (2022), only 32% of Americans have a will. That is a harmful statistic, because this is going to largely affect the family and friends of a loved one that has passed away. Having a will is not just for you, but it’s mostly for your loved ones, since they will be the ones affected by your decisions after you pass away. If your will is not up-to-date, or you’ve only expressed your wishes outside of a will, then they won’t be considered in the court of law, and your written wishes will not be executed.

Along with estate planning, there is an executor who upon your death will distribute all your assets to the beneficiary or beneficiaries and obey the instructions that you gave in your will and covers the management of your personal affairs in the event of incapacity. Make sure you trust your executor for your will and that they will fulfill their duty and responsibilities as one. Your executor can be a friend, family, or lawyer. They are someone that will act on your behalf to manage your money or property.

A will is a legal document that sets forth your wishes after you die. To make a will legal you need to have:

- At least two witnesses present.

- The will written down.

- Your signature.

- Witnesses’ signature.

- The document notarized.

WILL VS TRUST

What is the difference between a will and a trust? They have a lot of similarities, but it’s important to establish the differences.

A will is where you write down your wishes into a legal contract and establish how you want your personal assets to be distributed after you pass away.

A trust is where you write down a property or an asset under the name of the trust, then the asset that is under the trust is given to your trustee (person administering the property under the trust), to distribute to your beneficiary (person you want to receive the property).

A will has to pass through probate, which is the court system. What this means is that when you pass away, it will be presented to the judge, and the judge will make sure that all your wishes are met and legal.

A trust does not go through probate.

With a will, your assets are distributed with your heirs.

With a trust, your trustee controls the assets and then distributes them to your beneficiaries.

Attorney/lawyer

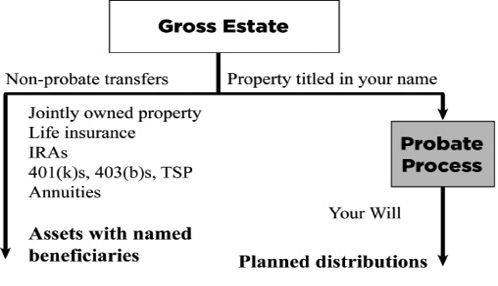

Figure 1 illustrates how estate planning works. There are assets that must go through probate and others that won’t go through probate. You start with your gross estate, which is the total dollar value of your assets. The assets that go through probate (the right side of the diagram) will go to a judge that will review your will and monitor to see that your wishes were legally executed and distributed to your heirs.

Then, there are the accounts or assets that won’t go through probate (left side of the diagram) and will go directly to whomever you named as beneficiary on each account, including retirement accounts and life insurance benefits such as Individual Retirement Accounts (IRAs), 401(k)s, 403(b)s, Thrift Savings Plans (TSP), and annuities. Joint tenancy with the right of survivorship - these accounts are joint owned properties, which if you die, will automatically transfer to the person with which you share ownership, such as a home jointly owned with a spouse.

Take the time to check the beneficiaries on your accounts and see if the names match what you have in your will. If your will is up-to-date and has the most recent desired names of the people you want to receive the benefits of those accounts, then you need to make sure those names are also stated as beneficiaries through the account’s documentation. Otherwise, if the names of the beneficiaries on those accounts are different from the up-to-date will, the names on the accounts overrule what is stated in your will.

If you have children, you should have a will! In your will you will state who you trust to take care of your children in the case of your death. If you are in a scenario where you would rather have your children taken care by a friend rather than a family member, but you die without a will, the government will likely decide to place your children with a family member of their choosing. When you have a will, you’re not only taking care of your things, but you are also taking care of the ones you love.

Figure 1. Estate Planning Diagram. Adapted from Goldberg Law Center, PC.

Family gathering

Having a will is not an outdated concept and it’s important to get the whole family involved. It should not have to be an uncomfortable conversation. If everyone speaks their mind and is honest about their thoughts of the person’s will, then it should be a beneficial meeting. In a family gathering, you should decide strategies for how various heirs may be treated – focusing on what’s fair, not necessarily equal. If you have children (plural), then their interests and needs will be different from one another. Therefore, you need to distribute your assets in a way that is fair for the children, taking into account that each child has different needs.

Letter of Last Instruction

The letter of last instruction will help your loved ones locate where your important documents are. The letter is not legally binding, but it is helpful. This information will be valuable, so make sure you talk about it with your loved ones, including where to find it. This letter could include:

- Funeral/ memorial service preferences: what songs you want played, flower arrangements, etc.

- Names of people to be notified of your death.

- Location of bank accounts, safe deposit box, etc.

- Disposition of personal effects (untitled property).

Legacy Drawer

A legacy drawer is a storage space where you will have all your important documents gathered in one place. Documents that should be included are:

• Insurance papers

• Your will and testament

• Passport

• Social Security

• Birth Certificate

• Investments papers

• Other important documents of high value

Make sure you talk to your family members, or significant others, about the legacy drawer and the location. On top of all the documents, place your letter of last instructions. The letter needs to have instructions so that if a 12-year-old were to read it, he or she would know exactly what to do. It’s important to keep your legacy drawer in a safe place and hard for others to obtain. Your legacy drawer can be in a secured online folder, or in a filing cabinet at home.

Not having a will can tear families apart. Be nice to your survivors and don’t put them in a difficult situation because you procrastinated creating a will. Think about the legacy you want to leave. Family members arguing and fighting over your possessions is not what you want. Remember you’re doing this for yourself, and most importantly, for your loved ones. This is a matter of taking responsibility for your things and taking care of them.

What Will Happen If There Is No Will?

If a New Mexico resident dies and leaves no will, their property is distributed according to laws and the court. Without a will, who the heirs would be and how they would share the property and assets under the present law are shown in Table 1, listed by entitlement priority. This happens after all assets are accounted for and valued, family and personal allowances are satisfied, and all debts are settled.

|

Table 1. How Property Is Distributed Without a Will |

|

|---|---|

|

Single Individual (including widowed, divorced, and unmarried) |

|

|

With children or children’s descendants |

All to children in equal shares or to descendants by their representation. |

|

Without descendant but with parent |

To surviving parents or parent. |

|

Without descendants or parent but with sibling |

To siblings in equal shares. If any are deceased, then to lineal descendants of siblings. |

|

Without descendants, parent, sibling, or descendant of sibling |

One-half to maternal grandparent or grandparents, then to heirs of those grandparents. One-half to paternal grandparent or grandparents, then to heirs of those grandparents. |

|

None of the above |

All to the state of New Mexico. |

|

Married Individual |

|

|

Without children |

All to spouse |

|

With children |

Community property: all to spouse. Separate property: one-fourth to spouse and three-fourths to children in equal shares. |

Factors That Increase the Need for a Will

In general, a more complex situation demands an increased need to have a will (as well as using an attorney to write one). These factors include:

- A huge amount of wealth, including homes, vehicles, and personal business assets.

- Complex family structure caused by divorces, children from different marriages and relationships, adoption, cohabitation, and separation may affect how you intend to leave your wealth upon your death.

- Plan to hand down (bequest) wealth to non-family members. You may have non-family members who have been very significant in your life or dear to you, including teachers, schools, universities, uncles and aunts who raised you, and religious organizations.

Property

There are two basic kinds of property: real property and personal property. Real property consists of land and fixed permanent improvements on land, such as buildings and fences. Personal property includes most of the remaining things, other than land, that people acquire during their lifetimes. Examples of personal property are furniture, vehicles, electronics, home appliances, and personal effects.

Who gets what depends greatly on whether a particular property is a community or separate property, especially when the deceased dies without a will.

Community property is anything you or your spouse purchased or accumulated while you were married. Separate property is a property:

- Owned before marriage.

- Received as inheritance or gifts to one spouse, including those received during marriage; and

- Purchased (and paid for) as a separate property even during marriage.

- Parallel definitions apply to community and separate debts.

Avoiding Probate

Probate is the legal process of gathering a deceased person’s assets, valuing the assets, paying the deceased person’s debts, and distributing one’s wealth after one’s death according to a will or the governing laws of inheritance, usually state law. People like to avoid the probate processes because a simple probate process, which takes place in an informal probate court, takes four to six months to be completed, costs a few hundred dollars, and becomes a publicly available record. The following ways can be used to avoid probate.

- Pay on death (POD) beneficiary: POD designations provide for successor ownership of a specific account only upon the death of the original owner. The recipient has no rights of ownership during the owner’s lifetime. The owner can change or terminate the designation at any time. POD works for bank accounts (checking, savings, CD), retirement accounts, and investment accounts. It is important to note that assets transferred via POD are taxed like additional income, except for Roth accounts.

- Transfer on death (TOD) deeds: A TOD deed provides a designation of ownership like POD only upon the death of the account owner. This can be done for real property (home, land) and cars at district court with a $25 processing fee (in 2012).

The use of POD or TOD designations can be appropriate estate transfer tools to avoid probate. Unlike joint accounts, they do not grant ownership to others during the original owner’s life, nor do they become a part of the probate estate on death. They allow the owner to keep accounts that may be needed during an extended illness and allow easy change of the beneficiary to adjust to changing times. Should bankruptcy or a calamity befall the beneficiary, creditors of the beneficiary have no rights to the POD and TOD accounts during the owner’s lifetime. - Joint accounts: If your real property, vehicles, and bank accounts have your beneficiaries’ names as co-owners, the assets will be shared by the living beneficiaries. Putting your beneficiaries’ names in the title is easy to do, but there are disadvantages:

- Since the beneficiaries are co-owners of the assets, their creditors can make a claim against the assets.

- For Medicaid planning purposes, giving away your portion of the house may affect your Medicaid eligibility.

- If a beneficiary (e.g., child) gets divorced, the beneficiary’s ex-spouse can claim a portion of the asset.

- It is not easy to revoke the rights of the other co-owners. If you plan to transact the assets (e.g., sell, borrow against the asset) or take a beneficiary’s name out, you need to have the beneficiaries’ approvals.

- Living trusts: Compared to a probate process with or without wills, living trusts do not become public record, are more expensive, and are highly technical such that they should be handled only by lawyers. A living trust is a document created in a will or by a separate instrument, and it manages property held by it for a specific purpose and for one or more specific beneficiaries. Living trusts are discussed in NMSU’s Cooperative Extension Service Guide G-256, Comparison of Living Trusts and Wills (https://pubs.nmsu.edu/_g/G256/index.html).

- Gifting: Transferring assets while you are alive means that you don’t have assets to be transferred via a will or living trust. New Mexico is not one of the states that impose state estate tax or inheritance tax. Having many beneficiaries for one asset may not be the best thing to do because beneficiaries may arrive at a stalemate on how to best proceed with a shared asset. For instance, a house that was successfully transferred to beneficiaries may be left untouched for years because beneficiaries cannot come to a consensus on whether to sell, rent, or sell the house to one of the beneficiaries to preserve memories associated with the house.

Important: Assets that are transferred through these probate-avoiding methods will not be distributed according to your will. In other words, they will not be part of your probate estate if you must go through probate.

If there is no will:

- The spouse will automatically inherit everything because New Mexico is a community property state.

- In case of no surviving spouse, the estates are inherited equally by children.

- If an heir or a spouse dies within 120 hours (5 days) of the deceased estate owner, they are treated as to have died simultaneously, which may pose serious ramifications with community or surviving heir questions.

- The state only gets your property if you have no living relatives.

- If you have a will, you are supposed to make others aware of it and its location. You should share this information with close ones and note it in your Letter of Instructions, which is explained in Guide G-246, Information To Help Your Heirs (https://pubs.nmsu.edu/_g/G246/index.html).

FINAL CAUTION

Laws governing distribution of property and tax are changed from time to time by the legislature. To be well informed, keep up with any changes that are made through your attorney and accountant. Guide G-256, Comparison of Living Trusts and Wills (https://pubs.nmsu.edu/_g/G256/index.html), will help you understand these estate-planning alternatives. Other issues, such as Medicaid planning, life insurance, and capital gains tax, are beyond the guide’s scope.

The information given here is general and may not be applicable to you. For solutions to specific estate and tax issues, seek the advice of a competent legal and tax professionals. You may contact these organizations for further information and specific questions:

- New Mexico Bar Association, 1-800-876-6227;

sbnm.org - State Bar of New Mexico for free legal advice from experienced attorneys for New Mexico residents aged 55 years and older; 505-797-6005; sbnm.org

- American College of Trust and Estate Counsel, 202-684-8460; actec.org

- National Academy of Elder Law Attorneys for referral to lawyers providing services in these areas, 703-942-5711; naela.org

REFERENCES

- Lustbader, R. (2022). Wills and Estate Planning Study. Caring.com. https://www.caring.com/caregivers/estate-planning/wills-survey/2022-survey/

- Darden, J.A., & Abdul-Rahman, F. (2012). Information to Help Your Heirs [Guide G-246]. NMSU Cooperative Extension Service. https://pubs.nmsu.edu/_g/G246/index.html

- Darden, J.A., & Abdul-Rahman, F. (2013). Comparison of Living Trusts and Wills [Guide G-256]. https://pubs.nmsu.edu/_g/G256.pdf

- Darden, J.A., & Abdul-Rahman, F. (2012). Things to Do before Making A Will [Guide G-247]. https://pubs.nmsu.edu/_g/G247/index.html

- Goldberg Law Center. (2024). http://www.goldberglawcenter.com

AVAILABLE RESOURCES

Publications and eBooks

- Darden, J.A. & Abdul-Rahman, F. (2012, February). Information to Help Your Heirs. https://pubs.nmsu.edu/_g/G246/index.html

- Darden, J.A. & Abdul-Rahman, F. (2013, September). Comparison of Living Trusts and Wills. https://pubs.nmsu.edu/_g/G256.pdf

- Darden, J.A. & Abdul-Rahman, F. (2012, February). Things to Do before Making A Will. https://pubs.nmsu.edu/_g/G247/index.html

Online resources, and community forums

- New Mexico State University Cooperative Extension Service https://mymoney.nmsu.edu/links.html

Free Online resources for creating a will

- Clark https://clark.com/family-lifestyle/wills-funerals/best-online-wills/

- Free will from Fabric https://meetfabric.com/wills

- Freewill http://www.freewill.com/

- Nationwide https://www.nationwide.com/lc/resources/personal-finance/articles/executing-a-will

- Quicken Willmaker.com

- US Legal Forms https://www.uslegalforms.com/wills/

- Online informational videos/webinars

- New Mexico State University Extension Family and Consumer Science http://efcs.nmsu.edu/resources/webinars.html

Workshops/short courses and academic degrees

- New Mexico State University Cooperative Extension Service https://nmsuondemand.instructure.com/courses/170/pages/home-page

Original author: Jackie Martin, Extension Family Finance Specialist. Subsequently reviewed/revised by Constance Kratzer, Family Resource Management Specialist, and M. Fahzy Abdul-Rahman, Extension Family Resource Management Specialist.

Bryce Jorgensen is an Associate Professor and Extension Family Resource Management Specialist at NMSU. He earned his Ph.D. at Virginia Tech. As a consultant, trainer, author, and speaker, he focuses on achieving individual, relational, and financial wellness for New Mexicans. An expert in the psychology of change, mindset, and behavioral economics, he provides customized programs leading to life and financial success.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at pubs.nmsu.edu

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

June 2025, Las Cruces, NM